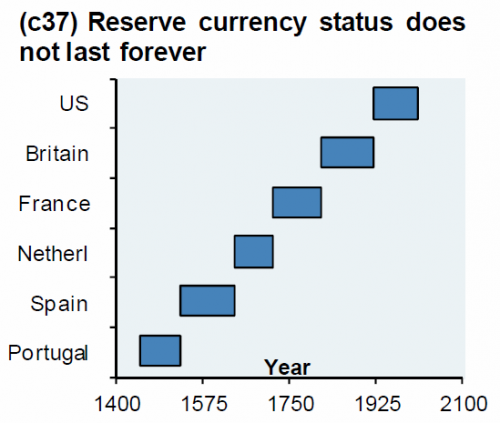

For almost two centuries, Sterling reigned supreme as the world's reserve currency, propping up the vast British Empire which was the world's superpower during the 19th century and the early 20th. Then, in the span of just a few months, everything changed and the US Dollar took over after a series of dramatic events.

For those unfamiliar with this historic transformation, Clarmond's Mustafa Zaidi and Chris Andrew describe the series of events in which Iran and its oil reserves proved to be the final nail in the coffin of sterling and the British Empire. However, what is far more interesting, is their suggestion that the current tensions between Washington and Tehran, and what happens to Iranian gas, could also be the event that results in the end of the dollar's own reserve status.

Why? Read on in Clarmond's observation on "Self Deception and Pride."

Wilting in the muggy summer of 1945 in Washington DC, an ailing Lord Keynes messaged London - his mission to procure a $5b grant to avoid a 'financial Dunkirk' had failed.

Instead the Americans had offered a $3.5b loan loaded high with conditions. "We are in Shylock's hands" muttered Ernie Bevin, the Labour Foreign Minister. The American demands were put forward by a former cotton king (Will Clayton) a future Chief Justice (Fred Vinson) and crafted by the President of Chase Bank (Winthrop Aldrich). There were three immovable requirements for the loan. First an end to Imperial Preference in trade, secondly the floatation of Sterling within a year, and thirdly Britain signing up to the Bretton Woods system.

The American objective was to put American industry and finance at the centre of the world. This meant dismantling the sterling free-trade market and destroying sterling's status as a settlement and reserve currency. During WWII Britain had already traded away to the US its naval bases and its world-leading technology; now its American ally was now gunning for the Empire's trade markets and currency.

New Jerusalem

The Labour Atlee government needed US dollars to deliver its promise of a 'New Jerusalem' - full employment, the national health service and social welfare. In just five days of debate, Atlee's government agreed to all the loan's conditions. Ironically, Labour was agreeing to free trade overseas yet was busily nationalising domestic industry. It sacrificed its trade empire and sterling's global dominance for its vision of a post-war utopia.

A year later, sterling was floated. It last only a disastrous 37 days before being controlled again; two years later it was devalued by 30%. As Keynes commented previously this exercise had been an odd mixture of 'self deception and pride'.

Sterling Oil…

With the loss of India, Bevin now turned to the Middle East where access to sterling-denominated oil from Iran kept Britain's balance of payments afloat. The UK could still pay for Iranian oil in sterling and thus preserve its precious dollars.

But American oil partnerships in Venezuela and Arabia, based on a 50/50 US/local ownership rule, made Britain's 70/30 structure in Iran untenable. Iranian nationalists now started to demand, and ultimately obtain, full control of their natural resource.

With the nationalisation of the AIOC (Anglo Iranian Oil Company), Britain was deprived of sterling oil, and thus became utterly dependent on the Americans to earn enough dollars to pay for their energy. Immediately this started a rapid exodus from holding sterling as a settlement currency and reserve. Iranian oil joined its other dollar-denominated brethren.

Fast forward 70 years and once again Iran stands at the fulcrum of how the energy source of the future is to be priced.

Persian deals

Britain's loss of sterling- denominated oil was the final nail in the coffin of sterling being a global currency. Its collapse was imperceptible and then a precipice.

As of today the US finds itself in a similar position as it remains to be seen what currency natural gas will be priced in.The world is transitioning from oil to gas, as, 70 years ago it had transitioned from coal to oil; once again Iran holds the key for this critical resource.

Today, natural gas is priced in US dollars in America, in euros for Russian gas in Europe, in renminbis for Russian gas in China, and US dollars for Qatari gas. It shall be the pricing of Iran's massive reserve of gas that will determine the future global currency denominator of this energy source. Or, to put it another way, the US$'s continuing position as the global reserve currency may be decided in how Washington deals with Tehran. War serves neither the dollar's nor the Donald's future longevity. America must find a way to have dollar-denominated Iranian natural gas.

Don't Tread on Me

Unlike post WWII Britain, America does not face an overwhelming competitor. But America seems to be in an Atlee-esque conundrum with domestic issues overriding international obligations. America's 'New Jerusalem' is captured on red baseball caps… 'Make America Great Again'. And this aspiration has a price - a peaceful withdrawal from global commitments - no Persian misadventures.

Commenti

Posta un commento