"Simply Awful": German PMI Plunges To 7-Year Low As Manufacturing Recession Accelerates, Spreads To Services

Weakness in euro-area manufacturing hit a climax this morning as German private sector activity plunged to a seven-year low. The Germany Manufacturing PMI slumped in September, dropping to 41.4, down from 44.7 in August, printing below the lowest sellside estimate (consensus of 44.4); worse, the German manufacturing recession is now spreading to the services sector, where the formerly resilient services PMI also slumped from 54.8 to 52.5, also missing the lowest analyst estimate, and collectively, resulting in the first composite PMI print below 50, or 49.1 to be precise, since April 2013. The rate of decline was one of the sharpest in seven years.

Key findings of the report indicate business conditions across Germany continue to deteriorate with no end in sight.

- Flash Germany PMI Composite Output Index (1) at 49.1 (Aug: 51.7).83-month low.

- Flash Germany Services PMI Activity Index(2) at 52.5 (Aug: 54.8). 9-month low.

- Flash Germany Manufacturing PMI(3) at 41.4 (Aug: 43.5). 123-month low.

- Flash Germany Manufacturing Output Index(4) at 42.7 (Aug: 45.8). 86-month low.

Commenting on the flash PMI data, Phil Smith, Principal Economist at IHS Markit said that "The manufacturing numbers are simply awful. All the uncertainty around trade wars, the outlook for the car industry and Brexit are paralyzing order books, with September seeing the worst performance from the sector since the depths of the financial crisis in 2009.

"Another month, another set of gloomy PMI figures for Germany, this time showing the headline Composite Output Index at its lowest since October 2012 and firmly in contraction territory. "The economy is limping towards the final quarter of the year and, on its current trajectory, might not see any growth before the end of 2019.

"With job creation across Germany stalling, the domestic-oriented service sector has lost one of its main pillars of growth. A first fall in services new business for over four-and-a-half years provides evidence that demand across Germany is already starting to deteriorate."

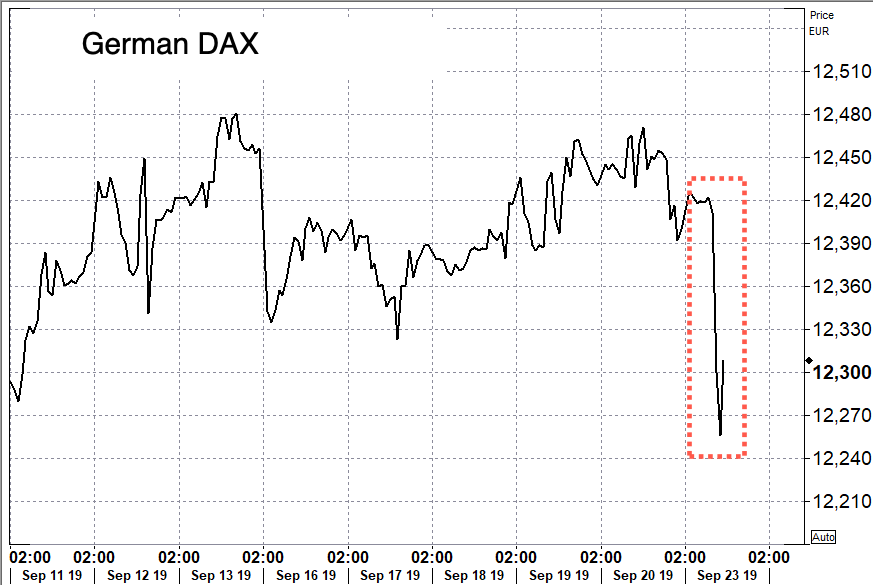

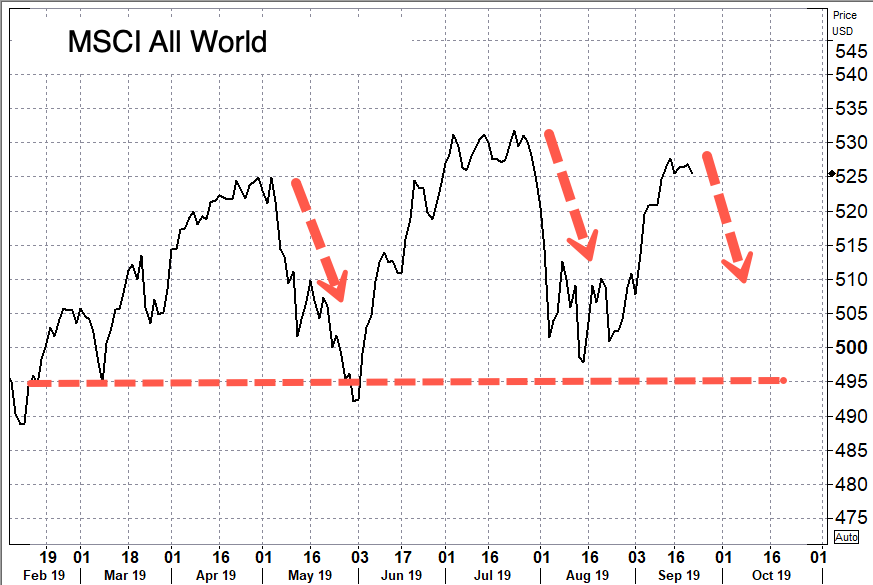

In kneejerk reaction, global equity futures across the world slumped. European equity futures, from the STXE 600, DAX, CAC 40, FTSE MIB, and IBEX 35 were down over -1%. S&P500 mini tumbled nearly -1%, rejecting the 3,000-handle, and finding a short term bottom around 2982 at the 5 am est. hour.

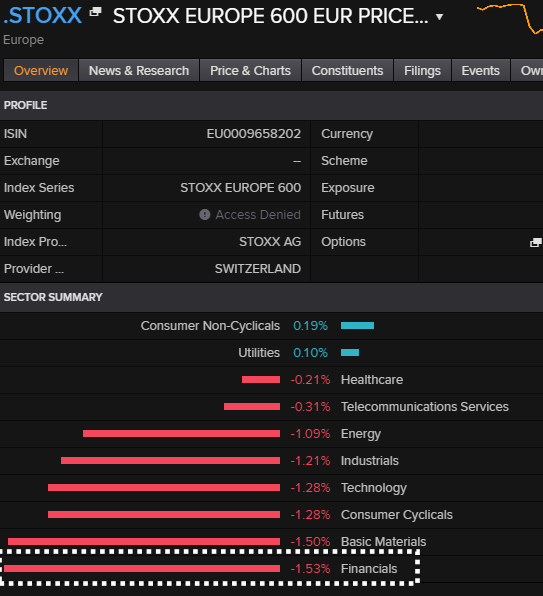

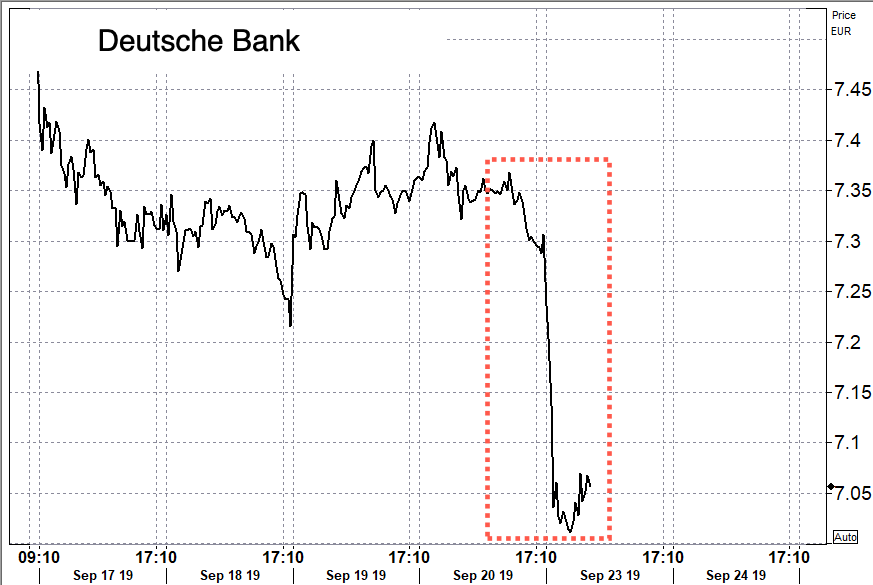

European banks were some of the worst performers of the morning, pulled lower by lenders after PMI figures for Germany were released. Around 5 am est., the Stoxx 600 Bank Index was down -1.6%.

Commerzbank (-5.1%) and Deutsche Bank (-3.6%) lead the declines as the latest PMI figures confirmed Germany is in a technical recession.

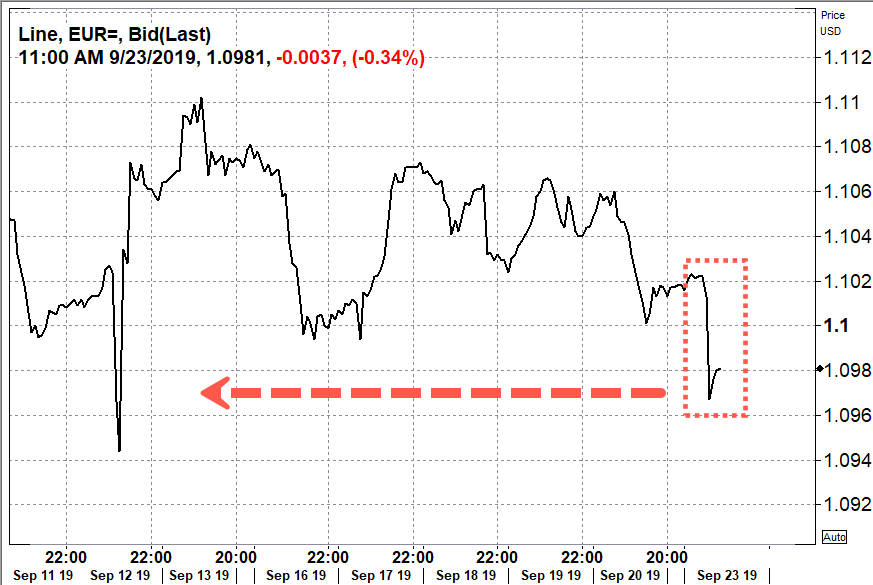

In currencies, the dismal PMI data pressured the common currency, and the EURUSD lost the $1.10 handle, dropping 0.5% to 1.0966, after both Germany and France PMis missed, and what's worse, now indicate there are spillover effects into the service sector. "Option-related demand around 1.1000 failed to absorb the selling pressure, with intraday bidding interest below 1.0980 also coming to the test," traders told Bloomberg.

The weak PMI data from Europe was not a surprise, but the spillover into services shows the consumer is starting to weaken, an indication that the slowdown is broadening.

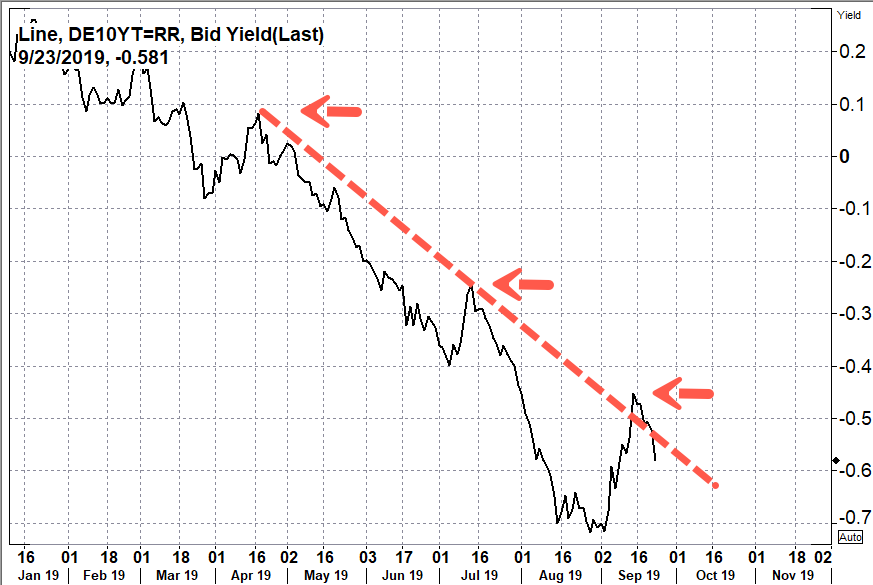

Predictably, Bund yields across the euro area fell in response to PMI figures for Germany, which deepened investors' recession fears and sparked a rally in government bond markets, where yields declined.

"The bit that will worry markets is that services that have been largely immune now show signs of substantial contagion effect from the slowdown in manufacturing," said Marc Ostwald, global strategist at ADM Investor Services.

"In terms of today's price action it will put a big old dent in equities and give the whole spectrum of government bonds a boost."

Germany's 10-year bond yield fell to -0.576% — its lowest level since the ECB meeting (Sept. 12) concluded that rate cuts and fresh stimulus were needed to boost weak growth.

The MSCI All Country World Index, which tracks shares across 47 countries, also dropped on the news of more slowing in Europe.

Brent crude futures jumped on doubts how fast Saudi Arabia can restore its crude output after a drone attack earlier this month crippled one of its largest oil processing facilities.

Brent crude futures climbed to as much as $65.50 per barrel, a gain of over 1%, but have gone red post-PMI data.

"Considering that Germany already contracted in Q2, today's numbers effectively increase the risk of another negative quarter in Q3, which by definition would constitute a technical recession," said Marios Hadjikyriacos, investment analyst at XM.

"It seems that the malaise in manufacturing -- owed to trade and Brexit worries -- has started to spread to the much larger services sector as well."

Market sentiment was already fragile entering the new week, and it seems that global markets could be returning to macro, scared by the deepening of the German manufacturing recession, and a spillover into services.

Commenti

Posta un commento