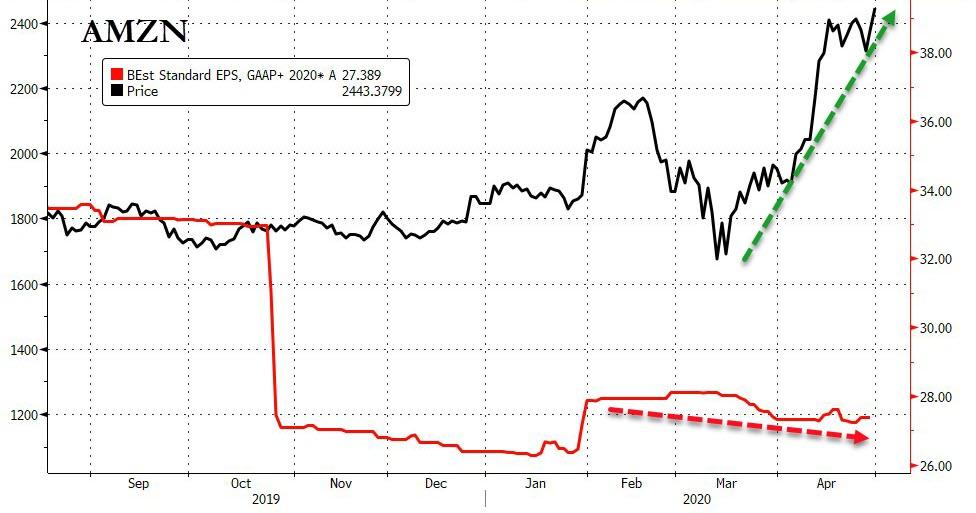

... the stock soared to a new all time high - resulting in a market cap of $1.2 trillion - on expectations that the online retailer would be the biggest beneficiary of the countrywide quarantine which shut down virtually all traditional retail outlets and forced Americans to go on an online shopping spree from home. Furthermore, heading into earnings after hours, options traders were positioning for even more gains in Amazon with calls outnumbering puts by a rate of 1.4-to-1 among the contracts expiring tomorrow, while the implied post-earnings move in the share price was about 6.5%.

Was this optimism justified? Well, this is what Amazon just reported.

- Q1 EPS of $5.01, missing estimates of $6.27

- Q1 Net Sales of $75.5B, smashing estimates of $73.74B

- Q1 AWS Net Sales of $10.22BN, missing estimates of $10.3BN, and up +2.7% Q/Q

- Q1 Operating Income of $4.0BN, down from $4.4BN a year ago.

In other words, Amazon missed on the bottom line and AWS growth, but beat on revenue. But it wasn't Amazon's solid Q1 earnings that were the focus but rather its outlook that spooked investors, because while the company now expects solid revenue growth in Q2, the midline of its profit guidance (-$1.5BN to +1.5BN) was just $0.0, as the "guidance assumes approximately $4.0 billion of costs related to COVID-19."

- Sales between $75.0 billion and $81.0 billion, or up 18% and 28% Y/Y, vs Ext of $77.93BN

- Operating income (loss) is expected to be between $(1.5) billion and $1.5 billion, compared with $3.1 billion in second quarter 2019. This guidance assumes approximately $4.0 billion of costs related to COVID-19.

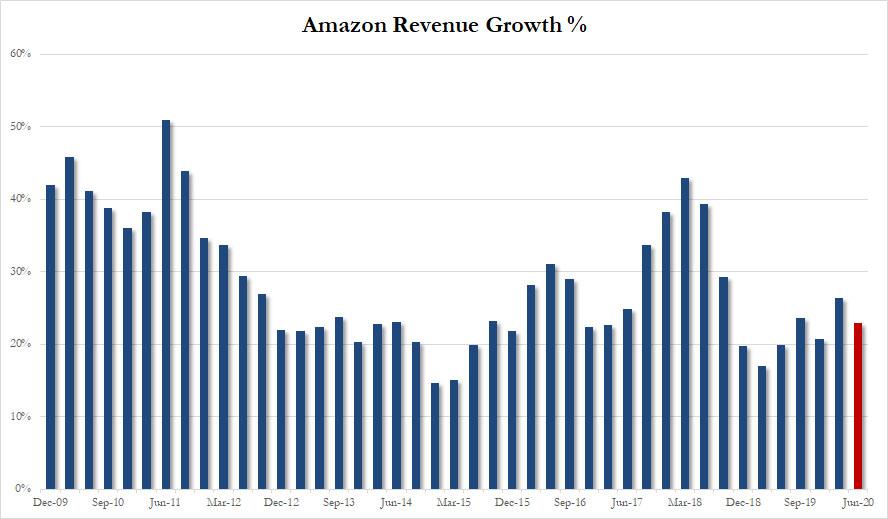

In other words, as Bloomberg puts it, the costs of managing online shopping demand in the Covid-19 era will be huge and could push Amazon into the red this quarter, spooking investors about the high cost of delivering essentials. Meanwhile, as shown in the chart below...

... Q2 revenue growth of 23% (taking the midline) was clearly solid and indicates the company does not expect any headwinds on the topline, however it is the concerns about covid expenses and profits that have spooked investors and are outweighing the upside of strong revenue growth

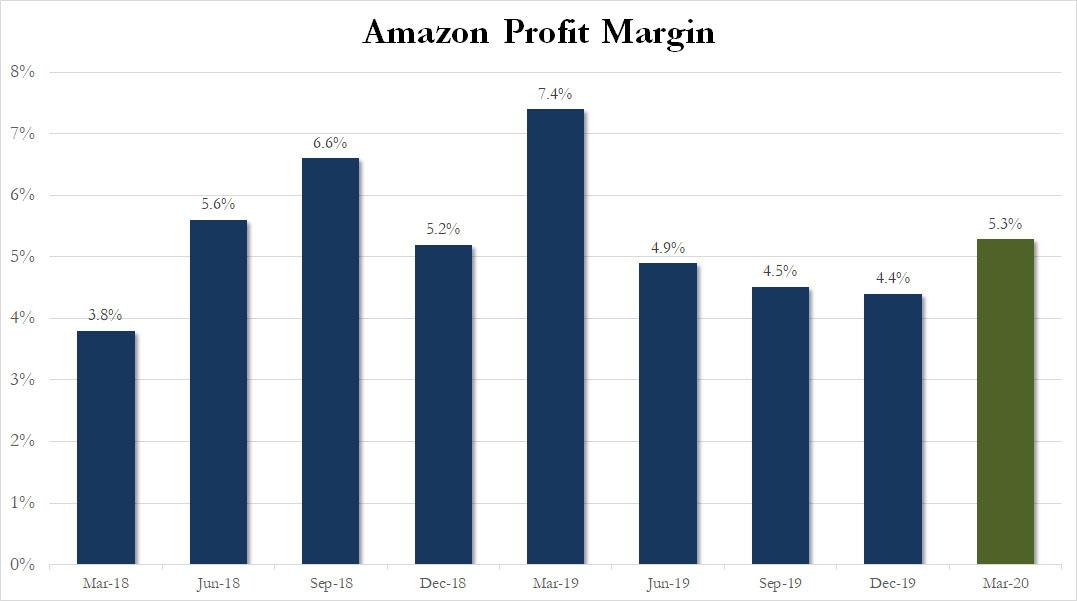

There was more good news in the company's profit margin which rose sequentially to 5.3% but dipped from 7.4% a year ago.

What is also clear is that the coronavirus has impacted the company, as the following headlines suggest:

- Amazon Sees Spending $4B or More on Covid-Related Expenses

- Amazon Says Has Procured 100M Face Masks

- Amazon Says Requiring Masks for Associates, Drivers, Staff

- Amazon Sees $4B in Covid-19 Costs Affecting Guidance

- Amazon Says Doubled Regular Hourly Base Pay for Overtime

- Amazon Says Has Hired 175,000 for Higher Demand, Assistance

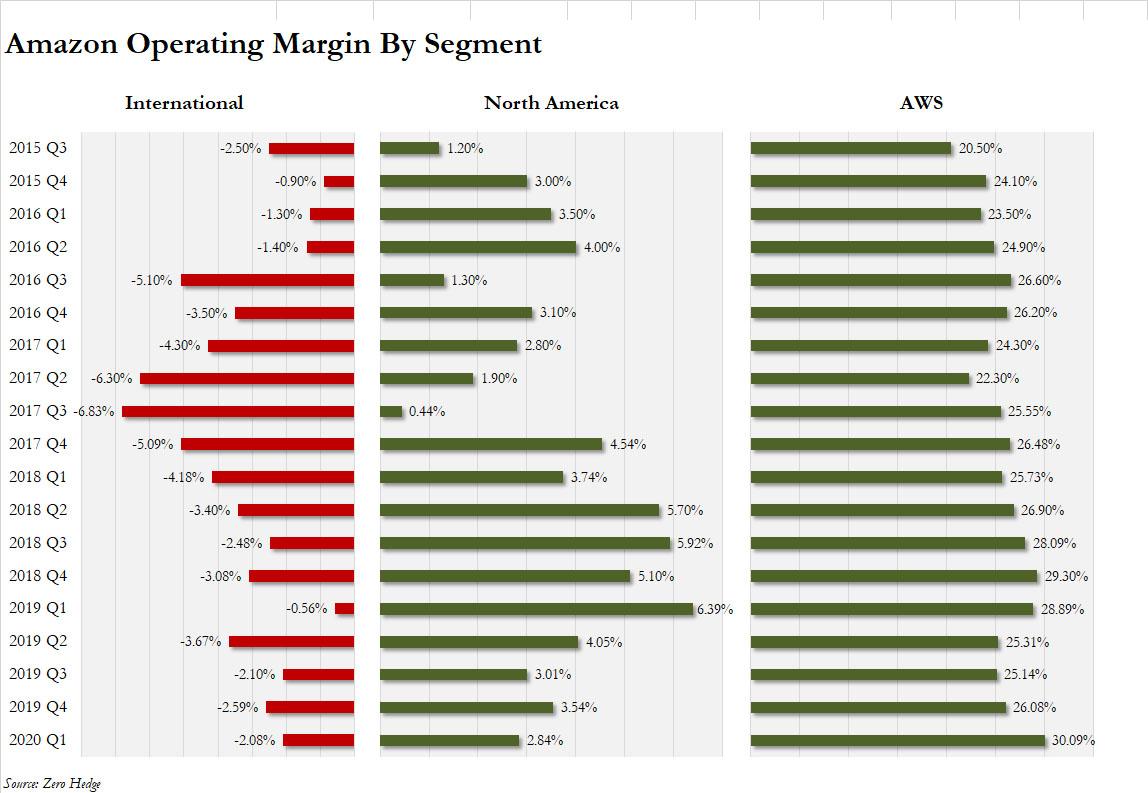

As usual AWS was the primary source of profit, and with $3.1BN in operating income (up from $2.2BN a year ago) or 77% of the company's total operating income of $3.989. Meanwhile, the international division continues to burn cash, and despite generating $19.1BN in sales, it resulted in yet another loss of ($398MM) in Q1.

To summarize, AWS revenue growth:

- Q1 2018: 48%

- Q2 2018: 49%

- Q3 2018: 46%

- Q4 2018: 46%

- Q1 2019: 42%

- Q2 2019: 37%

- Q3 2019: 35%

- Q4 2019: 34%

- Q1 2020: 33%

The good news however is that after declining for a year, AWS operating margin finally posted a modest rebound:

- Q1 2018: 25.7%

- Q2 2018: 26.9%

- Q3 2018: 31.1%

- Q4 2018: 29.3%

- Q1 2019: 28.9%

- Q2 2019: 25.3%

- Q3 2019: 25.1%

- Q4 2019: 26.1%

- Q1 2020: 30.1%

Meanwhile, Amazon's North America segment margins dipped to 2.84% from 3.54%, the lowest in three years.

Commenting on the results, Jeff Bezos had this to say:

From online shopping to AWS to Prime Video and Fire TV, the current crisis is demonstrating the adaptability and durability of Amazon's business as never before, but it's also the hardest time we've ever faced.

If you're a shareowner in Amazon, you may want to take a seat, because we're not thinking small. Under normal circumstances, in this coming Q2, we'd expect to make some $4 billion or more in operating profit. But these aren't normal circumstances. Instead, we expect to spend the entirety of that $4 billion, and perhaps a bit more, on COVID-related expenses getting products to customers and keeping employees safe. This includes investments in personal protective equipment, enhanced cleaning of our facilities, less efficient process paths that better allow for effective social distancing, higher wages for hourly teams, and hundreds of millions to develop our own COVID-19 testing capabilities.

I'm confident that our long-term oriented shareowners will understand and embrace our approach, and that in fact they would expect no less."

The results show that investors got a little carried away with their rosy projections about Amazon's performance in the Covid-19 era. Amazon CEO Jeff Bezos sees the big opportunity in front of him and is willing to spend as much as it takes now to keep customers happy and win market share long term. Investors always seem to forget that part of his personality even though he does this habitually.

In any case, after hitting an all time high just before earnings, the stock has since dropped some 5% after hours as investors digest the somewhat gloomy forecast.

That said, this is likely only temporary. As Bloomberg puts it, Amazon shares are falling, "but this is a smart move for Amazon from a public perception standpoint. The company has been under assault from some activist workers and unions who say it is skimping on worker protections and forcing people to risk their loves so customers can get patio umbrellas and other non-essential items during the lockdown."

If Amazon operates at a loss, it helps their public perception that they aren't profiteering from the crisis. U.S. regulators taking steps to shut Amazon down, like they have in France and India, is a much bigger threat to Amazon right now. Spending heavily on making its operations safe sends a strong message to regulators.

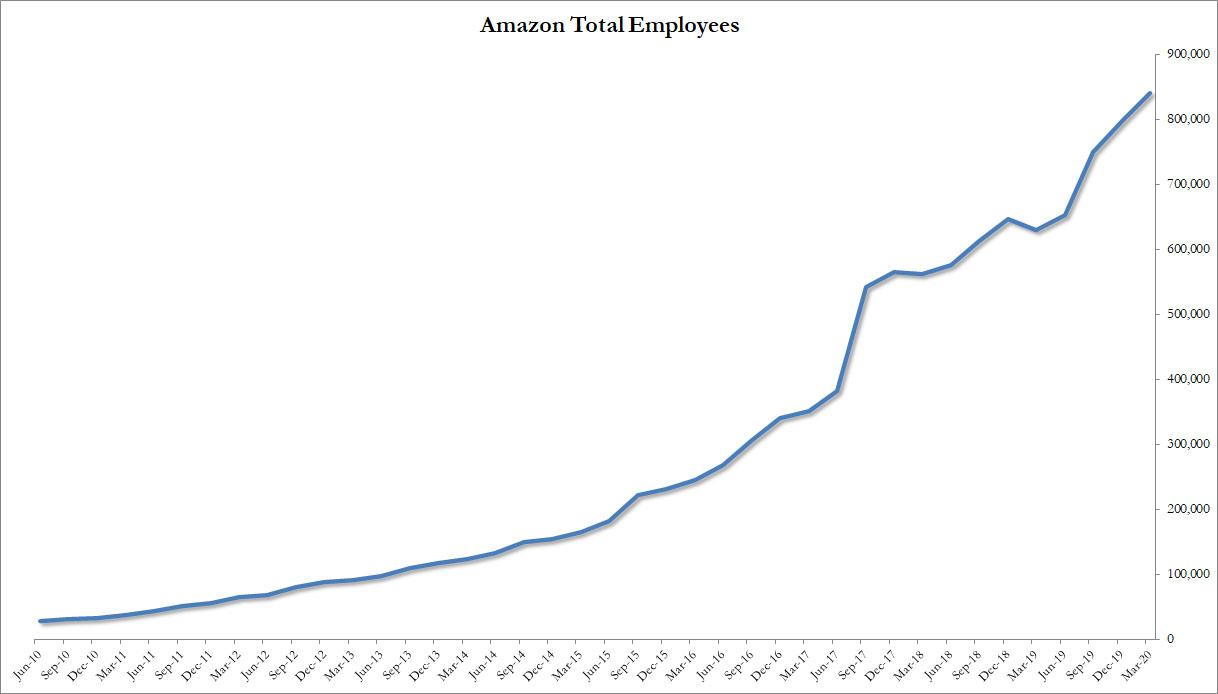

And speaking of employees, Amazon now has a record 840K workers.

In other words, despite the earnings drop, we expect the monopoly online retailer to trade at all time highs within a few days.

Commenti

Posta un commento