It seemed like such a good idea at the time.

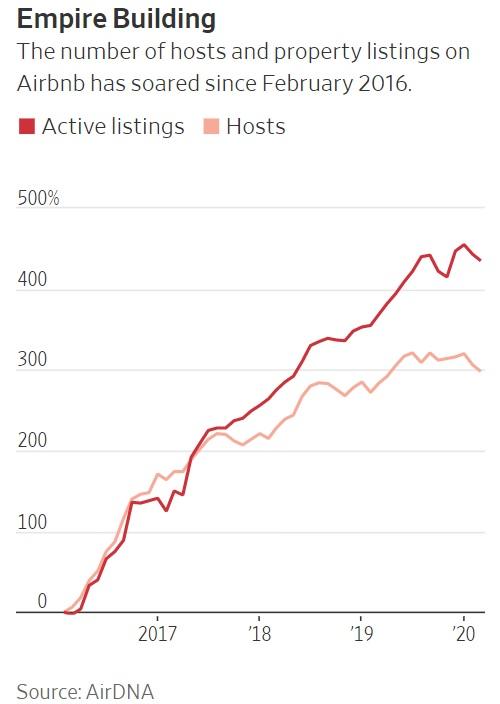

Airbnbs were the next wave in hospitality, taking market share from hotels and motels and backed by a tech network that made running a virtual bed and breakfast fun and easy.

At first it works.

Your properties fill up, your reviews are great, and your projected cash flow is twice what you would receive for a long-term rental.

You - along with thousands of others - are thinking "real estate empire."

Then out of nowhere comes a pandemic(!) and the sharing economy suddenly looks patently absurd.

Ride in other people's cars? No thank you.

Sleep in other people's beds? Gross!

Airbnb bookings fall off a cliff, while Airbnb itself reports massive, potentially company-threatening losses.

Now what do you do?

You already have a house of your own so you can't move into one of your rentals. You borrowed to buy your properties so you have big monthly payments. And even with the government's mortgage forbearance program, you've got maintenance and taxes to cover, and little income with which to do it.

You kind of have to sell, if not right now pretty soon. But to whom? See US pending home sales sank 20.8% in March. Meanwhile, big price reductions are becoming the norm on Zillow.

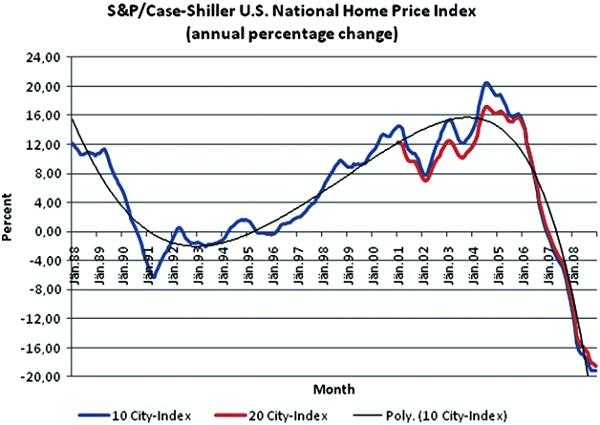

The stuff you bought near the peak of the cycle may now be worth 20% less – if you're lucky.

You, in short, are about to learn the definition of "illiquid."

Another Housing Bust?

Now let's dial the view back to the housing market as a whole. As recently as February, a lot of regional markets had what realtors defined as shortages of homes for sale, which going forward provides a cushion against falling demand.

But that was with thousands of would-be Donald Trumps snapping up Airbnb-worthy rentals in hot markets. Remove that future demand (because who in their right mind is buying Airbnb rentals today?) and add the new supply coming from people who have no choice but to sell, and the supply/demand calculus might change dramatically. We'll see.

Here's what happened to prices in the last housing recession:

Commenti

Posta un commento