Such are the unanticipated consequences of a media over-saturated culture that we were so easily deceived by appearances.

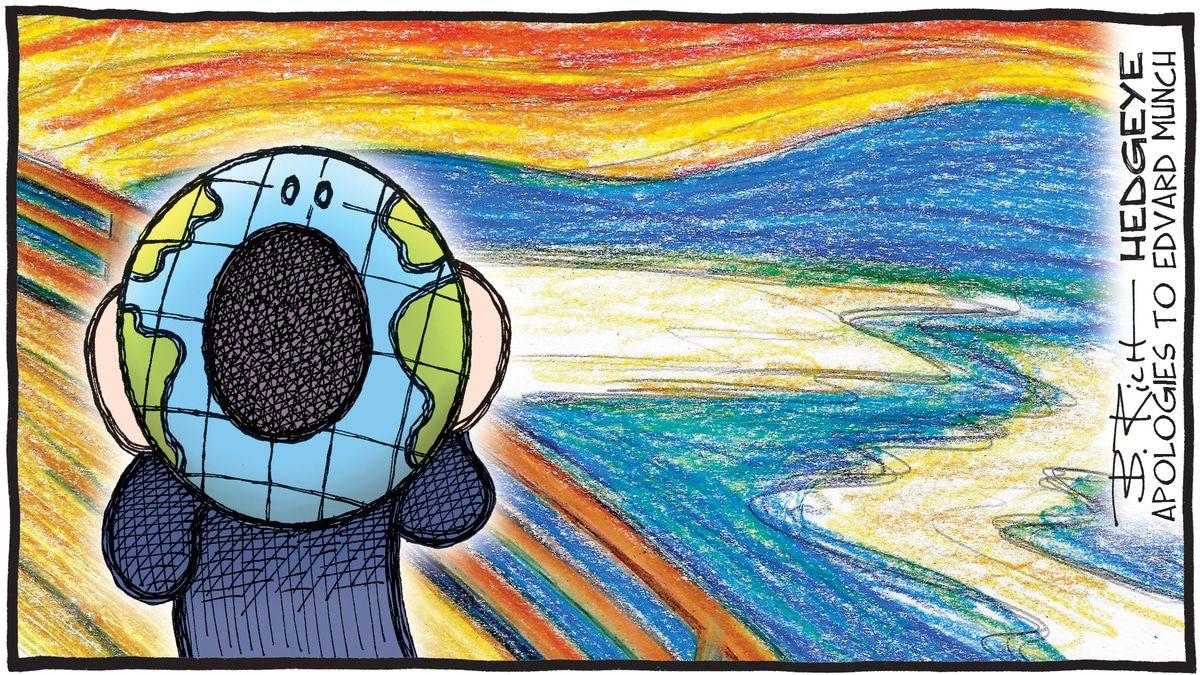

The emotions entrained by this implacable disaster have barely expressed themselves in the social arena. The public is still too shell-shocked by the prospect of losing everything – jobs, incomes, status, chattels, a future – to commence what the shrinks call "acting out." Anyway, half the country is still acting out over the election of Mr. Trump three years ago.

But, for the moment, an interesting debate rages internationally as to whether the Covid-19 virus was some kind of engineered event designed to bring about various political outcomes...

One thread declares that the Democratic Party, its media handmaidens, and a helpful Chinese leadership used the virus to blow up the US economy and finally, after several botched attempts, get rid of the vexing Mr. Trump.

It's a tidy story, but I don't buy it, for the simple reason that the entire global economy has blown up, including China's, so you can file that meme in the Wile E. Coyote folder.

A gloss on that one is the idea that NIAID director Anthony Fauci and other medical experts are wicked conspirators bent on destroying American morale by overstating the threat of Covid-19.

This includes the phrase that the novel corona virus is "just another seasonal flu," and so ordering people to stay away from work and business was unnecessary. Again, you'd have to ask yourself why medical experts and other plausibly intelligent people in so many other countries would do exactly the same thing. They can't all be orcs.

Then there's the one that has Bill Gates so worked up about climate change that he's using his foundation's deep resources to reduce the world's population by sowing maximum disorder onto the scene with Covid-19 hysteria.

This one casts Mr. Gates as something like a villain from a James Bond movie, deep in his Seattle mega-fortress petting a Persian cat as millions perish. Sounds like another case of Americans confusing movies with real life.

Another story has a shadowy gang of "globalists" using the disorder spawned by the virus to impose a centralized global uber-government run by international financiers.

First of all, that one smacks of the hoary conspiracy theory that Bilderberger bankers are scheming to take over the world – yet these supposedly hyper-clever "puppet-masters" are proving that they can't even run the banks and their own financial ops, which are now crashing down around their ears along with everybody else's. Thirdly, if there is trend anywhere in this collapse scenario, it is for the devolution of power downward, away from floundering centralized power structures and institutions. As they flounder, the faith of their subject peoples ebbs away and the trust horizon shrinks so that the people are no longer willing to depend on distant authorities for anything.

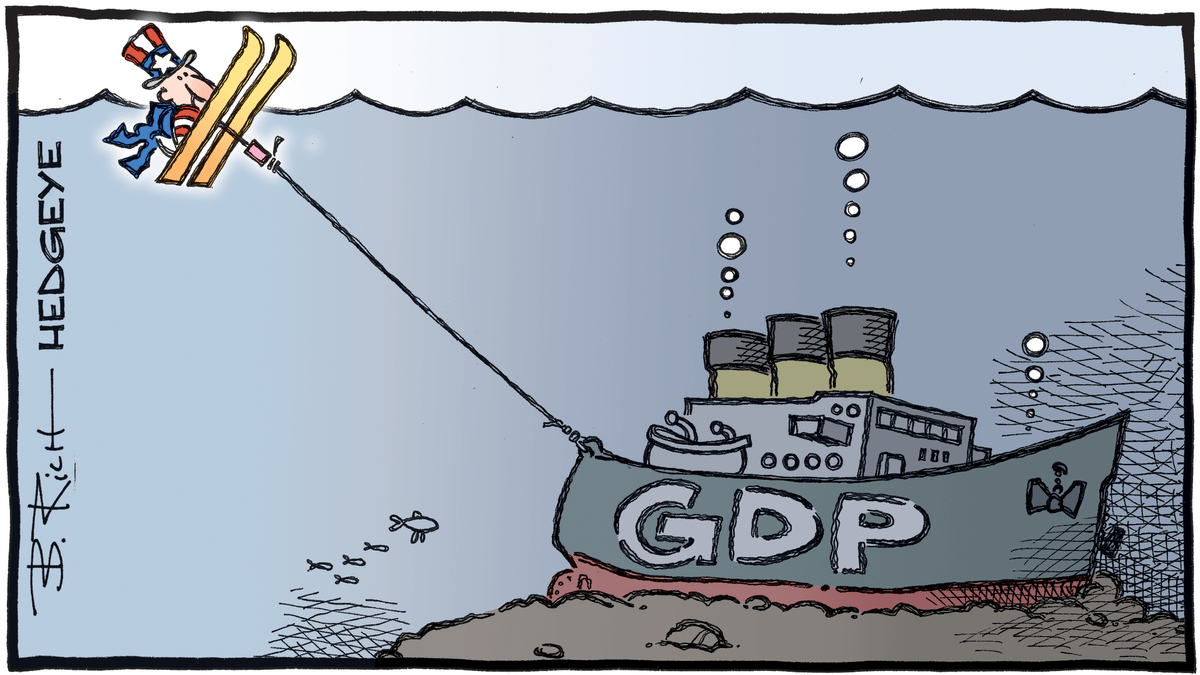

That floundering of centralized authorities is exactly what's in process here in the USA.

Mr. Trump surely has enough problems attempting to manage this crisis, not the least of which is his own unfortunate habit of jumbled impromptu speech that often sounds like sheer blather. Some observers like to call it "plain speech," but in my experience even the common folk of America, the plumbers, truck drivers, and waitresses, express themselves more coherently. It's just not very reassuring. Believe me, I don't want to see the president fail, but I would advise him to stick to the teleprompter.

Of course, then, there is Joe Biden, the implausible nominee-presumptive of the opposition. Who are they kidding with this emperor's new clothes scam? It's obvious now to anyone over twelve in this land that Joe Biden is missing a few transistors on the old motherboard – not to mention the slime-trail of grift and money-laundering that he laid down in his adventures abroad as vice-president. His manner of speech, while different than Mrs. Trump's, is even more pathetically incoherent. The Democrats' pretense that he is a viable candidate is the ultimate falsehood in a long train of barefaced falsehoods they've so earnestly retailed since 2016, making them utterly untrustworthy to run the nation's affairs.

We don't know whether anyone, or any faction, will be able to run the nation's affairs in the months upcoming. The least credible cohort these days are the folks presiding over the financial side of things. There is plenty of debate as to whether the mega bailouts and backstops will bring on inflation or deflation, both ruinous at the grand scale.

There's abundant evidence that this flood of money-from-thin-air will do nothing to arrest the unwind of a system so rotten that it casts an odor across the boundaries of history.

Wall Street has screwed America's pooch so completely that the poor pooch can't even squeal for mercy anymore. The Federal Reserve crew and their allied banksters have barely a few weeks before an immiserated public comes after them with the modern equivalent of pitchforks. Wait for the breaking news on the cable networks: The Hamptons are burning!

Commenti

Posta un commento