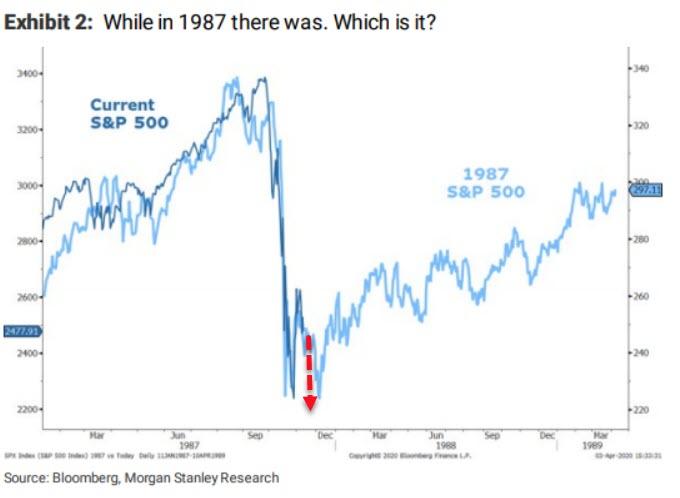

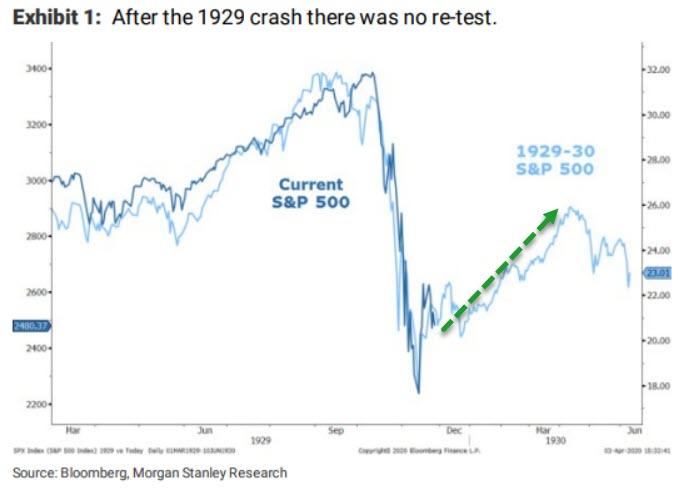

And while we have shown that the initial drop of the current crisis was more violent and rapid than the first leg of either the Black Monday crash or the Great Depression, the far more relevant question asked by traders, is what happens next if we use the 1987 and 1929 benchmarks as a reference. Will we "retest", or was March 20 the low, something which Morgan Stanley says is "the number one question we continue to discuss with clients", the same "number one" question that Goldman's clients were asking a week ago.

To answer that question we show Morgan Stanley's updates to these charts as they both remain remarkably on track for one of these episodes to play out.

In other words, if we are now re-living 1987, then a retest of the lows is imminent at which point the last of the bulls will be cleared out, leading to more near-term pain but also a faster recovery.

Alternatively, if 2020 "is" 1929, then prepare for a lengthy period of pain as stocks struggle for the next decade, with the silver lining that at least they won't drop below the late-March lows.

But, be careful what you wish for as that 1929 'no retest' ended very, very badly...

For what it's worth, Morgan Stanley notes that it does not think we will have full retest of the lows nor do we think this is the beginning of a depression" which is surprising to say the least for a bank whose economists not only expect GDP to crash 38% in Q2, but for the full GDP loss to be recovered only by the end of 2021.

Indeed, ignoring its own economic forecast, the Morgan Stanley equity strategy team says that "as we have discussed in prior notes, we think this is the end of a cyclical bear market that began 2 years ago in the context of a secular bull market that began in 2011."

Commenti

Posta un commento