Yellen Blames "Enormous Debt And Buybacks" For Coming Default Wave; Morgan Stanley Says It's All The Fed's Fault

"Will I say there will never, ever be another financial crisis? No, probably that would be going too far. But I do think we're much safer and I hope that it will not be in our lifetimes and I don't believe it will."

While the bulls cheered this idiotic prediction, some were quick to compare this statement by Yellen to Neville Chamberlain's infamous - and very, very wrong - "peace in our time" speech. In retrospect the some were right because less than three years later, the world is going through the biggest financial crisis in every living person's lifetime, which has resulted in the most aggressive central bank market stabilization and intervention in history.

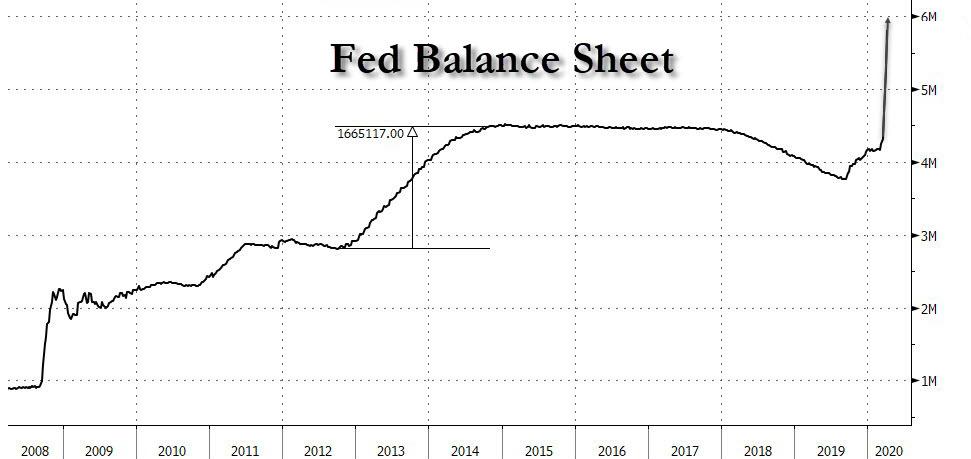

Also in retrospect, it is clear that Yellen didn't have any bloody idea what she was talking about (then, or any other time when she was boring traders and analysts to death with her droning, narcoleptic monotone) even as we - among others- were warning that it was her monetary policy decisions that guaranteed the next crisis would put 2008 to shame. And sure enough, while the current crisis was sparked by the coronavirus pandemic, it is what comes next that the financial crisis will truly strike home as thousands of companies that loaded up on cheap, cheap debt during the Bernanke, Yellen and Powell Feds, default.

Amazingly, it was again this same intellectual and otherwise midget, that last week had the audacity to deflect blame for the current crisis (which she said would never happen in her lifetime) when last Monday, Yellen said that choices by broad swaths of the financial industry and companies were going to make it harder for the economy to recover from the coronavirus crisis. Choices, which apparently, took place in a vacuum in which the Fed did not keep interest rates at the lowest level in history while blowing the biggest asset bubble ever. Or at least that's how the recent past looks like through Yellen's revisionist perspective.

Commenting on Yellen's video broadcast hosted by the Brookings Institution, the WSJ wrote that while the banking and financial sector was in "generally in good shape" ahead of the crisis, problems were already taking shape according to Yellen, who three years failed to predict the future with her patently idiotic "no crisis in our lifetimes", and now also appears unable to accurately discuss the past, where she just happened to be a key catalyst for the epic crash that is coming.

Blaming everyone but herself, Yellen said that "non-financial corporations entered this crisis with enormous debt loads, and that is a vulnerability. They had borrowed excessively" and they did it not so much for productive purposes like investment, but for buying back stocks and paying dividends to shareholders. And while these firms borrowed, investors also let their guards down in their hunt for high yields, the former central bank official said, shocking oblivious of the Fed's role in permitting all of this behavior to continue for years and years, building up massive imbalances which are now finally being unleashed and forcing the Fed to do absolutely everything in its power to prevent true price discovery which would take place... about 60% below current S&P levels.

This blameless narrative continued, with Yellen having the gall to go so far as saying that the corporate borrowing binge - which she helped unleash - "creates risk to the economy. And I'm afraid we'll see that in spades in the coming months, because it may trigger a wave of corporate defaults. Even where a company avoids default, highly indebted firms usually cut back a lot on investment and hiring, and that will make the recovery more difficult," the former central banker said, once again hoping to never be named in the list of antagonists whose actions led to the biggest US depression in a century.

We are confident that history will have a different take that Yellen's endlessly self-serving bullshit, and it was none other than Morgan Stanley's Michael Wilson who best explained last week why the corporate bond bubble, which will over the coming weeks and months mutate into the biggest default wave in decades, is a direct consequence of the Fed's actions in general, and Yellen's stupidity in particular to wit:

We have never seen corporate leverage as high as it is now. Much of this credit was added because credit markets have rarely been so inviting to issuers. This is the direct result of the financial repression era orchestrated by central banks during and after the Great Recession.

In short, the abnormally low cost of borrowing has encouraged companies to lever up and use this financial leverage to drive better earnings growth in what has been a sluggish economic recovery.

Companies are capitalist entities and so they are simply acting in their fiduciary duty to shareholders when they behave in such a manner. Much of this financial arbitrage has been executed via share buybacks, which is now being criticized by members of Congress as they pass the largest fiscal stimulus in history.

It's important to note that low growth is very different from negative growth. Now that we have entered a recession, the corporate bond market knows the risk of default is much greater – hence the dramatic moves we have seen in credit spreads in the past month. As an aside, the correction in stocks really took a turn for the worse when tensions between Russia and OPEC caused a collapse in oil prices.

This is what triggered the stress in corporate credit markets, in our view, which contributed significantly to the crash in stocks and the economy.

Many acknowledge that credit markets are more important to the functioning of the economy than equity. As bad as the moves were in stocks this month, they were much worse in credit than they were in equities on a risk-adjusted basis.

And while Yellen's entire career, and her ability to "predict" the future are now the butt of all financial jokes, here is one forecast that we are absolutely certain will come true: when historians look at the cast of villains responsible for the coming second great depression, Yellen's name will figure in the top three, and for her sake, one hopes that the US public - traditionally clueless when it comes to all maters Fed-related - remains clueless, or else when it comes to "lifetimes" hers may be materially tapered once the tribunals start rolling.

Commenti

Posta un commento