The pool of negative-yielding debt across the world exceeded $18 trillion for the first time in history, according to Bloomberg data. The move came after the ECB announced it will expand its massive monetary stimulus program by another €500 billion and will extend emergency bond purchases for nine months.

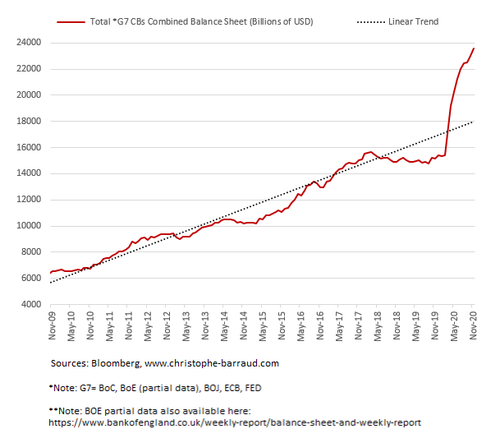

In a context where global economic policy uncertainties remain particularly high (Covid-19, Brexit, U.S. fiscal stimulus, etc.), it seems that central banks in advanced economies are ready to be even more accommodative in the coming months to support confidence and economic activity. As a reminder, according to my calculation, G7 central banks' combined balance sheet has already increased by more than $8.0 trillion since February 2020.

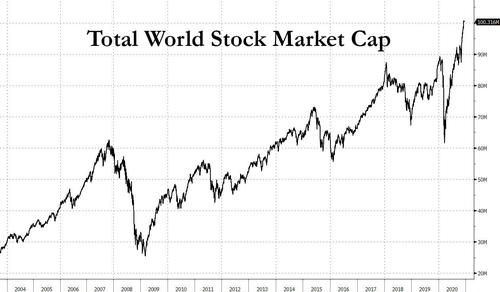

These policies have led to a sharp increase in money supply and have contributed to inflate price of financial assets such as bonds (downward pressure on yields) and equities. In this context, Bloomberg World Exchange Market Capitalization (equities) topped $100 trillion last week.

Commenti

Posta un commento