Good Morning. As of this writing, The DXY is flat after a pounding yesterday . Bonds are unchanged. Gold February futures are up $1.50 at $1891.90. March Silver is trading $26.13 after a massive rally yesterday, PGMs are mixed and Copper is up 3 cents at $3.60. Stocks across the board are up small. BitCoin is up 150 around 23,000 after touching 23,837 a significant ATH change from 3 days ago. Oil futures are up slightly, at $48.55. Nat Gas is trading up 4 cents at $2.68ish. Soy futures are up 8 cents having cracked the $1200 barrier.

BitCoin Goes Bonkers- touches just below $24,000

Gold, Brent, and WTI Technicals

The following are excerpts from Moor Analytics Gold and Energy Technical Reports[EDIT- Written 5:05AM- VBL] posted here with permission:

- Gold (G)-Upside: Sell against/into $1,900.1- XXX (-1 tic per/hour starting at 8:20am); get long on a solid penetration above and look for strength to come in...

- Brent (G)-12/15 EOD: Decent trade below $49.80 (+1.4 tics per/hour starting at 8:00pm) will put this below a minor pattern that will warn of pressure. If we break below here decently and back above, look for short covering to come in.

- Crude Oil (WTI) (F) 12/15 EOD: Decent trade below $45.96 (+1 tic per/hour starting at 6:00pm) will project this downward $1.85 minimum, $2.35 (+) maximum [with prescribed risk stops placed appropriately]

Go to MoorAnalytics.com for 2 weeks of his report free

Japan Sells Gold to Finance Debt

Reuters reports that Japan sold 80 tons of gold allocated for coin minting to another arm of the government to fund part of its huge stimulus package to combat the coronavirus crisis. Or at least that is what the government officials told them. In a rare action, in order to raise cash in dollars for stimulus funding, the Finance Ministry of Japan sold FX reserves to the Japanese central Bank.- Reuters

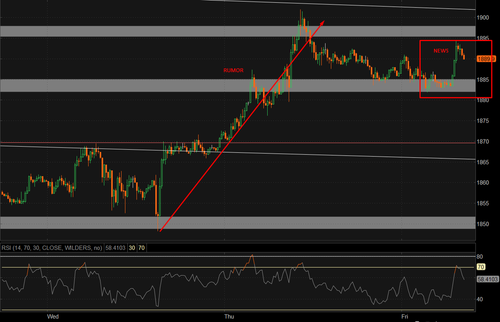

Gold 15 minute Chart: Nothing to see here.

"From the standpoint of fiscal consolidation, this deal may be described as effective use of state property," said Yoshimasa Maruyama, chief market economist at SMBC Nikko Securities. "It sounds reasonable for the BOJ to top up dollar funds. But it was probably the government, not the BOJ, that pulled the trigger in hope of securing money for the university fund." he concluded. Is it reasonable that they didn't actually sell the gold on open market yet?

Smoking Gun for Yesterday's Massive Gold Rally?

What makes this rarer is that the gold was not actually sold, but a paper transfer was done to the BOJ according to Reuters. In other words, the central bank stood for the Gold instead of letting it go out on the market. The trade as they used to say was "crossed in house." When government does it they call it "effective use of state property". One has to wonder if expectations of a gold sale hitting the market being scrubbed was part of the rally catalyst yesterday. Maybe some dealers got caught with their pants down? Or maybe the ECB had to go to market on its own buying? If it had to, then Benoit Gilson may have been a little busy.

Past significant gold sales marked the bottom of the Gold market. Between 1999 and 2002 the Bank of England was a seller of gold to finance its own issues. This proved to be a bottom for the metal and was dubbed "Brown's Bottom" back in the day.

Source Wikipedia- The sale of UK gold reserves was a policy pursued by HM Treasury over the period between 1999 and 2002, when gold prices were at their lowest in 20 years, following an extended bear market. The period itself has been dubbed by some commentators as the Brown Bottom or Brown's Bottom.

Japan Today reported this morning: "From the gold sale, the division in charge of debt management gained proceeds worth 500 billion yen ($4.84 billion) that would be used to finance a new fund aimed at boosting research and development at universities, two officials told Reuters on condition of anonymity as they were not authorised to speak publicly."

Less Selling Means Higher Prices Usually

The BOJ announced on Wednesday it would buy dollars from the ministry as a precaution against any market disruptions caused by the pandemic. Yes, the pandemic caused this. In for a penny in for a pound... or is it in for a yen in for a million yen?

VBL Comment: This time it may also put in a floor for different reasons. The fact that the BOJ was buyer instead of letting the Fin Min hit the market or worse, sell it to a Bullion bank on a private deal, could be interpreted as bullish. Could it be that the BOJ is being savvy instead of the finance ministry being the sap? We think so. That said, the BOJ could be looking to sell at a later date. But why do that when you can print a few trillion yen and swap them for the dollars you need? It's not real anyway.

Commenti

Posta un commento