- The U.K. became the first Western country to start vaccinations for COVID-19 today, while the FDA is set to OK the emergency use of Pfizer/BioNTech's vaccine.

- With much of the vaccine enthusiasm reflected in November's rally, equities are posting just modest gains.

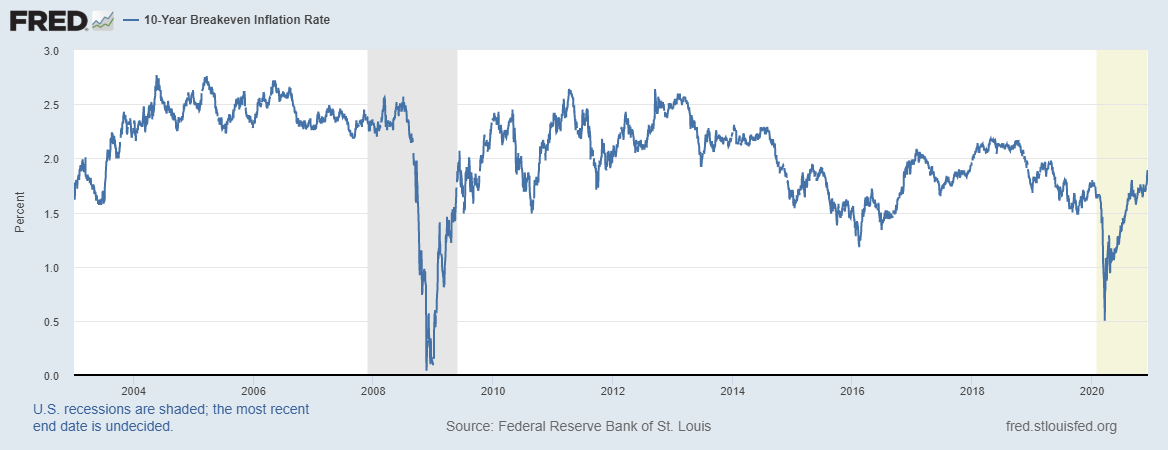

- But the market's expectations for inflation are higher than they've been in 19 months and around the rebound levels where the economy broke out of recession after the financial crisis in 2009.

- The 10-year breakeven inflation rate is at 1.89. The breakeven rate is the difference between the 10-year Treasury yield (now at 0.91%) and the 10-year inflation-protected TIPS, or real, yield (now at -0.98%) and implies expectations for inflation, on average, in 10 years.

- The breakeven rate is now as high as it has been since May 5, 2019, when it hit 1.91%, moving down from the 2019 peak of 1.98%.

- It got back to 1.97% in June 2009 as economic growth resumed.

- Former New York Fed President Bill Dudley wrote last week that "a number of reasons inflation might come back much more quickly than the consensus suggests."

- Dudley cites low 2020 prices for comparison next year, normal spending in 2H 2021 after vaccine distribution, reduced capacity in the face of resurgent demand, a Fed willing to let inflation run hot and more fiscal stimulus.

- But there could be several potholes on the way to higher prices, such as the production of enough vaccines (and a population willing to take them) and a stimulus stalemate.

- But Wells Fargo Head of Global Fixed Income Strategy Brian Rehling writes "the yield curve continues to send accurate signals as to the future state of the economy" and his expectations "of improving economic conditions in 2021 is confirmed by the yield curve, which has been slowly steepening."

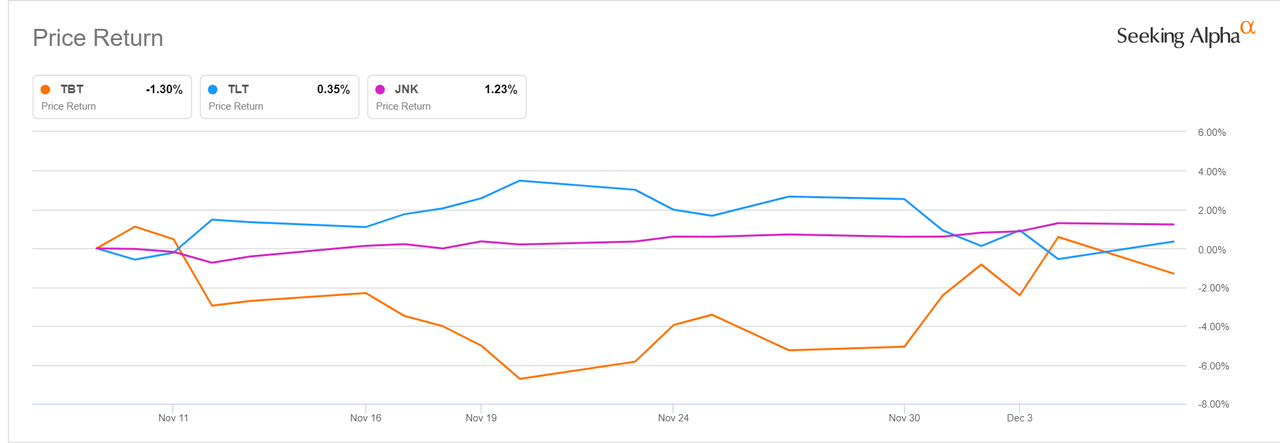

- The iShares 20+ Year Treasury Bond ETF (NASDAQ:TLT) is up 0.6% and the ProShares UltraShort 20+ Year Treasury ETF (NYSEARCA:TBT) is down 1.3%.

- Alexander J. Poulos writes on Seeking Alpha that now is the time to short long-duration bonds, noting "TBT bottomed in late 2008, well ahead of the final bottom in the US stock market in March of 2009."

Commenti

Posta un commento