Over the weekend, Morgan Stanley's chief equity strategist Michael Wilson spooked some of the most vocal market propagandists when he pointed out the patently obvious, that tapering is in fact tightening, but also made a troubling observation for the market bulls: as Wilson put it, "the most powerful offset to a material correction in the S&P 500 this year has been the extremely resilient buy-the-dip mentality among retail investors, a strategy that is now being challenged. After the Evergrande dip and rally, stocks have probed lower and taken out the prior lows, making this the first time that buying the dip hasn't worked, simultaneously violating important technical support."

Then, overnight, Bank of America - which has been just as bearish as Morgan Stanley for much of 2021, most recently warning that the market's growing fragility would lead to a 20% correction in stocks - echoed Wilson in observing that "equity investors are losing confidence in Buy The Dip."

As BofA's derivative strategist Nitin Saksena writes, after suffering a "meaningful setbacks in recent weeks," the coast appears far from clear.

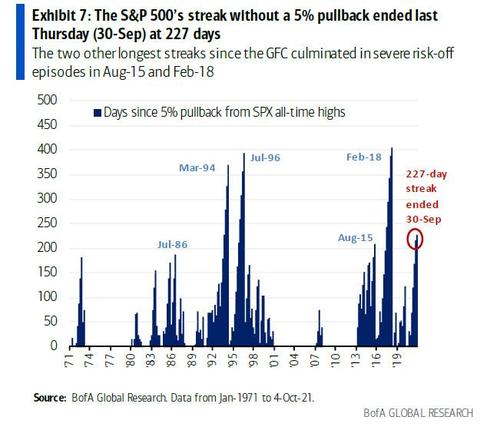

Summarizing the recent market moves, Saksena then notes that after the worst calendar month since Mar-20, the S&P 500's streak without a 5% pullback ended last Thursday (Sep 30) at 227 days. It was the longest streak since Feb-18 and the 4th longest in the last 50 years.

And consistent with his core thesis that stability breeds fragility, he points out that the two other longest streaks since the GFC culminated in severe risk-off episodes in Aug-15 and Feb-18.

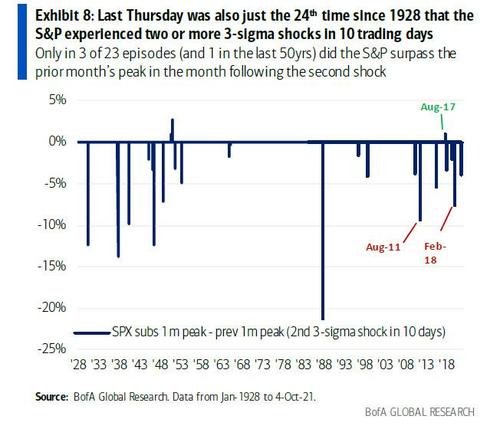

Last Thursday also marked the second daily selloff of 3 standard deviations or more in just 7 trading days, only the 24th time since 1928 that the S&P experienced two or more 3-sigma shocks within 10 trading days.

This is notable because while isolated equity selloffs have traditionally signaled an opportunity to profitably buy the dip, BofA finds that history is less supportive of "buying after clustered shocks" and indeed, only in 3 out of the other 23 episodes (and only in 1 in the last 50 years: the North Korea nuclear missile scare of Aug 2017) did the S&P surpass the prior month's peak in the month following the second shock.

To be sure, while the magnitude of the recent weakness won't make the history books, the stats above carry important sentiment implications for such a momentum-driven market as this one. Most important - according to Bank of America which echoes what Morgan Stanley said - is the realization that buying the dip has failed to be profitable this time, which in turn "may lower investors' confidence in buying the next dip and helping resume the market's climb."

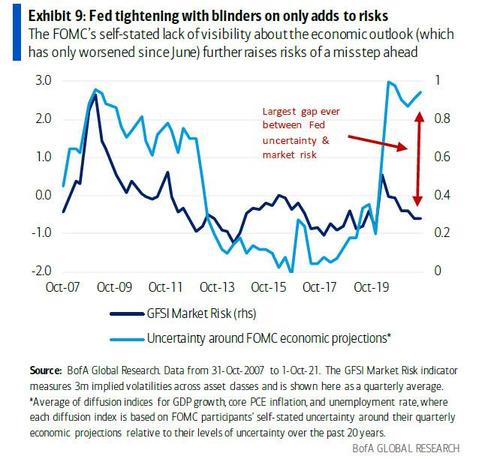

It's not just technicals, of course: BofA suggests that another key obstacle to fading investor confidence in BTFD is the Fed's hawkish turn to begin tapering as early as next month. Obviously, any hints of Fed tightening are daunting for a market so dependent on central bank support, but as BofA also notes, "the FOMC's self-stated lack of visibility about the economic outlook (and which has only worsened since June)...

.. further raises risks of a misstep ahead."

So are these increasingly bearish takes credible?

One look at stocks today, which are surging - as the Monday dip is clearly being bought - and one would be hard pressed to conclude that BTFD is no more. On the other hand, a signal which validates that TBFD may be in trouble comes from Susquehanna International which analyzed OCC data and found that retail traders - the market's most-avid dip buyers earlier this year - are showing further evidence that their famous YOLO, or "you only live once" appetite for risk is waning.

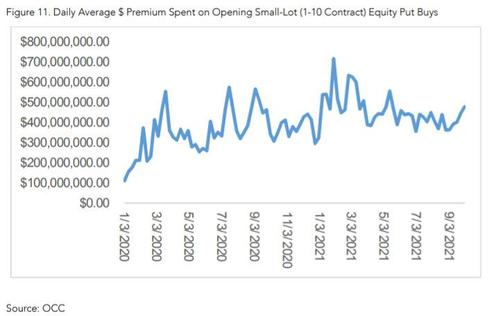

According to the trading house, after the S&P 500 spent just two weeks in the red in September, small-lot options traders - those buying 10 contracts or less at a time - spent just 43% of their total volume on bullish contracts, the lowest share so far this year. In fact, markets sold off further last week, small lots paid up for puts. The daily average premium that small-lot traders shelled out for protection jumped to $480 million, the most since May according to Options Clearing Corp. data. While the premium paid for rout protection is still below its January highs, it is rising as have failed to make new highs, signaling more expectations for even more losses...

... which paradoxically means more are hedged to a drop and will likely step in aggressively to... BTFD when the next correction happens. In fact, we may already be seen just that: while the daytrading crowd may be backing away from small lot calls, its participation in individual stocks and ETFs has held steady. Tech heavyweights like Apple and Nvidia were among the most bought assets on Fidelity's platform during Monday's slide, with individual investors also placing massive bets on the triple-leverage ProShares UltraPro QQQ ETF, betting on a sharp rebound. Looking at today's action, it will be another good day for retail traders.

Commenti

Posta un commento