The energy crisis that is rippling through Asia and Europe could unleash electricity shortages and blackouts in the U.S., according to Bloomberg.

Ernie Thrasher, CEO of Xcoal Energy & Resources LLC., told energy research firm IHS Markit that U.S. utilities quickly turn to more coal because of soaring natural gas prices.

"We've actually had discussions with power utilities who are concerned that they simply will have to implement blackouts this winter," Thrasher warned.

He said, "They don't see where the fuel is coming from to meet demand," adding that 23% of utilities are switching away from gas this fall/winter to burn more coal.

With natgas, coal, and oil prices all soaring is a clear signal the green energy transition will take decades, not years. Walking back fossil fuels for unreliable clean energy has been a disaster in Asia and Europe. These power-hungry continents are scrambling for fossil fuel supplies as stockpiles are well below seasonal trends ahead of cooler weather.

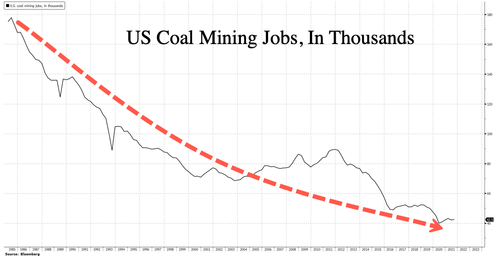

A similar story is playing out in the U.S., where increased demand for coal might not be reached by mining companies. We noted Thursday morning that boosting output might be challenging due to years of decommissioning mines to reduce carbon emissions and transition the economy from fossil fuels to green energy. There's also been a steady decline of miners over the last three and a half decades.

"That whole supply chain is stretched beyond its limits," Thrasher said. "It's going to be a challenging winter for us here in the United States."

Utility company Duke Energy Corp.'s Piedmont Natural Gas unit, covering North and South Carolina customers, warned power bills this winter are set to rise due to high natgas prices and low production.

A pure-play coal company that is already benefiting from the demand surge and rising prices is Peabody Energy Corporation. As cooler weather fast approaches, the company may see increased demand for its thermal coal that utility companies use to produce electricity. On a technical basis, a so-called bullish "golden cross" was just triggered.

The troubled green energy transition gives the fossil fuel industry new hope, especially "Making Coal Great Again."

Commenti

Posta un commento