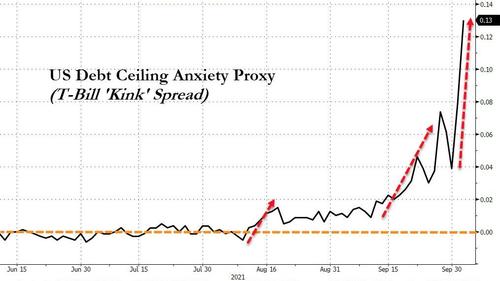

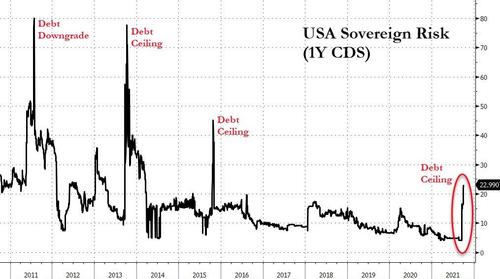

Debt Ceiling concerns are mounting fast as Biden blames McConnell:

Source: Bloomberg

After the desperate rampathon on Friday, stocks drifted gently lower overnight on the heels of Evergrande headlines. That drift turned into an avalanche at the US cash open (as yields spiked and cryptos puked in what felt like some liquidation effort) and stocks stabilized around the European close. Nasdaq was doiwn over 2% on the day and was the biggest loser while Small Caps and The Dow outperformed by only losing 1%...

Nasdaq closed at its lowest since June.

Notably, the S&P gave up all its Friday ramp gains and that's where support came (at a key inflection point in S&P's gamma profile)...

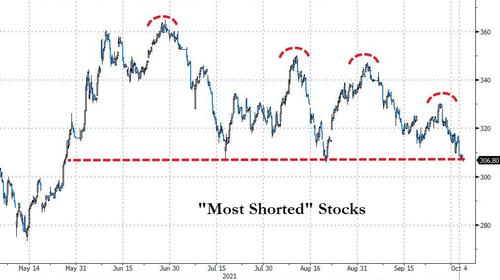

"Most Shorted" Stocks tumbled once again to what is key support...

Source: Bloomberg

"Turn those machines back on!!!"

Algo and large specs appeared to be running the show today amid higher volumes in stock futures while cash trading was light. Large Specs are long and wrong on this one...for now...

Source: Bloomberg

The S&P 500 held below its 100DMA for a third consecutive session today - something that has not happened since the pandemic.

Source: Bloomberg

Dip-Buyers are not emerging and this time is different as the lower low after an initial break of the 50DMA is also not something we have seen since March 2020...

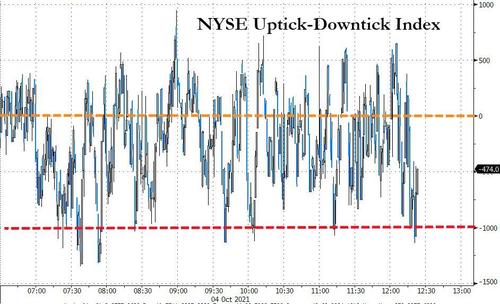

Several 1000+ name sell programs went through the market today, including the third largest computer-generated scheme since the Sept. 20 quad-witch opex...

Source: Bloomberg

Non-Profitable Tech stocks plunged today, back to their lowest since early May...

Source: Bloomberg

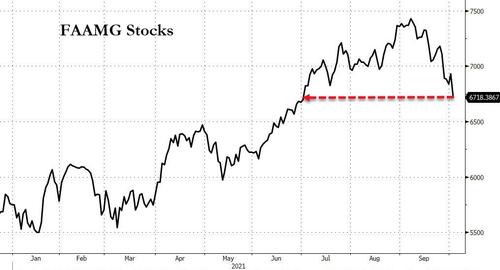

And 'Profitable" Tech stocks are tumbling too with FAAMG stocks down almost 10% from their record highs at 3-month lows (thanks to FB's monkeyhammering among others)...

Source: Bloomberg

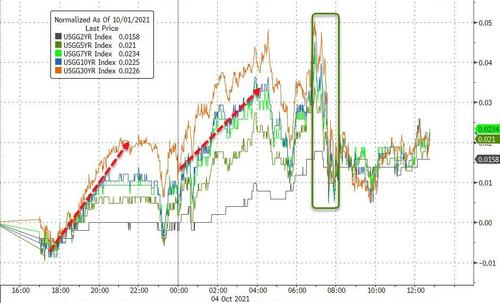

Despite the equity puke, bonds were also sold today (up around 2bps across the curve).NOTE that all the selling was overnight during the Asia and EU sessions with a big bid shortly after the US cash open...

Source: Bloomberg

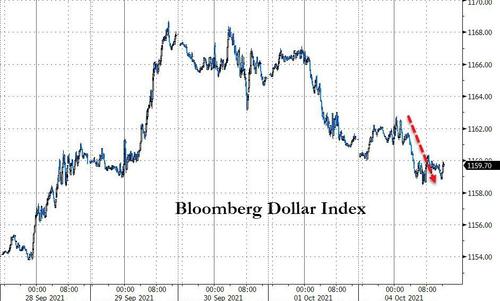

And the dollar was also dumped (though modestly)

Source: Bloomberg

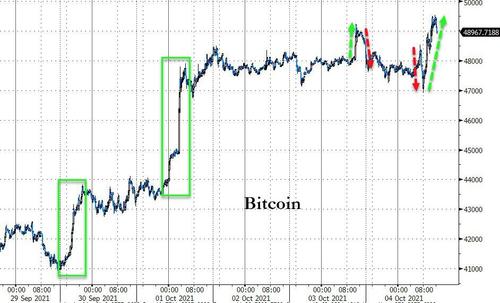

Cryptos were volatile but ended higher as it appears they are once again emerging as inflation (or catastrophic failure) hedges. Bitcoin was volatile but topped $49,500 later in the day...

Source: Bloomberg

And along those lines, Gold also managed gains today...

WTI surged to its highest since 2014 after OPEC+ JMMC erred on the more bullish side of output increases...

Source: Bloomberg

We also note that European natural gas continues to trade astronomically rich to US natural gas...

Source: Bloomberg

Finally, USA Sovereign risk continues to rise...

Source: Bloomberg

Get back to work Mrs.Pelosi!

Because if not...

Source: Bloomberg

Commenti

Posta un commento