Global stocks have re-surged back near record highs, US equities are at record highs, and European companies have rallied an impressive 15% in the last few weeks ahead of earnings season.

This scream higher has occurred despite a major divergence with earnings revisions - continuously negative for months...

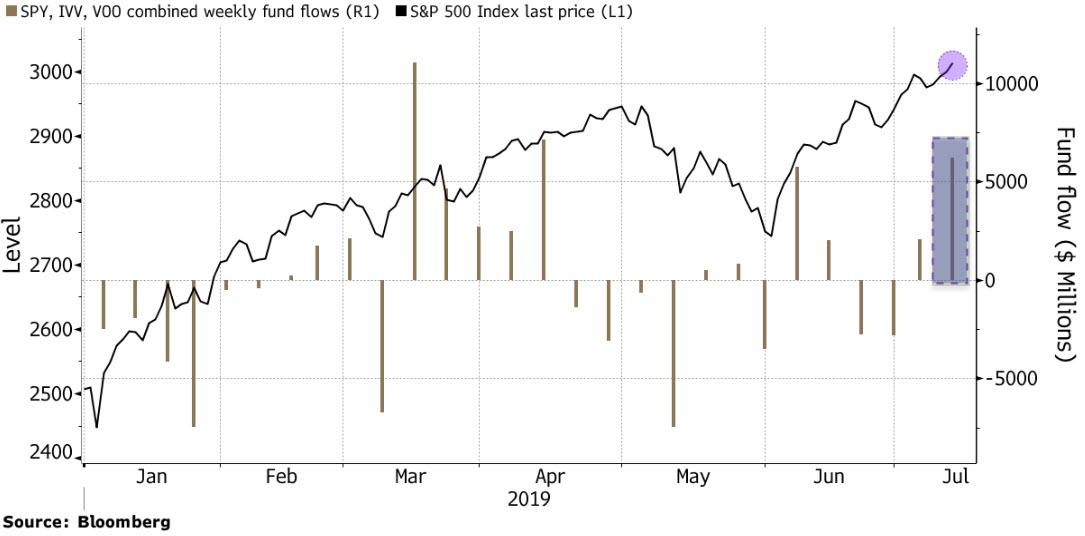

However, thanks in major part to The Fed's massive flip-flop and The ECB's promises, investors are doubling-down on bets that the party will continue. Bloomberg reports that the three largest exchange-traded funds that track the S&P 500 Index took in a combined $6.2 billion last week, just as the benchmark topped 3,000 for the first time, data compiled by Bloomberg show. Of the more than 1,600 U.S.-listed equity ETFs, these three -- known by their tickers SPY, IVV, and VOO -- received more cash than any other funds in one of their best weeks of 2019.

Investors are "all-in on equities," Steven DeSanctis, a U.S. stocks strategist for Jefferies wrote in a Monday report.

Much of the cash that flowed into ETFs last week went to large-cap funds designed as core holdings, he wrote.

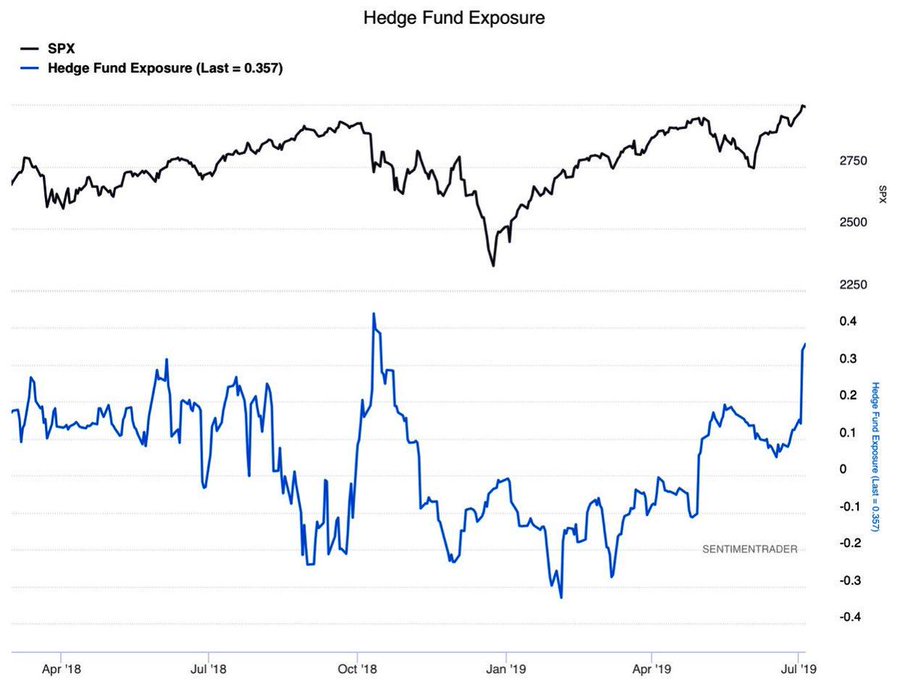

It's not just retail investors either. Hedge Funds are "aaalllllllll aboard!"

But, so far, the broader rally has been more the result of expectations for the easing of central bank policy than anything else, according to strategists at Bank of America Merrill Lynch. Indeed, hopes of a trade truce didn't have much effect on stocks.

And finally, we've seen this kind of hope-filled decoupling between (soaring) stock prices and (downward) earnings revisions...

And things didn't work out so well that time.

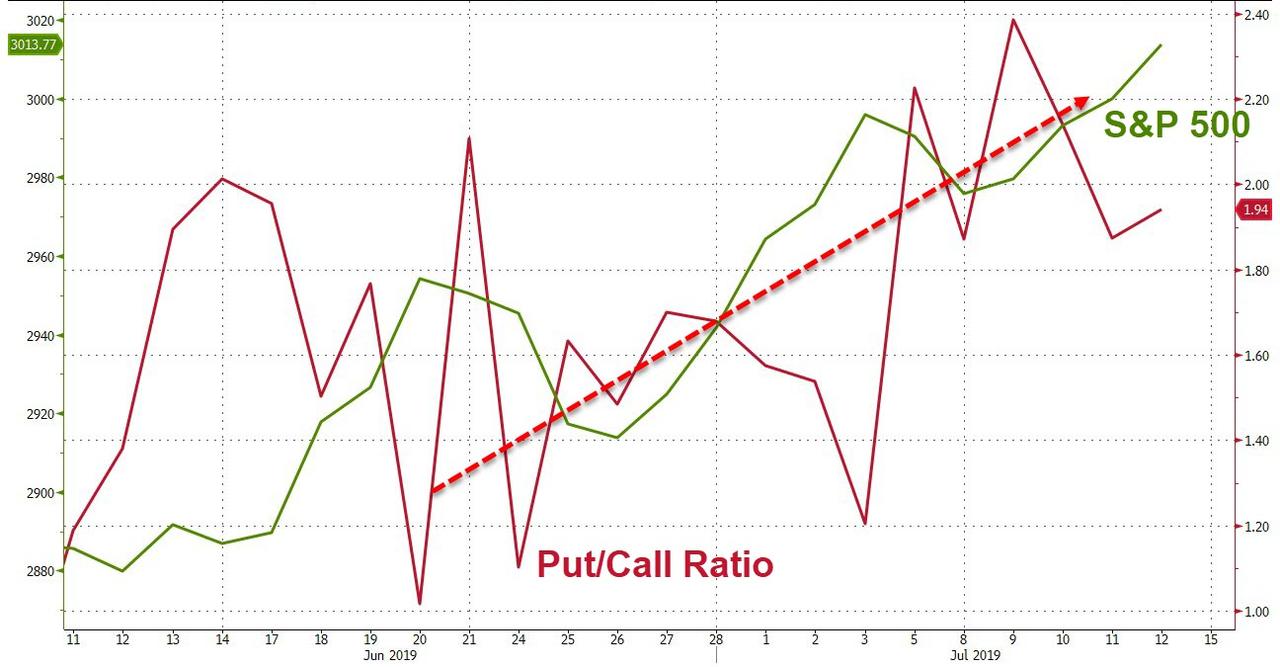

And finally, we note that as stocks have risen, investors have been buying puts far more than calls...

Not exactly the kind of bullish sentiment that supports an extended breakout.

Commenti

Posta un commento