Now that the S&P 500 has finally broken out above the key psychological resistance of 3,000 which served as a ceiling to risk assets for the past two years, the market has entered fresh nosebleed valuation territory.

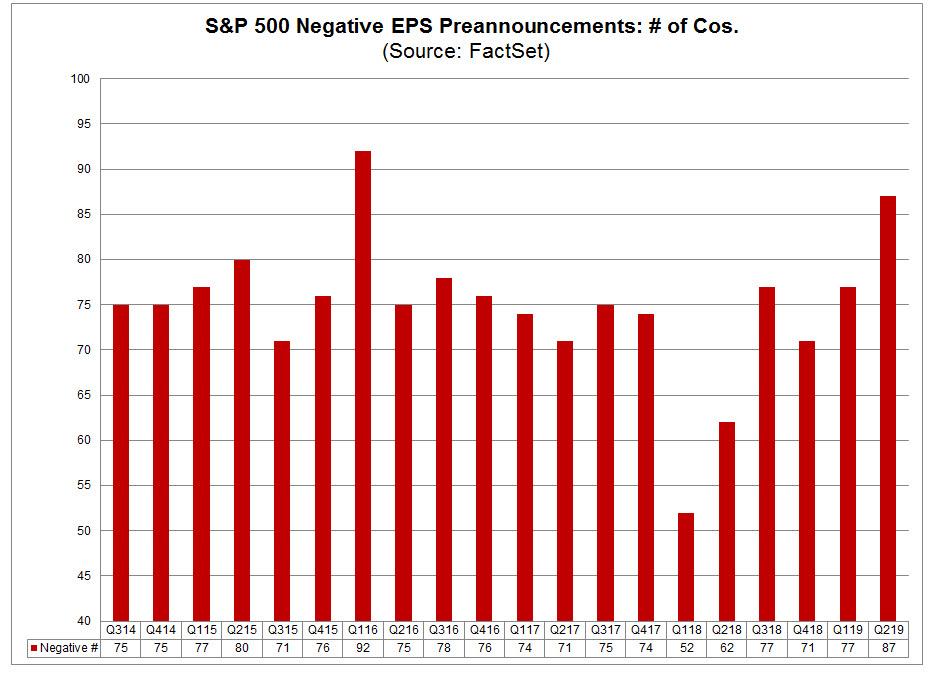

As Bank of America writes today, following one of the strongest June markets ever, the forward P/E of the S&P 500 on consensus estimates rose by 6% to 16.7x. However, unlike JPMorgan which like a good penguin raised its year end 3,000 price target to 3,200 just to stay ahead of the market, Bank of America - just like Morgan Stanley - refuses to do that (for now) and warns of downside risk to consensus earnings (they forecast $176 over the next 12 months or NTM) putting the S&P 500 PE at 17.4x on the bank's NTM forecast ($169), which is hardly a bargain, while noting that guidance for the 2H and 2020 has turned sharply negative (as we reported at the end of June, the second highest number of S&P500 companies is issuing negative guidance).

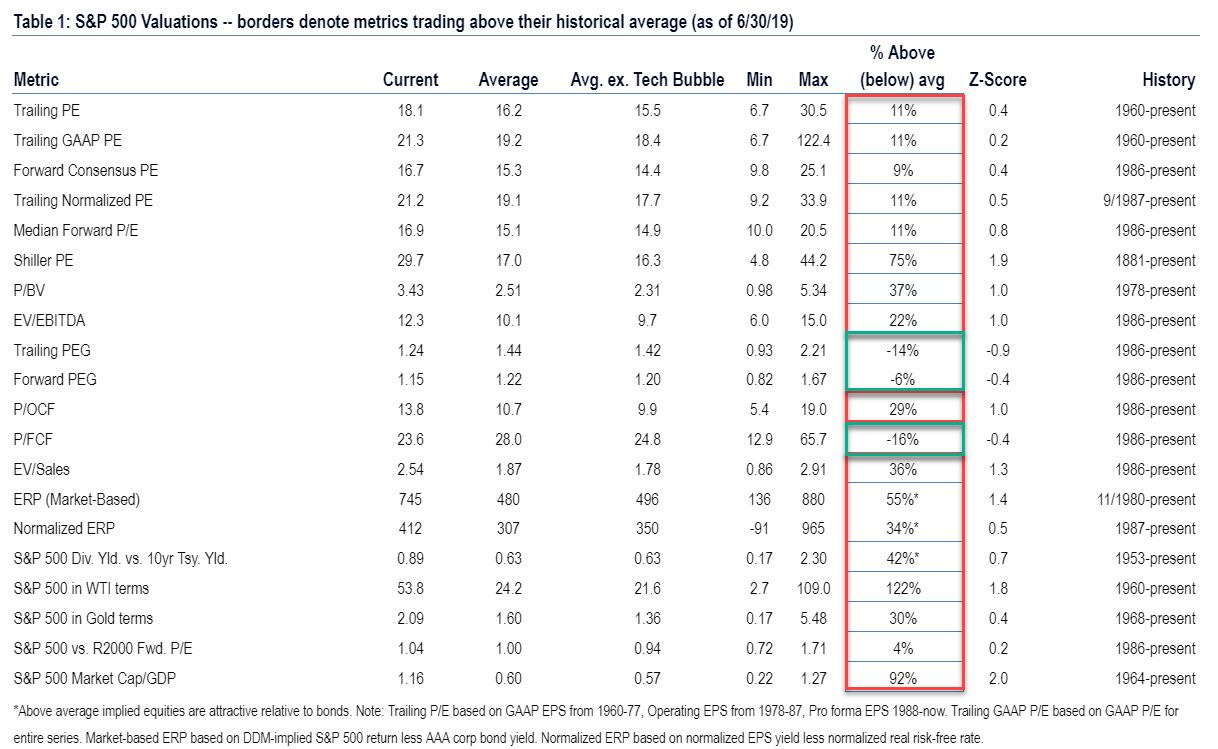

Yet while the market's multiples on earnings look elevated relative to history, they still look cheap on growth (assuming such growth is justified in a world where central banks are set to cut rates due to a sharp economic slowdown and trade war), cash flow and relative to bonds. Indeed, there is one place where stocks looks decidedly cheap - when dividend yields are compared to bond yields, or as BofA writes, "the yield opportunities within the S&P 500 can't be ignored in light of the Fed's accommodative stance: almost 60% of S&P 500 stocks' dividend yield eclipses expectations for the year-end Fed target rate."

Stripping away BofA's subjective commentary, to allow readers to decide for themselves whether stocks are massively overvalued and overbought, or perhaps cheap compared to the world's biggest bond bubble, here is a breakdown of the S&P 500 across a wide variety of valuation measures proposed by Bank of America, 20 in total. What the analysis shows is that of 20 metrics, the S&P is overvalued based on 17 by as much as 92% (on a historical market cap to GDP basis) and up to 122% if looking at the S&P in WTI terms, and is cheap only according Price to Free Cash Flow (23.6x vs 28.0x) which however is a function of ultra low interest rates, and also based on a ratio of both Trailing (-14% cheap) and Forward (-6% cheap) PEG multiples.

What the analysis above demonstrates, is that if analysts' overly optimistic earnings forecasts are materially, or even modestly, wrong then watch out below as the market will soon be overvalued on virtually every single metric, with the appropriate impact on stock price to follow shortly.

Commenti

Posta un commento