While the US bond market is closed today for Columbus Day (while stocks are inexplicably open for trading) with no news and event, DB's Jim Reid notes that it's going to be a busy week, culminating with global policymakers gathering in Washington for the IMF and World Bank's annual meetings. The latest IMF world outlook is out tomorrow which will attract lots of headlines. There will be lots of talk around this as to whether the global economy is at risk of slipping into recession.

Obviously the trade deal - assuming consensus agrees Phase 1 was in fact a "deal" - will reduce some of the risk but many will feel it's too little too late and won't remove a lot of the uncertainties. Elsewhere China's Q3 GDP release (Friday) should give us a further indication of how the economy is being affected by trade issues.

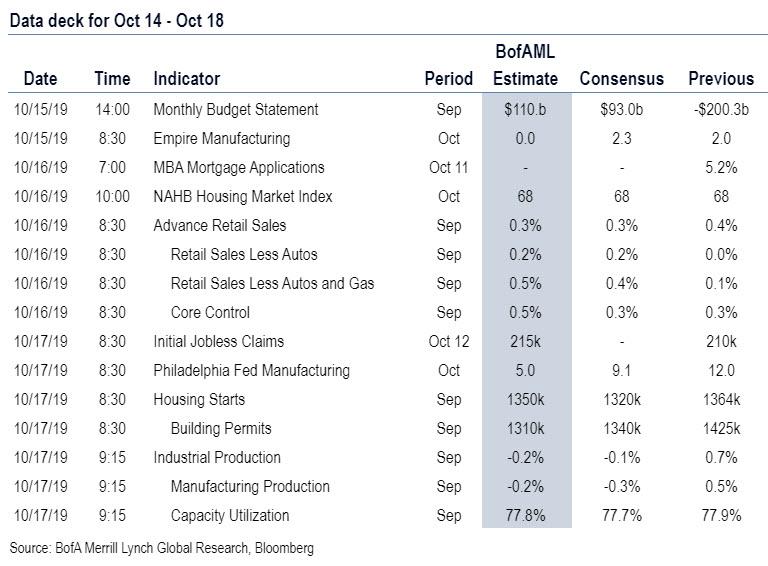

Other data releases to watch out for include US retail sales (Wednesday) and industrial production (Thursday), Germany's ZEW survey (tomorrow), today's Euro Area IP and the start of US earnings season.

Momentum will start tomorrow with the highlights including Goldman Sachs, Citigroup, JPMorgan, BlackRock, Johnson & Johnson, Wells Fargo and UnitedHealth Group. On Wednesday, Bank of America, Netflix, IBM and Abbott Laboratories will all be reporting. Thursday sees Morgan Stanley, Philip Morris, Honeywell International and Union Pacific release earnings, while on Friday we have Coca-Cola and American Express.

Meanwhile also in the US, with over a year to go until the presidential election next November, another Democratic primary debate will be taking place on Tuesday. 12 candidates will appear on a single night, including the polling frontrunners, former Vice President Joe Biden and Senator Elizabeth Warren.

Day-by-day calendar of events, courtesy of Deutsche Bank:

Monday

- Data: Euro area August industrial production; China September trade balance.

- Central Banks: ECB's De Guindos, Hernandez de Cos, and BoE's Cunliffe speak.

- Politics: Queen's Speech in UK.

Tuesday

- Data: China September CPI, PPI; Japan August capacity utilisation, tertiary industry index, final industrial production; France final September CPI; UK August unemployment, average weeekly earnings; Germany October Zew survey; US October Empire State manufacturing survey; Canada September existing home sales

- Central Banks: RBA minutes from October meeting released; BoJ's Kuroda, Fed's Bullard, Bostic, George and Daly, BoE's Carney, Vlieghe speak

- Earnings: Goldman Sachs, Citigroup, JPMorgan, BlackRock, Johnson & Johnson, Wells Fargo, United Health Group.

- Politics: Democratic primary debate takes place.

- Other: Tariff hike from 25% to 30% scheduled on $250bn worth of Chinese goods by US; IMF release World Economic Outlook.

Wednesday

- Data: South Korea September unemployment rate; EU27 September new car registrations; Italy August industrial sales, industrial orders; UK September CPI, RPI, PPI; Euro area August trade balance, final September CPI, core CPI; US weekly MBA mortgage applications, September retail sales, October NAHB housing market index, August business inventories; Canada September CPI

- Central Banks: Bank of Korea decision, Federal Reserve publishes Beige Book; ECB's Knot, Lane, Weidmann, Villeroy, BoE's Carney, Fed's Evans and Brainard speak.

- Earnings: Bank of America, Netflix, IBM, Abbott Laboratories

Thursday

- Data: Australia September unemployment rate; Italy August trade balance; UK September retail sales; Euro area August construction output; US September building permits, housing starts, October Philadelphia Fed business outlook survey, weekly initial jobless claims, continuing claims, September industrial production, capacity utilisation; Canada August manufacturing sales

- Central Banks: ECB's Villeroy, Visco, Knot, De Cos, Fed's Evans, Bowman and Williams speak.

- Politics: European Council summit meets

- Earnings: Morgan Stanley, Philip Morris, Honeywell International, Union Pacific

Friday

- Data: Japan September nationwide CPI; China September industrial production, retail sales, Q3 GDP; Italy August current account balance; Euro area August current account; US September leading index

- Central Banks: Fed's Kaplan, George and Clarida speak.

- Politics: European Council summit continues Earnings: Coca-Cola, American Express

- Other: US tariffs scheduled to come into effect on EU goods.

Commenti

Posta un commento