Source: Bloomberg

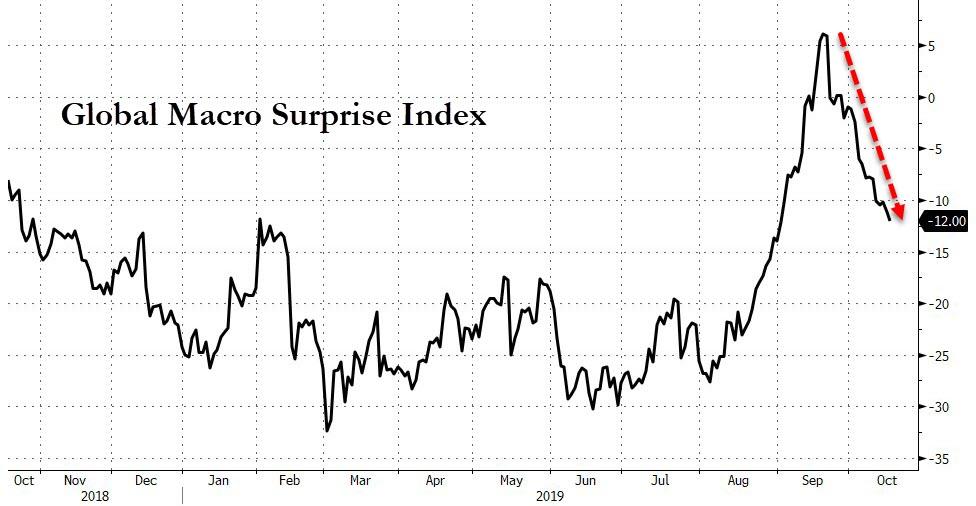

It's true that this week economic forecasts have been lowered all over the place.

Source: Bloomberg

The IMF was downbeat on the global economy, Germany spoke for theirs. And Japan downgraded their assessment. While prognosticators can't afford to assume that issues they have no control of will dissipate, investors are under no such constraints.

The overnight ranges have, by and large, been modest. The most notable exception being Chinese equities which had a bad day. That looks like more of an over-reaction to the GDP print than anything else. It was a miss, but hardly a shocker. The rest of the market appears to be waiting to see what happens tomorrow in the U.K. Parliament.

BOE Deputy Governor David Ramsden told Bloomberg News that a smooth Brexit would put rate hikes back on the table. And you can be sure that ECB policy makers will be glued to their televisions as the parliamentary debate unfolds. If the deal passes, you will probably hear a lot of Governing Council dissenters claiming they were right all along.

This is important as the fierce debate over the sensibility of negative rates rages, with those against gaining adherents quickly and those in favor sounding increasingly shrill.

Earlier today RBA Governor Philip Lowe said negative rates in Australia ere "extraordinarily unlikely."

BOJ Governor Haruhiko Kuroda, for his part, told the IMF that they need to continue "massive easing."

You can be sure that both of these governors are following trade dispute developments with rapt attention.

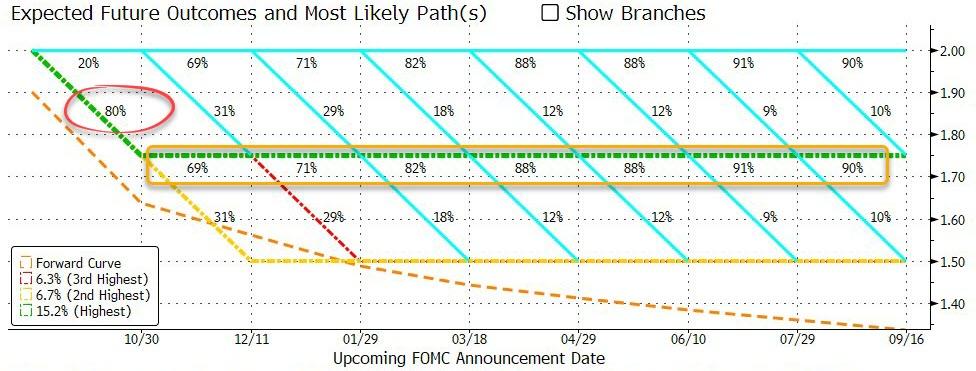

There is little chance that the Fed won't ease on Oct. 30. But there is a decent chance it could be the last cut before a wait-and-see pause.

Source: Bloomberg

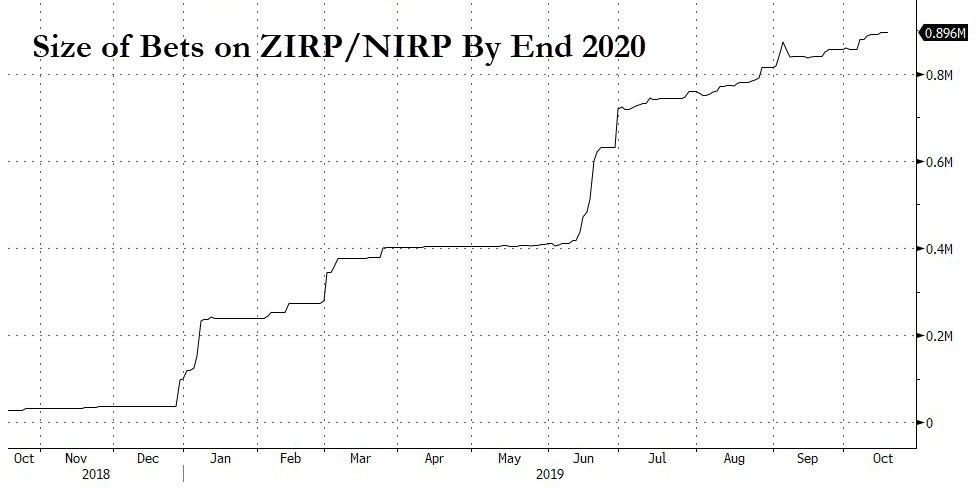

Traders, on the other hand, continue to load up for extremely dovish prospects for U.S. rates going forward. Even going so far as to take fliers on negative ones at some point next year.

Source: Bloomberg

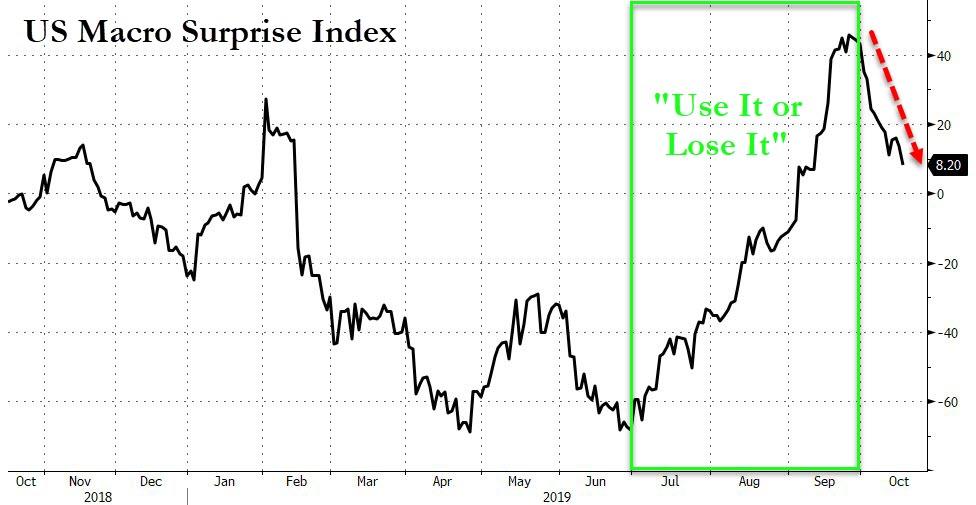

It's why it was so striking that, Treasuries were showing little reaction to yesterday's weak data.

Source: Bloomberg

That seemed significant. Especially, because global rates look like they're attempting to stage a rally. Meanwhile, weekly charts tell a story that differs from the vast majority of narratives.

Weak China GDP? Ten-year yields are at 3-month highs and finally back above their 21-week moving average.

German economy flailing? Yields are above their 21-wma for the first time since last year.

Ten-year Canadian rates flew above their moving average last week and have continued to rise.

The laggard, by this measure is U.S. Treasuries, but being over 25 basis points above the last two weeks' double low isn't too shabby.

This is actually a more compelling story than whether or when the S&P 500 will make a new all-time high.

And it's well worth keeping an eye on the dollar indexes. Both DXY and BBDXY have managed to poke below their 21-wma's this week. Think of it as positive for the other side of the equation from the dollar. The MSCI Emerging Market Currency Index is up for the third week in a row.

There is at least a chance of changing around the trajectory of the global economic disaster. Now we just have to hope someone doesn't mess it up.

Commenti

Posta un commento