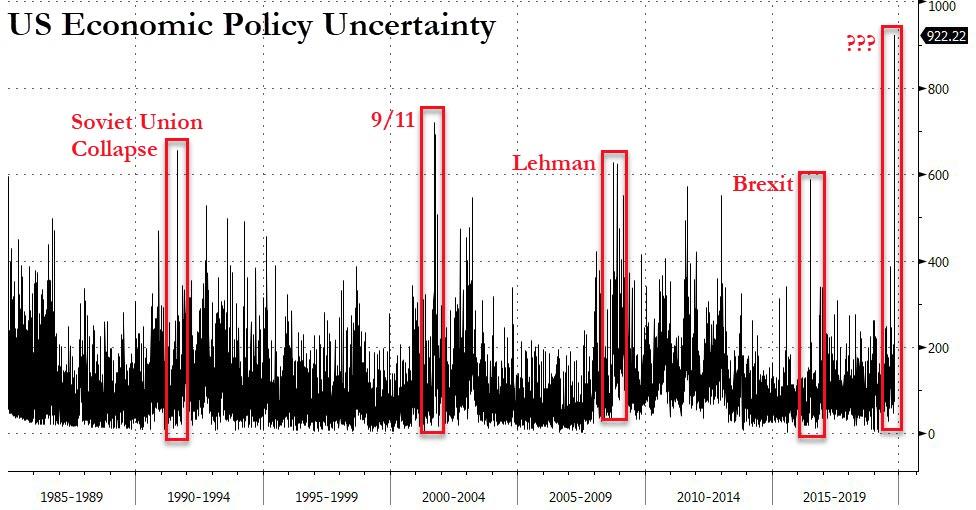

On the other hand, an even cursory assessment of current events - where in addition to trade war, slowing economies, renewed easing (there have been 54 global rate cuts YTD), repo market instability, an earnings recession, rising wages and shrinking margins, the world's most powerful person is now facing impeachment - would suggest that something is about about to snap, a conclusion which was confirmed by today's shocking surge in the US economic policy uncertainty index, which bizarrely hit an all time high.

Incidentally, the S&P - which is trading less than 2% below its all time high - would obviously validate the VIX's cheerful outlook, although in a market as reflexive as the US stock market, it has become virtually impossible to distinguish cause from effect: is the VIX low because the market is high, or vice versa?

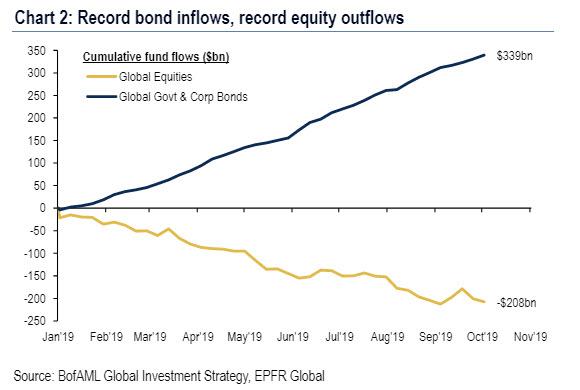

In any case, those traders looking at the VIX for signs of turbulence in the future would be left with the impression that traders are complacent, yet this too would be wrong if for no other reason than what fund flows are telling us: and with $339 billion in inflows to bond funds globally in 2019 vs. $208 billion in outflows from global equity funds, both on pace for a record year, it is clear that most investors are fleeing from risk assets and flooding into safe havens such as government securities.

Meanwhile, despite an artificially low VIX - largely the result of constant central bank intervention to minimize risk and rampant institutional selling of volatility which has become the "New Normal's" carry trade, investor concerns are anything but negligible. In fact, according to another risk metric, investors have rarely been more worried about what is to come.

Which brings us to the topic of this post: with the VIX worthless, how are big institutions hedging for a possible crash?

For the answer, one has to look not at the market's implied volatility, but rather its far less popular derivative, skew. Skew, in its simplest definition, measures demand for "extreme" risk relative to "normal" risk - i.e. how much more you would pay to protect from a big downside move relative to normal every day volatility.

Indeed, as Goldman's Alessio Rizzi writes, despite last week's risk on move which pushed the S&P just shy of all time highs, investor sentiment remains subdued, as equity fund flows remained negative and demand for portfolio hedges is still strong.

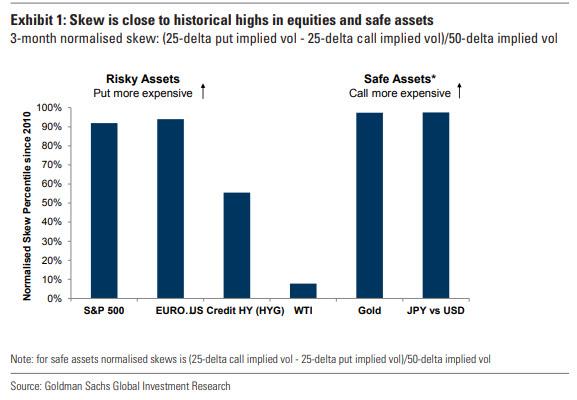

And this is how to observe just how nervous investor are: since the start of the year, and particularly in recent weeks, implied volatility skew has reached new highs in most equity indices. With stock markets rallying more than 15% YTD, and with the spot VIX tumbling, investors have increased their demand for equity put options to protect against a "sharp drawdown", which is a polite phrase for a crash. And the chart below shows, while investors no longer bother with the VIX, they have been piling into S&P 500 and Euro Stoxx 50 3 month 25-delta skew, which are now above the 90th percentile hit since 2010.

It's not just risk assets, however, where investors are bracing for a sharp drop: similarly, demand for "safe" assets has increased further and call options on gold and the yen became more expensive relative to puts. Within risky assets, only WTI skew remained subdued, which is odd given increased geopolitical risk in the Middle East, while credit skew looks less extreme than in equity.

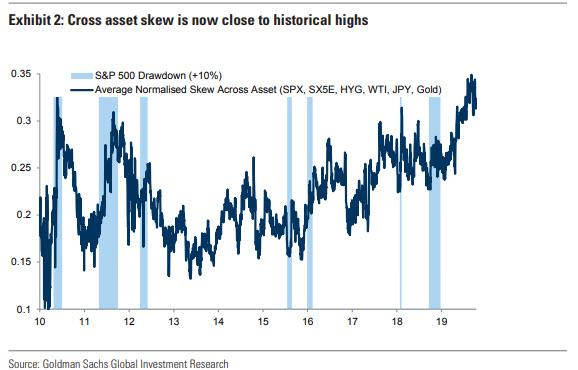

But the clearest indication of just how nervous institutional traders are, is the simple average of the normalized skew across assets (S&P, Stoxx, HYG, WTI, JPY and gold) which now stands at its highest since 2010, which according to Goldman suggests a strong increase in demand for hedges - something one would never guess by looking at the VIX at 14 or so.

Ominously, on all previous occasions when the normalized skew hit high levels, the S&P suffered a 10% (or greater) drawdown every single time.

So with the skew screaming take cover, and the VIX giving the all clear, which barometer of market risk will prove to be more accurate, and will institutions bracing for a major market "drawdown" be proven right? And will all these worries be simply swept away by the Fed's restart of "Not QE"... or will the market finally decide to "fight the Fed"? We are confident that we will get the answers to all these pressing questions over the next few weeks.

Commenti

Posta un commento