The latest stress in the global diamond industry is emanating from Israel. Ynetnews is saying the country's diamond exports have plunged 22%, a sign that consumer demand from Asia is faltering.

Trade data showed for the first three quarters of 2019, Israeli exports of diamonds were $2.62 billion, down from $3.32 billion during the same period last year.

In 3Q19, imports and exports of diamonds by Israel plunged 28% YoY.

The Times of Israel blamed the downturn on the trade war and social unrest in Hong Kong.

Yoram Dvash, president of the Israel Diamond Exchange, told Ynetnews:

"There is a global crisis. The government needs to help out the industry. Everywhere people are helping because they understand that there are difficulties now. Trump's trade war with China and the Hong Kong protests really influence the industry. Hong Kong accounts for about 30% of our exports. The Hong Kong government said that in recent times, the sector that's been damaged the most there has been the jewelry industry."

Dvash said Hong Kong jewelry shops, which import hundreds of millions of dollars of diamonds from Israel per year, have noticed collapsing demand from mainland China because of the social unrest and economic downturn in the region.

"Right now, the Chinese government isn't granting visas to Chinese to go to Hong Kong in order to put pressure on business people there and hurt the economy. It's paralyzing the number 2 diamond market in the world," Dvash said.A source told Ynetnews that a credit crisis in India involving Indian diamond companies has negatively impacted the global industry.

Earlier this month, De Beers', one of the largest diamond exploration, diamond mining, and diamond retailing companies in the world, saw a 39% YoY drop in September sales.

A diamond analyst last month said markets remained oversupplied, resulting in weak global sales.

"The current malaise in the market is due to oversupply," said Paul Zimnisky, an analyst in New York, who said diamond buyers had too much inventory.

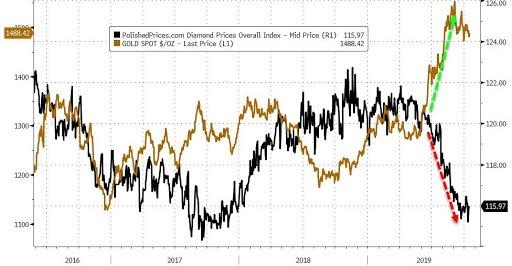

Spot diamond prices on the IDEX Diamond Index shows how oversupplied conditions have weighed down prices in the last 8 months.

Source: Bloomberg

And while diamonds are supposed to "a girl's best friend", recent months have seen gold the preferred shiny thing of choice...

Source: Bloomberg

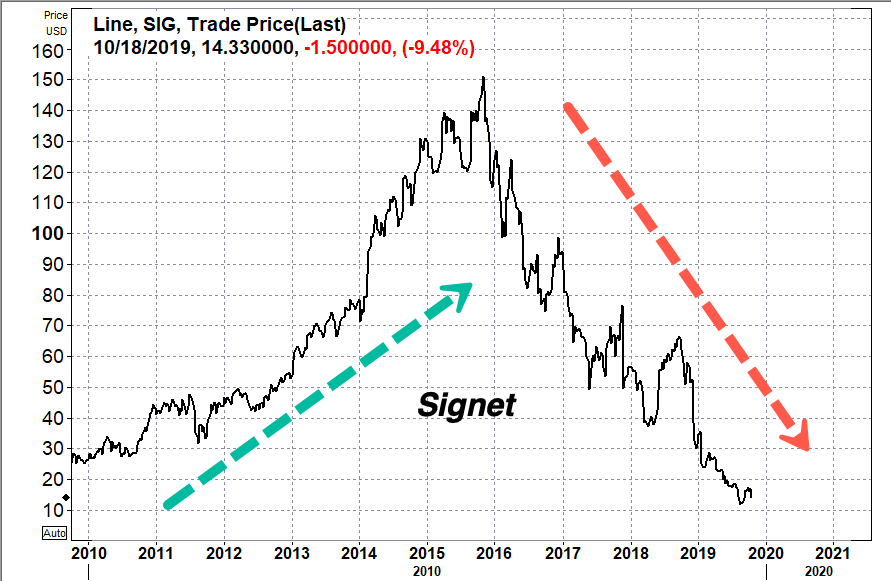

Shares in Signet, the world's largest retailer of diamond jewelry, have crashed 89% in the last four years.

It appears a diamond crisis is unfolding, and this is what usually happens right before a global recession, a sign that the consumer can no longer power the global economy. Turmoil is ahead.

Commenti

Posta un commento