A 'funny' thing happened on the way to record high equity markets... the credit market started to crack, and now that pain is spreading and escalating.

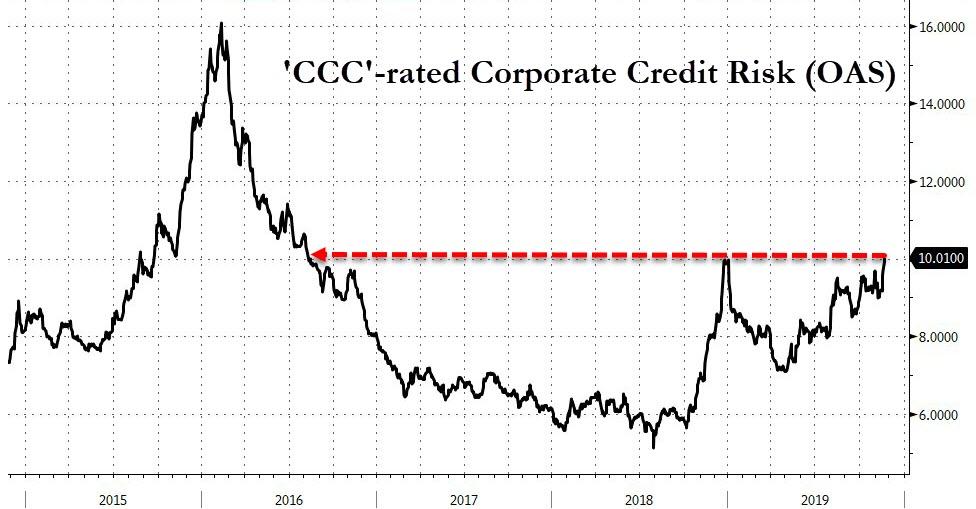

Starting from the weakest of the weak, spreads on CCC U.S. junk bonds have jumped above 1,000bps for the first time in more than three years as a sell-off in energy weighs on the lowest-rated debt.

Source: Bloomberg

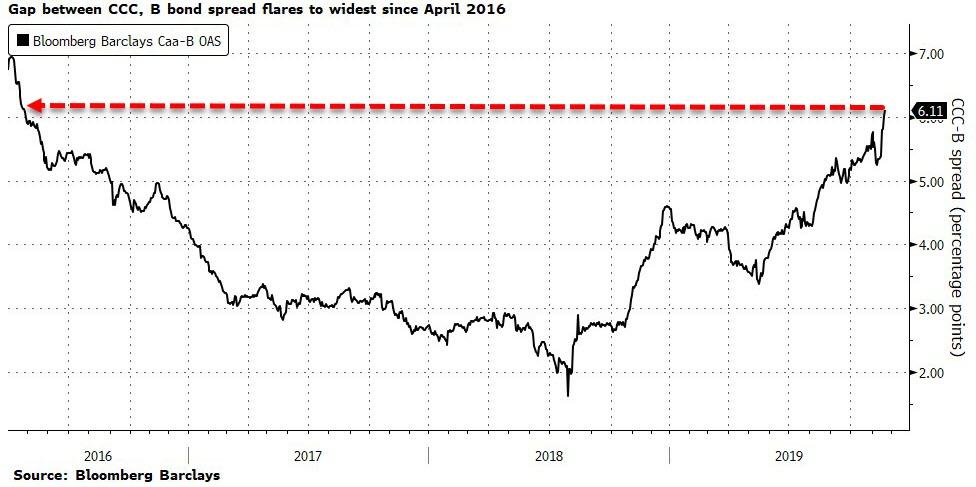

Blowing the CCC market's risk out to its widest against single-B since April 2016...

Source: Bloomberg

The weakness in the low-rated debt is dominated by energy firms as investors run, don't walk, away, despite oil's "stable" price (ahead of the Aramco IPO)...

Source: Bloomberg

But another key market for demand of 'junky' loans is starting to flash very red...

Source: Bloomberg

The broader U.S. junk bond market has posted negative returns this month... as stocks have soared...

Source: Bloomberg

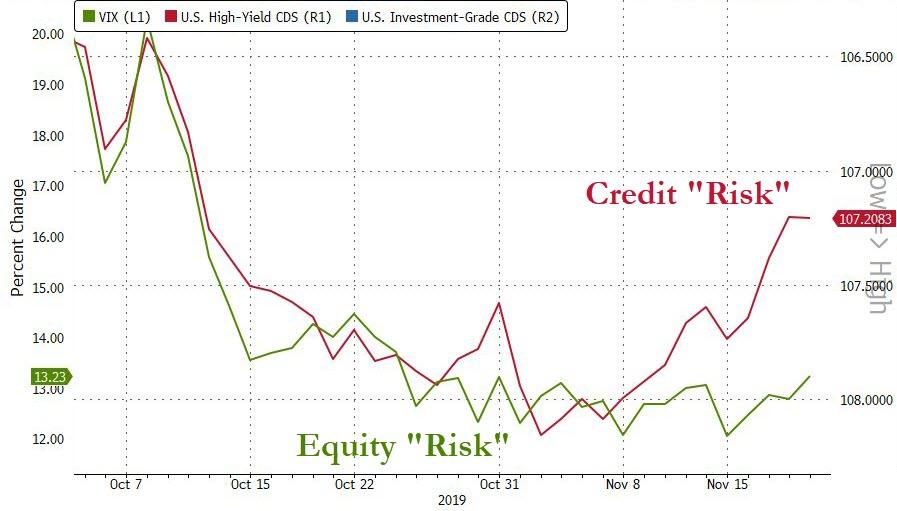

...and is notably decoupling from equity risk... for now...

Source: Bloomberg

As former Fed president Bill Dudley warned in his latest op-ed, the longer this BBB bid lingers, the bigger will be the ultimate problem. Again, from Dudley's op-ed:

When the next recession occurs, a significant portion of this debt will be downgraded to junk. Credit spreads for this debt will rise because of the deterioration in quality.

But the story isn't likely to end there. Forced selling will generate significant congestion within the corporate debt market. After all, many investors with mandates that restrict holdings to investment-grade debt will have to unload their newly junk-rated bonds.This selling will push securities prices below their underlying value. Prices will have to become overly cheap to provoke opportunistic buying.

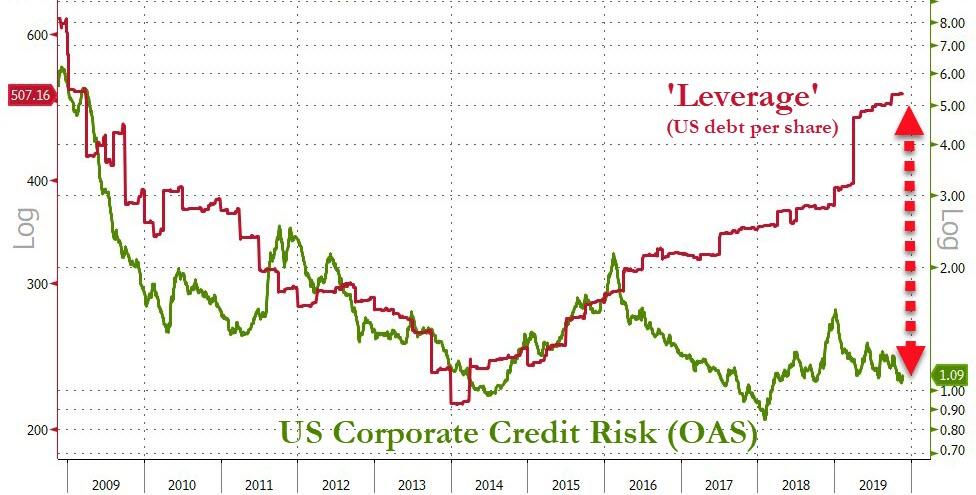

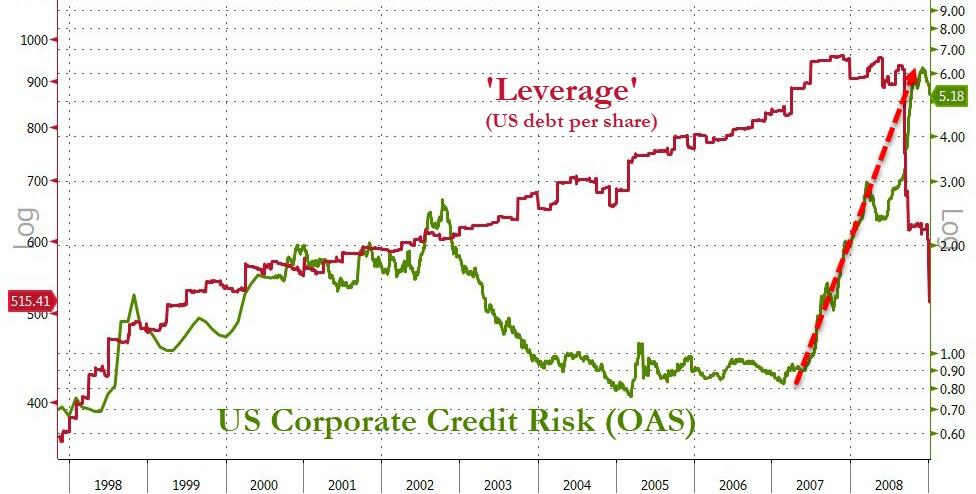

Finally, we suggest the FOMO-driven dip-buyers look away - the divergence between corporate leverage and corporate credit risk is becoming absurd again...

Source: Bloomberg

As one veteran credit market participant noted,

"...this works fine when the economy is chugging along. No doubt that companies will take extraordinary measures to maintain their IG rating. However, when the next recession - actually scratch that - when the next decent economic slowdown hits, these companies will have zero ability to cut anywhere near enough CapEx to stop downgrades. They are skating that close to the edge. And the BBB guys are not the ones doing big stock buybacks, so that will not be an option to stop the slide either. These over-levered companies will have zero ability to arrest the descent to high-yield. And when it starts, it will feed on itself."

In case there's any doubt, the last time that happened did not end well for stocks or credit...

Source: Bloomberg

Trade accordingly.

Commenti

Posta un commento