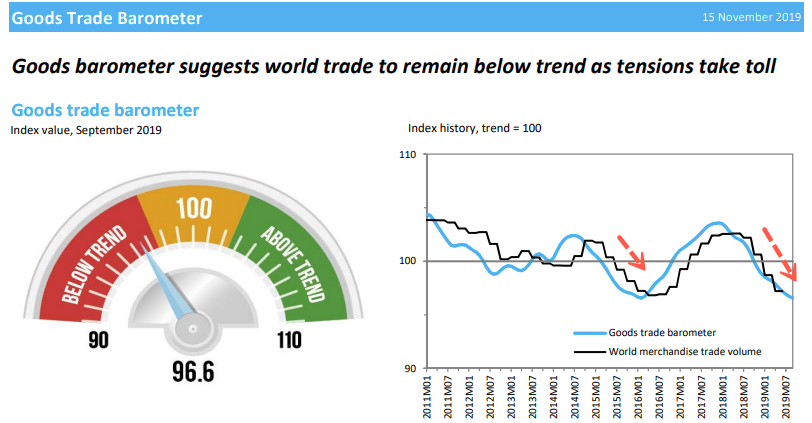

The Geneva-based intergovernmental organization's leading-indicator called the Goods Trade Barometer printed at 96.6 for Sept., down from 95.7 in Jun. Readings under 100 recommend below-trend expansion is present.

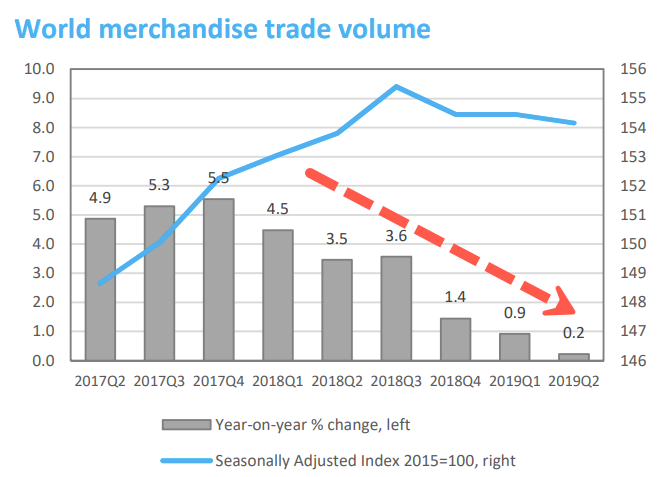

In Sept., WTO economists downgraded global trade growth expectations for 2019 to 1.2 %, down from a 2.6% forecast in Apr.

The deceleration of slowing global growth was attributed to "increased tariffs, Brexit-related uncertainty, and the shifting monetary policy stance in developed economies," WTO analysts said.

Year-on-year growth in world merchandise trade volume has stalled in recent quarters, as new evidence shows a decline could be seen in early 2020.

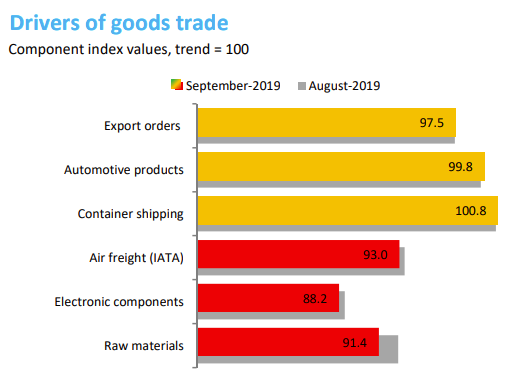

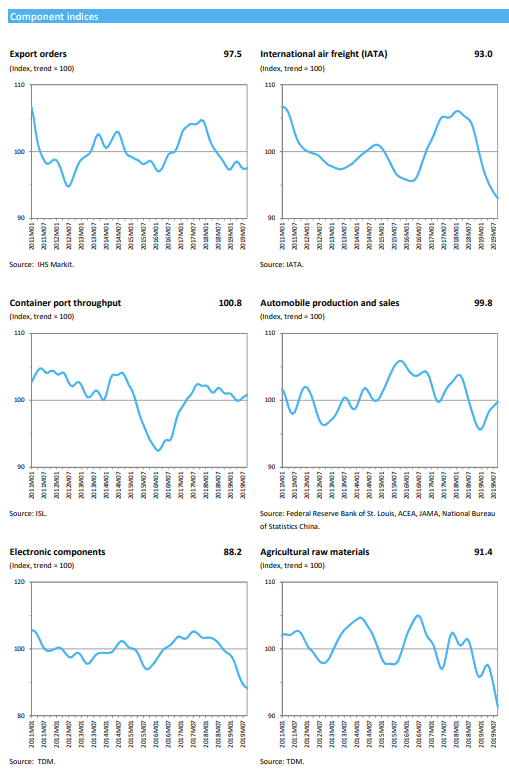

Airfreight, electronic components, and raw materials "have all deteriorated further below trend," the report showed.

"Indices for export orders (97.5), automotive products (99.8), and container shipping (100.8) have firmed up into on-trend territory. However, the indices for international air freight (93.0), electronic components (88.2), and raw materials (91.4) have all deteriorated further below trend. Electronic components trade was weakest of all, possibly reflecting recent tariff hikes affecting the sector."

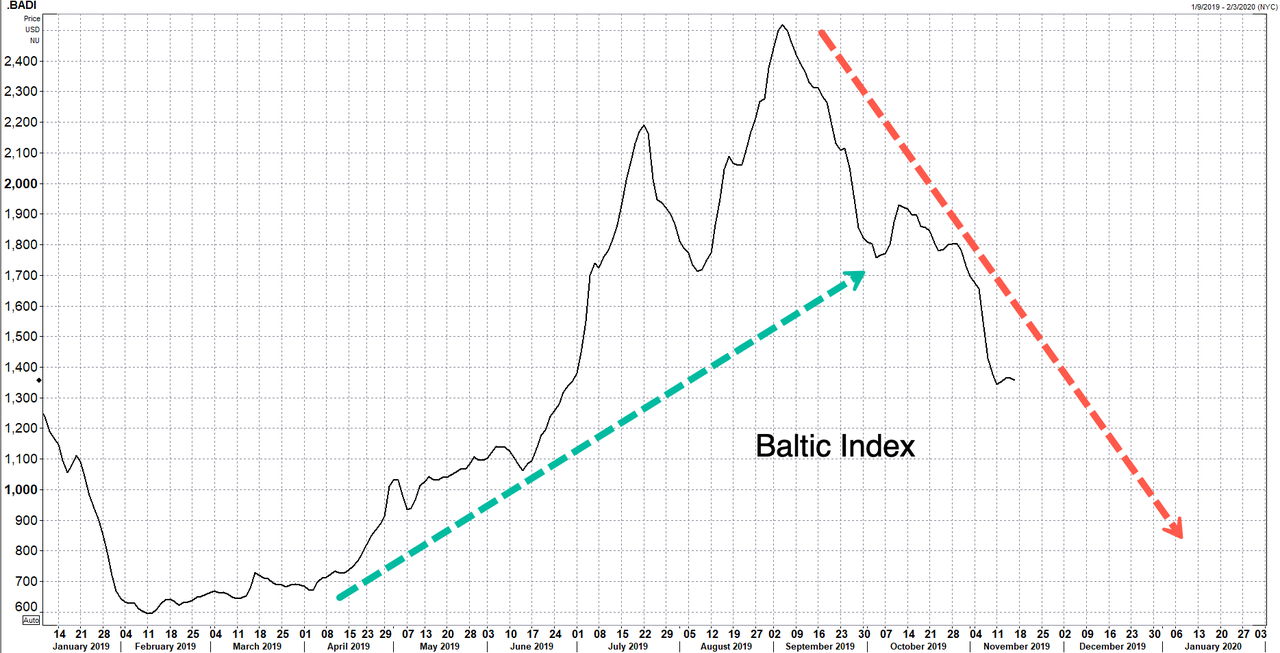

And with world trade sinking quick into year-end, the Baltic Exchange's main sea freight index has just tagged a 4-1/2 month low on sluggish vessel demand.

While the global economy implodes, a rally in global risk assets continues to push US equities to new highs. This is due to central banks pumping a tsunami of liquidity into stocks, in the attempt to save the world from a global trade recession that could be around the corner, if not already here. The biggest threat today as central bankers pump stocks, is that the real economies across the world remain stagnant, which could suggest risk assets are in blowoff tops.

Commenti

Posta un commento