European equity investors, especially those betting on banking stocks, are gearing up for the new ECB President Christine Lagarde's first public speech, at a banking conference today. The central bank's lower-for-longer rates have hit lenders' margins in recent years, and Lagarde's words will be scrutinized for any signs of potential changes on that front.

Beyond potential clues on rate policy, investors will specifically look for any comments on banking integration, which could potentially provide fresh impetus to the banking sector's rebound that has stalled this month. The rally has been fueled by expectations that there are no more cuts to the deposit rate on the table, as well as by comments from German Finance Minister Olaf Scholz that progress toward a European Union banking union is gaining momentum.

Having a well-connected politician like Lagarde at the helm of the ECB might turn out useful, according to Fidelity Investments CIO Romain Boscher. It could help push financial integration, such as a banking union, Boscher said during an event in Frankfurt on Tuesday. It would also be useful should the ECB need to take even more "unconventional measures" to support the economy, he added.

Banking stocks were buoyed earlier this month by Scholz's proposal to break a deadlock over the European banking union. A deal in principle could be possible by December, Scholz said. Lagarde's views on the matter will be especially important, considering the plan got a mixed welcome from euro-area governors.

Goldman Sachs analysts believe the banking union completion would reduce systemic risk, remove barriers to cross-border flow of funds and introduce incentives for cross-border banking, including M&A. They see the completion of the union as a precondition for the EU to construct a stronger, safer and profitable banking system. Key beneficiaries would be large EU banks with cross-border business models as well as pan-Central and Eastern European banks, the analysts say. They see buy-rated BNP, ING, KBC and Unicredit, as well as neutral-rated Societe Generale and Nordea, as well positioned.

More broadly, the big picture for the sector has improved in the past few weeks. The macroeconomic data showed some signs of stabilization and bond yields are trending higher. On top of that, the earnings season was not disastrous.

That prompted Morgan Stanley's analysts to upgrade European banks to "attractive" going into the next year, citing among reasons a growing confidence that earnings expectations will bottom out in the second half of this year. Better cost efficiency, clarity on capital plans and improving profitability are the key themes Morgan Stanley is looking for, and names Unicredit, Santander and Lloyds are top picks in that context.

The buy side is slowly turning bullish too. Pictet Asset Management chief strategist Luca Paolini upgraded financials to overweight to gain exposure to the current rotation into value stocks. Paolini says the trend has further to go after value shares lagged growth stocks over the past decade. The recent inflection is not a surprise, he says, as value tends to outperform during times of modest growth. He expects the business cycle to move to a more mature phase.

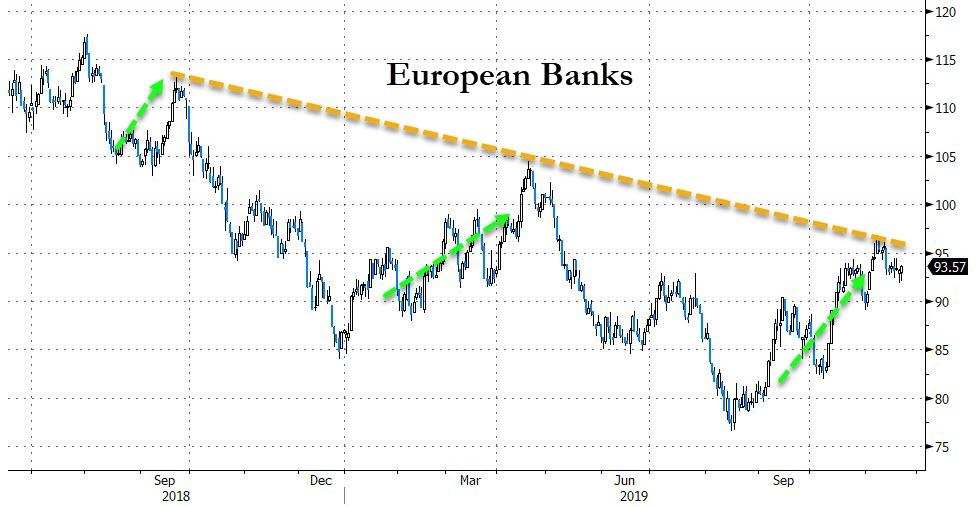

The near-term prospects look less rosy for the sector on the technical front, with the Euro Stoxx Bank Index hitting its longer-term downtrend again and failing to break through.

"I doubt the sector has any legs from here and technically the SX7E chart doesn't look good to me," says Aurel cross-asset sales Gurmit Kapoor. The gauge could easily drift back to 90 points or even 85 points, he says.

Commenti

Posta un commento