Draghi Goes All Out: ECB Cuts Rates, Restarts Open-Ended QE, Changes Forward Guidance, Eases TLTRO, Introduces Tiering

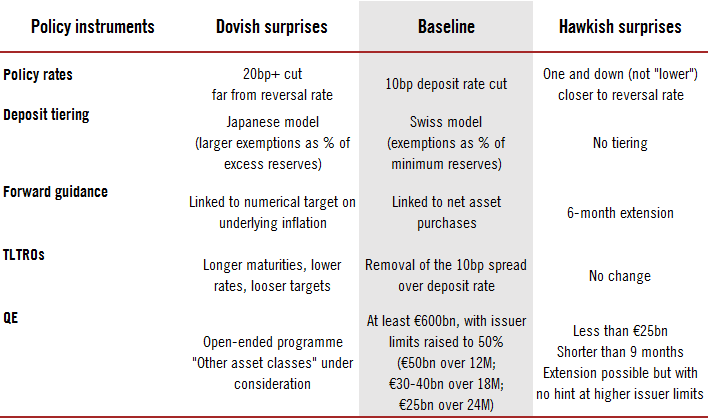

... that is how the market initially interpreted today's ECB press release, which cut already negative deposit rates for the first time since 2016 to stimulate the sagging European economy, but by a smaller than expected 10bps to -0.50% while restarting QE but by "only" €20 billion, less than the €30 billion baseline.

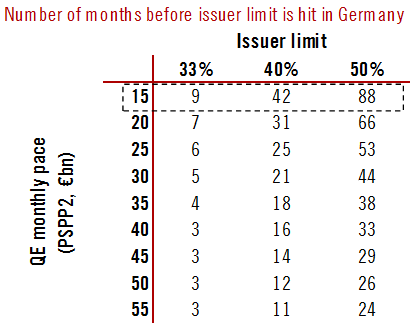

However, there was more than enough offsetting dovish bells and whistles, because while the restarted QE (or the Asset Purchase Program) was smaller than expected, it will be open-ended, and the ECB will run it "for as long as necessary to reinforce the accommodative impact of its policy rates, and to end shortly before it starts raising the key ECB interest rates." Of course, the question here is how long can a safe-asset constrained Europe run an "open-ended" QE, and the answer is it depends on what the issuer limit by nation is, with Frederik Ducrozet observing that "at €20bn/month, assuming up to €5bn in corporate bonds, QE can run for ~9 months under current limits... and for more than 7 years if limits are raised to 50%!" So look for more information on that angle.

At €20bn/month, assuming up to €5bn in corporate bonds, QE can run for ~9 months under current limits... and for more than 7 years if limits are raised to 50%!

We might get details about issuer limits in the separate press releases and/or the press conference.

Additionally, the ECB dropped calendar-based forward guidance and replaced it with inflation-linked guidance, noting that key ECB interest rates will "remain at their present or lower levels until it has seen the inflation outlook robustly converge to a level sufficiently close to, but below, 2% within its projection horizon." Furthermore, the ECB eased TLTRO terms, with banks whose eligible net lending exceeds a benchmark, the rate applied in TLTRO III operations will be lower, and can be as low as the average interest rate on the deposit facility prevailing over the life of the operation; additionally, the maturity of the operations will be extended from two to three years.

Finally, as many expected, the ECB will introduce a two-tier system for reserve remuneration in which part of banks' holdings of excess liquidity will be exempt from the negative deposit facility rate, in an attempt to mitigate the adverse impact to banks.

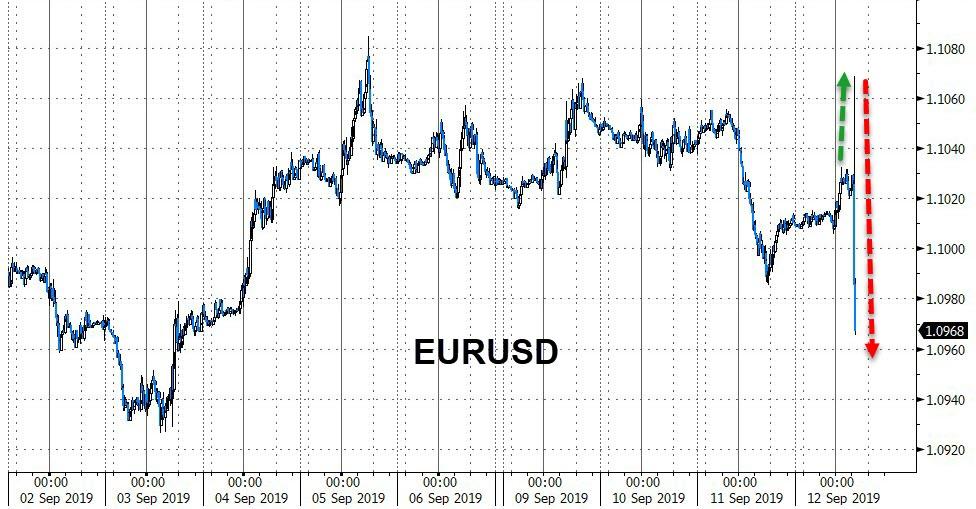

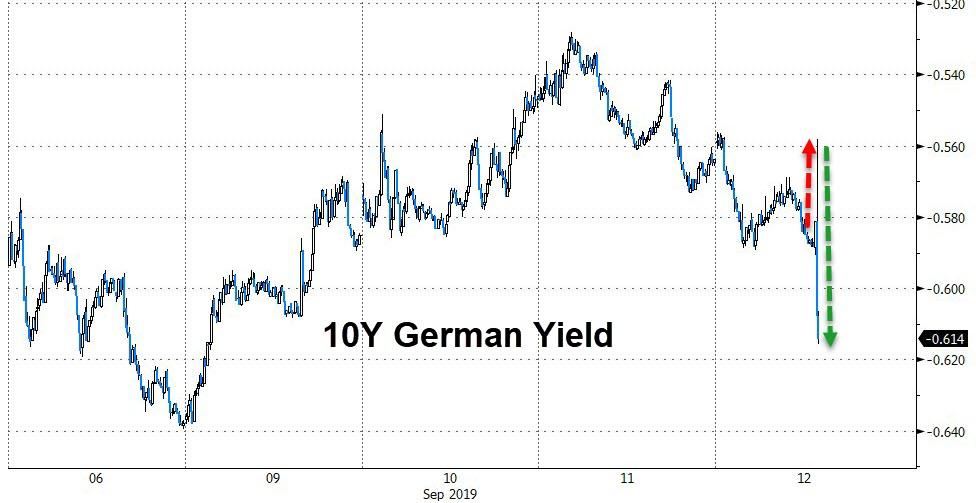

In short: a somewhat hawkish read on the rate cut and QE amount, but dovish on every other aspect, from the changed forward-guidance, to the open-ended QE, to the easing in TLTRO terms and to the introduction of a two-tier deposit system.

This was reflected in markets, with the EURUSD first spiking the tumbling ...

... and the German bund following suit as the market realized the ECB was far more dovish than the kneejerk reaction suggested:

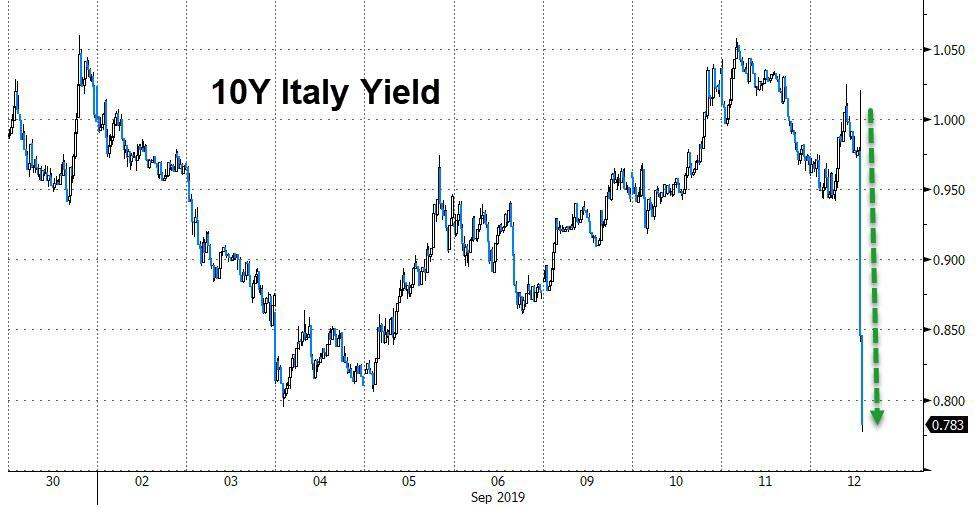

... with Italian yields tumbling to a record low of 0.783.

The full ECB press release is below:

At today's meeting the Governing Council of the ECB took the following monetary policy decisions:

(1) The interest rate on the deposit facility will be decreased by 10 basis points to -0.50%. The interest rate on the main refinancing operations and the rate on the marginal lending facility will remain unchanged at their current levels of 0.00% and 0.25% respectively. The Governing Council now expects the key ECB interest rates to remain at their present or lower levels until it has seen the inflation outlook robustly converge to a level sufficiently close to, but below, 2% within its projection horizon, and such convergence has been consistently reflected in underlying inflation dynamics.

(2) Net purchases will be restarted under the Governing Council's asset purchase programme (APP) at a monthly pace of €20 billion as from 1 November. The Governing Council expects them to run for as long as necessary to reinforce the accommodative impact of its policy rates, and to end shortly before it starts raising the key ECB interest rates.

(3) Reinvestments of the principal payments from maturing securities purchased under the APP will continue, in full, for an extended period of time past the date when the Governing Council starts raising the key ECB interest rates, and in any case for as long as necessary to maintain favourable liquidity conditions and an ample degree of monetary accommodation.

(4) The modalities of the new series of quarterly targeted longer-term refinancing operations (TLTRO III) will be changed to preserve favourable bank lending conditions, ensure the smooth transmission of monetary policy and further support the accommodative stance of monetary policy. The interest rate in each operation will now be set at the level of the average rate applied in the Eurosystem's main refinancing operations over the life of the respective TLTRO. For banks whose eligible net lending exceeds a benchmark, the rate applied in TLTRO III operations will be lower, and can be as low as the average interest rate on the deposit facility prevailing over the life of the operation. The maturity of the operations will be extended from two to three years.

(5) In order to support the bank-based transmission of monetary policy, a two-tier system for reserve remuneration will be introduced, in which part of banks' holdings of excess liquidity will be exempt from the negative deposit facility rate.

The irony, of course, is that the ECB is merely doing more of the same that it did before and got it to the current predicament. Also ironic: the ECB couldn't even last a full 9 months without QE.

And now we prepare for the ECB press conference in 30 minutes, but that will be nothing compared to the angry twitter tirade we expect by president Trump who will demand that Powell immediately match everything that Powell has done.

Commenti

Posta un commento