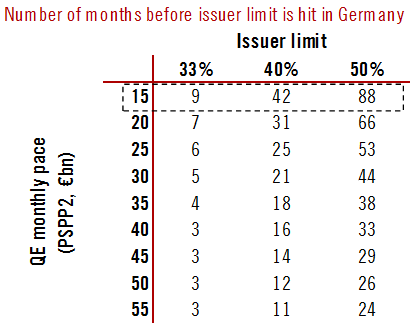

Here opinions differ slighlty, but converge on roughly 12 months of possible QE under the current limits.

According to Pictet's Frederik Ducrozet, at the proposed €20bn/month in QE, and assuming a split of €5bn in corporate bonds and the balance in sovereign, QE can run for roughly 9 months under current limits.

Separately, Danske Bank's strategist Peter Sorensen said that according to his calculations, the ECB can buy German bonds under its fresh €20b per month program for about 14 months. Here, Italy has the most most months left, at 87 while France, and Spain have 57 months and 25 months respectively. On the other end, Finland will have only five months of buying before limits reached while Slovakia has already hit the buffers.

Finally, Credit Agricole's Valentin Marinov was even less subtle: the FX strategiust pointed out the same thing we did, namely that "Draghi indicated that there was no discussion of raising the issuer limit as a way to boost the size of the pool of assets available to buy under QE." The problem: this will limit the duration of QE at 20 billion euros to between just six to 12 months, according to Credit Agricole estimates.

"So much for the infinity QE. Assuming that the capital key is sacrosanct, they cannot boost the size of their balance sheet in a meaningful way without an increase in the issuer limit."

His conclusion is that "this could put a base under the euro for now" and sure enough, upon realizing that open-ended QE is just a myth, the EURUSD has not only recovered all losses but is now up for the day!

Commenti

Posta un commento