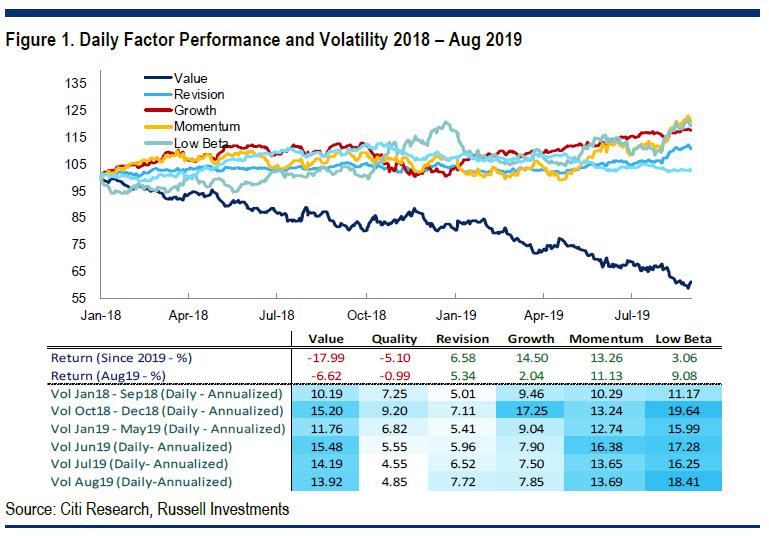

To those who read, and took heed of, last week's Quant Insights report by Citi, which cautioned that Price Momentum and Low Beta outperformed while Value underperformed most in August as the equity market turned to risk-off again, that Low Beta (Low Vol) had become the most crowded factor in the U.S. because of its historically high valuation and macro risk exposure, and that Short interest continues to build up in high beta stocks...

... the trade was a no brainer: unwind the best performing YTD strategy, which - as we noted last week - was momentum, and reallocate to value.

To everyone else who did nothing, well... the momo massacre that swept across markets over the past three days has made sure that anyone who had market-beating profits as recently as the start of the month, is now read for the year!

It wasn't just Citi who saw the divergence: as JPM's head quant, Marko Kolanovic writes today, the divergence observed last Friday with the record performance gap between small and large companies, was an "all-time extreme", as JPM's momentum indicator - a weighted average of 1, 3, 6 and 12M price momentum - of small cap stocks reached its maximal negative reading, while the same indicator for the S&P 500 reached its maximal positive reading.

This divergence, as Kolanovic describes it, "has only occurred on two days in history" and most recently was recorded on one day in February 1999 during the tech bubble.

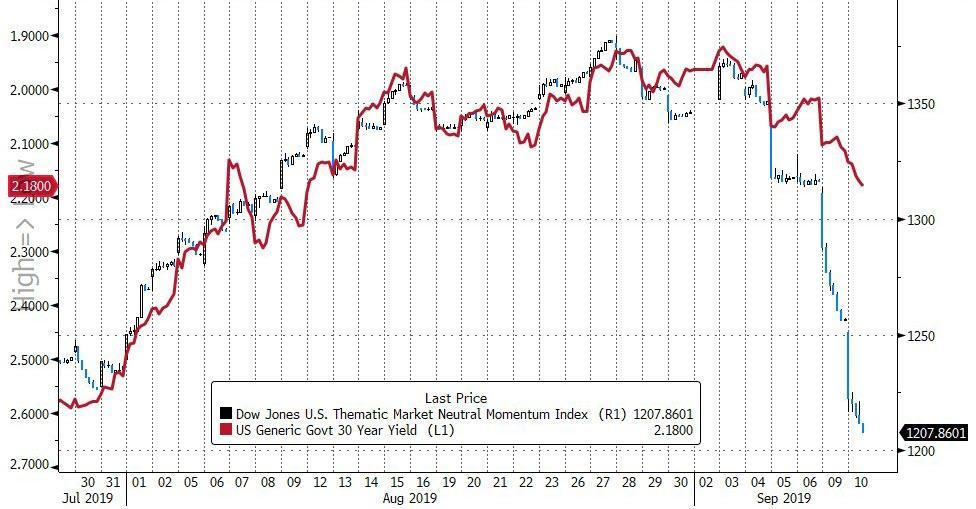

Of course, as subsequent market action demonstrated vividly, this record gap between value, cyclicals, SMid and high beta stocks on one side, and momentum, low volatility, and growth on the other side was not sustainable, and as shown in the chart below, the market suffered a ~5 standard deviation rally of value vs. momentum yesterday and today.

So what happens next? Or as Kolanovic notes, "many clients are asking how long this rotation can last." Indeed, if duration and low vol are now effectively one and the same trade, there is a long ways to go, with a non-trivial chance that we end up with the biggest VaR shock in history if the 30Y has yet to catch down to the momo bloodbath.

Before answering that question which suddenly preoccupies anyone who trades real money, Kolanovic reminds us that as discussed recently, the positioning of equity investors is near historical lows, "with global hedge fund equity beta in its 2nd percentile, and equity long-short hedge funds in its 1st percentile."

And while systematic investors recently dipped their toe into the broader market, their exposure is also low, with CTAs' equity beta in its ~20nd percentile, and volatility targeting exposure in its ~25th percentile. Meanwhile, volatility has started declining from the August spike and dealers' index option convexity is now long (further suppressing realized volatility), which suggests that systematic funds will soon be automatically pushed into the market.

As a result, Kolanovic predicts "equity inflows on account of declining volatility" coupled with strong buyback activity over the next ~3 weeks, ahead of the Q3 blackout.

Besides the bullish technicals (mostly in the form of low positioning), the JPM strategist also notes that there are some "positive fundamental developments related to Brexit, Italy, Hong Kong, US economic activity (services), and most importantly negotiations between the US and China that are scheduled for October."

Yet while one doesn't have to have a view Regardless of the outcome of these negotiations, there does seem to be a 3-week window in September where the market can move higher from record low positioning. How would an increase of equity positioning look? We first note that while net equity positioning is near lows, gross exposure of hedge funds is very high (for instance, JPM's Prime Brokerage portfolio shows gross leverage in its 99th percentile since Jan'18). Given record high gross and near record low net exposure, the most likely way to increase exposure is by closing shorts. This is the type of move that we saw yesterday and we think it has a lot of room to continue.

Indeed, as noted earlier, one of the main reasons for the dramatic push higher in stocks today was precisely due to a wholesale lifting of the most shorted stocks...

... which the JPM quant believes may continue, and would push value, cyclicals, high volatility, and small caps to outperform the broad index.

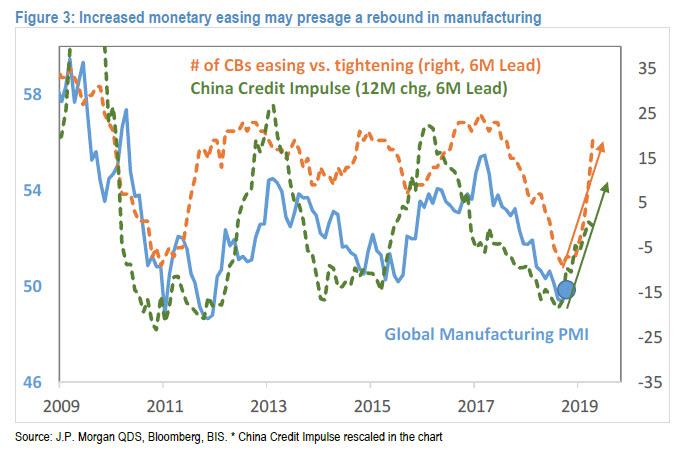

Besides the purely technical reasons, Kolanovic also predicts that a more sustained value and broader market rally beyond the October trade talks is "quite possible" given the recent increase of monetary and fiscal stimulus globally that typically acts with a delay, coupled with the rebound in the China credit impulse. And while manufacturing lags both, JPM now expects that in the coming months manufacturing activity will pick up "given the increased monetary stimulus, providing support for the market and value stocks." As such, "the October negotiations will be the key for future performance of equity markets and more broadly the global economy", and a favorable outcome could results in further dramatic mean reversion in the value-momentum divergence.

There is another wild card why Kolanovic is "cautiously optimistic" about progress being made during trade talks, and it has to do with growing fears that the US economy is sliding into a recession, and Trump's desire to avoid being blamed for one especially with the 2020 elections just around the corner.

As JPM argues, "recent voter polls indicate that 65% of US voters would blame US administration trade policies and Trump directly for market volatility, and 57% would blame Trump if the US were to enter recession."

These results were confirmed with another poll yesterday indicating similar results. A recession going into election would be politically devastating, and with the time window to the election closing, it would be reasonable to expect some progress on trade. This could give enough time for monetary and fiscal measures to turn around economic activity.

In sum, while the recent violent snapback between value and low beta/momentum stocks is unlikely to persist at the same pace, JPMorgan's head quant believes that "the value rotation can continue and the broad market could move higher going into October negotiations, and if real progress is made, continue into a more sustained rally."

This view is based on positioning, record factor spreads (e.g., value vs low volatility), and an unwind of some of the August technical flows in both rates and equities.

That said, just like the market barely dipped as value stocks tumbled due to a great rotation of capital underneath the surface, JPM does not expect a sharp move in the broader S&P, but rather mostly sees upside potential in small caps, cyclicals, value, and Emerging Market stocks.

So if Kolanovic is right, and the value outperformance/quant crash/short squeeze all persist over the next two months, what are the opportunities and how can investors quickly re-balance portfolios towards value? As the quant notes, "one market segment that got hit particularly hard is SMid companies in the energy and material sectors. This segment is at the nexus of selling by low volatility, growth and momentum style investors, shorted by discretionary PMs, and sold by long only investors due to trade war concerns and the strong USD."

Investors can also go long commodities, for example nat gas, as commodity prices got suppressed by a high level of shorting by CTAs (e.g., near record short interest in natural gas futures), and the unwind could result to tremendous upside (and volatility). As Kolanovic concludes, "normalization of these extreme conditions, and related feedback loops, may create unusually high upside in this market segment."

Commenti

Posta un commento