Posted on 1 March 2020 by fabrusvr

The market correction last week was one of the most brutal we have ever seen.

We explain why the bottom could be near.

Don't stress too much. We will put this genie back in the box and come out smarter and stronger for it.

Usually our market updates are reserved to our investors, members of High Dividend Opportunities. But given the severity of the market correction, we decided to share it with our readers and followers. Our service does not only cover high dividends, but we also monitor macro economic conditions and propose hedging strategies. We have warned about a market correction back in January and advised to raise a 20% cash position to redeploy as when the correction occurs. This is where we are now.

MARKET UPDATE: A BOTTOM COULD BE NEAR

The S&P 500 index pulled back sharply on Friday, but bounced back and was able to close well above the 2900 level which is a key support level. The index closed at the 2954 level which is the high of the session. This is very positive from a technical perspective, and suggests that a bottom is probably very near. We would expect the markets to see a sharp bounce next week. We also expect crude oil prices to bounce back from here. The $45 level held well today on bullish inventory data and is likely to bounce back too. Note that we are likely to see extreme volatility in the near term. Just remember we may bounce half way the correction, and then retest the lows. It will appear that some "news" caused this, but it has everything to do with asset flows and positioning.

SUPPORT FROM THE FEDERAL RESERVE

Federal Reserve Chairman Jerome Powell signaled Friday that it's prepared to cut interest rates if needed.

The fundamentals of the U.S. economy remain strong. However, the coronavirus poses evolving risks to economic activity, Mr. Powell said in a statement released Friday afternoon.

"The Federal Reserve is closely monitoring developments and their implications for the economic outlook. We will use our tools and act as appropriate to support the economy."

The Fed used a similar approach just last June to indicate it was willing to cut interest rates if needed during the U.S.-China trade war which was causing global slowdown. This is of course very good news for equities.

MORE ABOUT THE CORONAVIRUS

It's still too early to judge the impact of the CoronaVirus on the global economy. However, the number of death cases has been much lower for the coronavirus than from Influenza (or the Flu). In early 2019, a publication from the Global Burden of Disease Study (GBD) estimated a range of 99 000 to 200 000 annual deaths from lower respiratory tract infections directly attributable to influenza. So far, the coronavirus has resulted in 2,458 deaths based on the most recent data available.

The current market correction is more related to panic and speculation rather than economic fundamentals. So far, there's no evidence of a global health crisis that would cause a significant dent to the global economy.

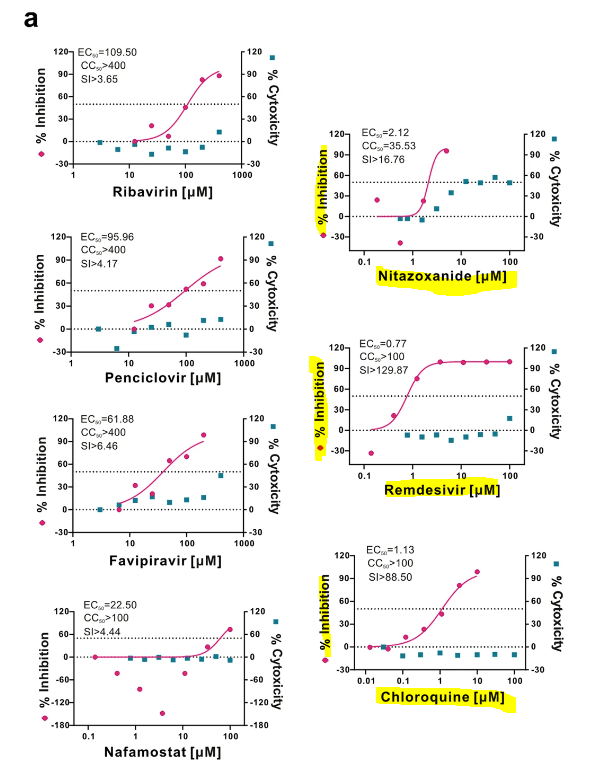

Our knowledge and understanding of this virus is progressing rapidly. Even without first-world care, case fatalities have fallen quickly. In China, the overall case fatality rate or CFR was higher in the early stages of the outbreak (17.3% for cases with symptom onset from 1-10 January) and has reduced over time to 0.7% for patients with symptom onset after 1 February." 0.7% CFR in a developing country without having identified effective drugs is a big improvement over the first month. During 100 clinical trials are in progress and at least five very promising drugs are being studied. Some have shown remarkable effectiveness against even stronger coronavirus strains like SARS and MERS. More recent studies on COVID-19 have shown multiple drugs can inhibit the virus in-vitro (in lab tests). Three of those drugs are very likely to work well inside the body as well considering the doses required for virus inhibition.

Source: Cell research

Multiple drugs even beyond these are rapidly being tested and evaluated. The coronavirus is not going to be the end of the world or anything. Life will go back to normal even if it means everyone wears a mask until then.

As soon as the hysteria is over, the markets should strongly recover. At this point, we recommend that investors remain calm and keep a long-term view. It's not the time to panic and sell.

Finally, markets can deplete the most precious pieces of capital and those are time, health and happiness. If those are lost, then money becomes secondary. So don't stress too much. We will put this genie back in the box and come out smarter and stronger for it.

Commenti

Posta un commento