If Tesla was truly a story about actual economics - you know, things like demand and production - we might expect the fact that registrations are plunging to have an effect on the company's stock price.

But, as it goes, the company's stock is and has been wholly disconnected from reality, which is why at the stock sits currently with a $700 handle, we're certain it won't be phased by the fact that registrations have plunged in top European markets.

For instance, Tesla recorded only 83 new cars in Norway last month, comparing to 1,016 vehicles last year. In the Netherlands, registrations also plunged, down 68% to 155 units, according to Bloomberg.

It is not a good look for Tesla, as these are two of the only four countries that Tesla breaks out revenue for on a quarterly basis. For the first two months of the year (and first 66% of the first quarter), registrations were down 77% and 42% in Norway and the Netherlands - and that was against easy comps. The Model 3 was only just starting to get underway with sales in early 2019.

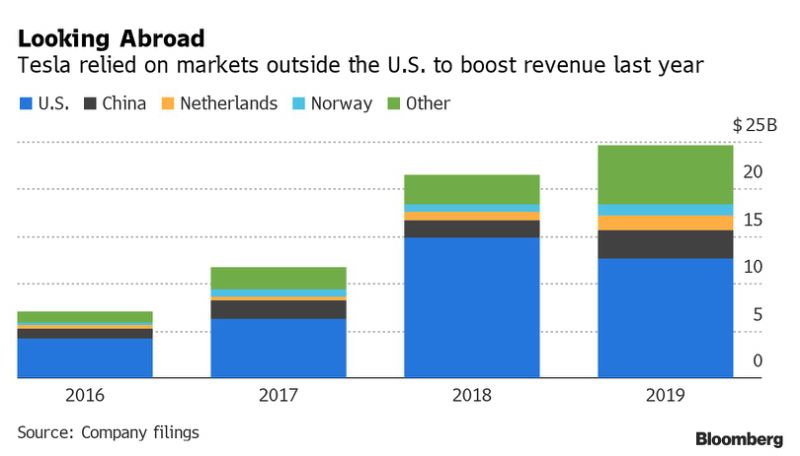

Norway began to saturate last year and the Netherlands saw a favorable tax provision for EV buyers disappear. Revenue from the Netherlands and Norway was up 65% and 48% in 2019, respectively, which helped offset a 15% drop in the U.S. With these key Europeans countries not absorbing the blow any further, what could Tesla's Q1 2020 revenue look like?

Of course, the Tesla "carrot on the string" now turns to Germany. In addition to Tesla building its next Gigafactory there, the country has unveiled a landmark climate related stimulus package. It is offering subsidies to boost EV sales and is expected to overtake Norway as the regional EV leader.

But the falling sales in Europe will make it tough to cushion any blow not only in the U.S., but in China, where coronavirus has ravaged the country and auto sales, in general, are down between 80% and 90% for February. This hasn't stopped Tesla's stock from holding a bid in the $600 to $700 range, even despite the market's recent sell off on coronavirus fears.

For now, the $120 billion cash incinerating company remains in tact.

We can't help but wonder if a further plunge in the markets could reveal any "interesting" information about Tesla and/or its financials going forward.

Commenti

Posta un commento