How does it affect me?

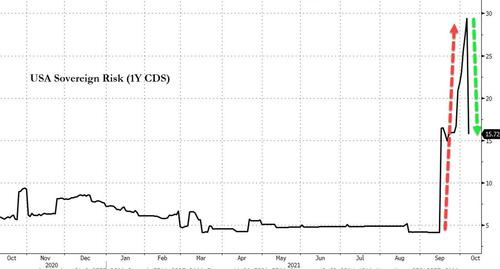

The graph below shows a decreased fear of US default. While still elevated, it is off recent highs. Important to understand this is not a predictor of default. It is the price of insurance should the US actually default. It reflects risk managers taking out policy to protect bond portfolios. That doesn’t make it any less important of a barometer. So feel free to not panic, unless you are in need of bond insurance. But the price of insurance is correlated with default risk. At the highs, default risk protection was 6x the cost from a month ago.So that may not be a big absolute jump from a low starting point, but 6x the cost is still 6x the cost.

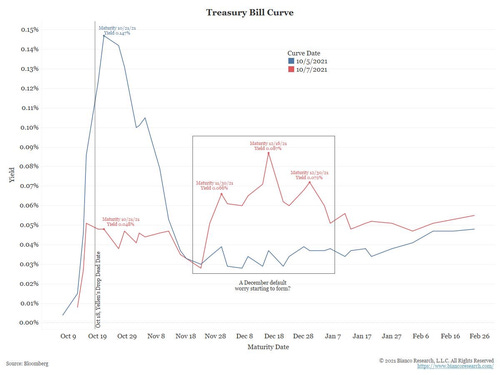

Let’s look quickly how this manifests in the very short term. When everyone was concerned about a debt ceiling crisis, Bonds that expired right before that date went bid as bonds right after it cratered. As the can gets kicked down the road, so does the divergence, like a python eating a pig.

As you can see, the risk of default has merely been kicked down the road a few weeks. The above chart shows - the kink in the T-Bill curve is swelling once again. Now imagine if it gets kicked for years. So why care as a citizen? Here’s why:

The real problem will be if this persists, investors in bonds will demand higher yields for the potential risks; which translates into higher cost for the nation to finance itself Which means:

Higher taxes on you to pay that debt interest

Lower standards of living for you to compensate for having less to spend- (ford pinto is a good car!)

More inflation eventually which will function as a tax on your money to pay their debt

That’s the reality of it. That is why regular investors should care. The US will not default to trade partners. At least not really default. But it will use its middle class to make sure it doesn’t default. This has been policy since 1971.1.

Working people are the backstop of every mistake their government has ever made. The current analogy is that Inflation is a stealth tax. We feel it is much worse. Inflation is a slow motion default to its own citizens; in both financial and fiduciary responsibility.

BONDS and GOLD

Bonds sold off again. Even though Bonds selling off is a sign of inflation (or default risk), Gold will frequently react poorly to the decrease in negative real yields.2 Specifically, the opportunity cost of owning Gold increases if bonds yield more. And even though if you subtract inflation from yields you still get negative real yields; those real yields are getting less negative now. So, Gold is more risky to own. Anyway, that’s the story. Why Gold isn’t trading down from $3,000 in the first place on this news is a different story and testament to neo-keynesian bank engineering.

Structurally this cannot hold up forever; but until the market believes inflation is truly out of control ( or we actually default) and the Fed has lost its mind, expect Bonds and Gold to have this type of relationship. Bond yields rising is a function of the Fed withdrawing stimulus and/or the market properly keeping inflation in check.

Commenti

Posta un commento