The US bond market may be closed, but it was fully open in China, and locals took advantage of this fact to do one thing: sell.

In the aftermath of the post ""Catastrophic" Property Sales Mean China's Worst Case Scenario Is Now In Play", China property firms bonds were hit with another wrecking ball on Monday as Evergrande was set to miss its third round of (offshore) bond payments in as many weeks and rival Modern Land became the latest scrambling to delay deadlines.

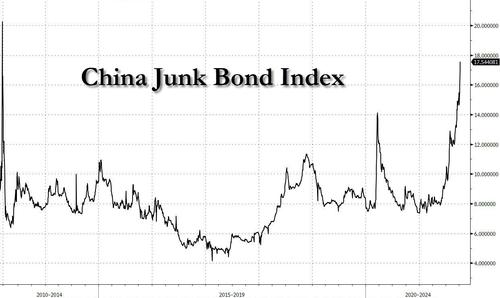

Having already suffered the fastest drop on record, Chinese junk bond markets - where property developer issuers dominate - were routed once again as fears about fast-spreading contagion in the $5 trillion sector, which drives a sizable chunk of the Chinese economy, continued to savage sentiment. Meanwhile, China Evergrande Group's offshore bondholders still had not received interest payment by a Monday deadline Asia time, Reuters reported citing sources.

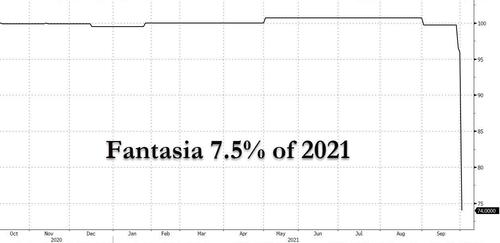

But while Evergrande's default is now just semantics, and one week after Fantasia shocked bondholders with a surprise announcement it too would stuff creditors just weeks after it had said its liquidity was fine, which sent its bond plunging from par to 74 cents in seconds...

... other signs of stress included smaller rival Modern Land asking investors to push back by three months a $250 million bond payment due on Oct. 25 in part "to avoid any potential payment default." This was not expected, and Modern Land's April 2023 bond plunged more than 50% to 30 cents on the day.

Elsewhere, Xinyuan Real Estate proposed paying just 5% of principal on a note due Oct. 15 and swapping that debt for bonds due 2023. Fitch Ratings called the move a distressed debt exchange while downgrading the firm to C. At least the two companies are relatively small: Modern Land and Xinyuan have $1.35 billion and $760 million of dollar bonds outstanding, respectively, according to data compiled by Bloomberg. In comparison, Evergrande has $19.2 billion.

Among the declines for high-yield issuers, China Aoyuan Group's 6.35% note due 2024 dropped 13.2 cents on the dollar to 57.5 cents; Sunac's 6.5% dollar bond due 2026 declined 9.4 cents to 57.9 cents, leaving both poised to close at the lowest-ever levels.

Kaisa Group, which was the first Chinese property developer to default back in 2015, also saw some of its bonds slump to less than half their face value while supposedly "safe" names such as R&F Properties, and Greenland Holdings, which both have prestige projects in global cities like London, were also widely sold.

Yields on Chinese junk-rated dollar bonds surged 291 basis points to 17.54% last week, the highest level in about a decade, according to a Bloomberg index.

And just to add insult to injury, China's10-year government bond futures declined to a three-month low as the central bank's latest liquidity draining weakened expectations of fresh monetary policy easing. Futures contracts on 10-year notes fall 0.4% to 99.14, the lowest level since July 12. 10-year sovereign bond yields rose 5bps, the biggest gains in two months, to 2.96%.

"It's a disastrous day," Clarence Tam, fixed income PM at Avenue Asset Management in Hong Kong, told Reuters, highlighting how even some supposedly safer "investment grade" firms had now seen 20% wiped off their bonds. "We think it's driven by global fund outflow .... Fundamentally, we are worried the mortgage management onshore hits the developers' cash flow hard," he added, referring to concerns people could stop putting deposits down on new homes.

In other words, the dynamic we discussed over the weekend in which we explained why "China's Worst Case Scenario Is Now In Play" is spreading from the biggest rotten apples - i.e., Evergrande, Fantasia - to collapsing confidence in the property sector, to credits that until now were seen as healthy and immune from a property implosion. In short, the bursting of the US housing bubble has moved to China, and yes - that culminated with the original Lehman moment.

Meanwhile, JPMorgan analysts highlighted how international investors were now demanding the highest ever premium to buy or hold 'junk'-rated Chinese debt. There is now a whopping 1,200 basis point difference between the bank's closely-followed JACI China high yield index and a similar index of investment grade AA-rated local Chinese market bonds, known as "onshore" bonds. The option-adjusted spread on the ICE BofA Asian Dollar High Yield Corporate China Issuers Index (.MERACYC) is also at its widest ever.

"Evergrande's contagion risk is now spreading across other issuers and sectors," JPMorgan's analysts said, demonstrating a rare talent for observing the obvious.

And while today may have been "disastrous" it could get far, far worse if the market loses faith that Beijing will bail out the bond market.

"We believe policymakers have zero tolerance for systemic risk to emerge and are aiming to maintain a stable property market, and policy support could be forthcoming if the deterioration in property activity levels worsen," said Goldman head of Asia Credit Kenneth Ho.

Overnight we saw the first sign of such an implicit support in Harbin, the capital of northeastern Heilongjiang province, which became one of the first cities in China to announce measures to support property developers and their projects. According to a report on a website run by Harbin Daily, the city will offer as much as 100,000 yuan home-purchase subsidy to "talents" that meet certain requirements. The city would also make more existing homes eligible for housing provident fund loans to buyers; the moves are aimed at promoting stable and healthy development of the city's property market, according to the document.

The cash-strapped property developer's troubles and contagion worries have sent shockwaves across global markets and the firm has already missed payments on dollar bonds, worth a combined $131 million, that were due on Sept. 23 and Sept. 29.

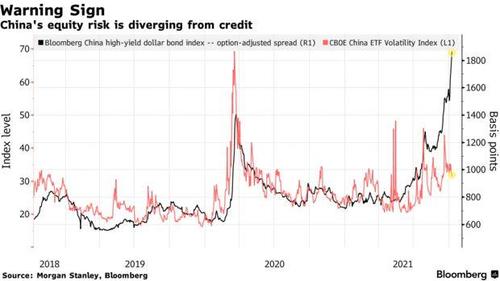

While China's property sector turmoil has so far been contained to the bond market, tensions amid offshore bonds could soon create headaches for the country's equity traders, according to Gilbert Wong, head of Asia quantitative research at Morgan Stanley. High-yield credit spreads over comparable Treasuries are the widest on record -- at about 1,866 basis points on an option-adjusted basis, data compiled by Bloomberg as of Friday show. But a measure of stock volatility has actually fallen so far this month.

Still, the pair has shown a close relationship in recent years, which suggests their divergence may not last. In the end, a crash in the stock market, where hundreds of millions of Chinese residents are invested, may be just the kick Beijing needs to wake it out of its no bailout stupor.

Commenti

Posta un commento