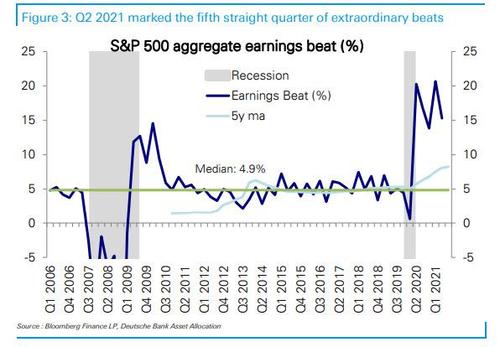

As the following chart from Bloomberg shows, for six consecutive quarters, earnings season provided the antidote to all the stock market ills (if not on fundamentals but because stock stubbornly tracked the relentless growth of the Fed's balance sheet which rose by $120BN every month like clockwork). But that perfect record is about to get its biggest test yet at a time when uncertainty is swirling among equity investors, and not just because a potentially ugly earnings season is on deck but because the Fed's liquidity cannon is about to see its first "tapering" since the covid pandemic unleashed trillions and trillions in liquidity.

Looking back, the large and persistent earnings beats over the last 5 quarters...

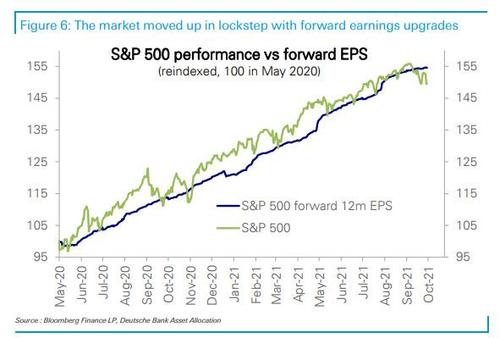

... prompted record upgrades to forward earnings estimates.

The market has moved higher in lockstep with these upgrades...

... leaving the forward multiple remarkably flat at very elevated levels since May of last year. And as Deutsche Bank's Binky Chadha warns, "the market is priced for these large beats and upgrades to continue" but can Q3 earnings season deliver?

And so, as jittery investors brace to comb through the corporate tea leaves for clarity on everything from the impact of rising rates and commodity inflation to broken supply chains, setting the stage for a particularly dramatic serving of results, below we take a loot at what Wall Street expects as 3Q earnings kick off tomorrow when JPM reports bright and early.

Following another huge beat in 2Q, 3Q EPS has risen 3% over the past three months to $49.06 (+27% YoY), down from an eye-popping 94% Y/Y surge in Q2; typically this estimate falls by 4% into the quarter. According to BofA, consensus forecasts imply the 2-year growth rate falling sharply to +16% vs. +27% in 2Q amid supply chain issues and the delta variant-driven slowdown (the just released news about Apple slashing its iPhone production due to chip shortages being the latest case in point).

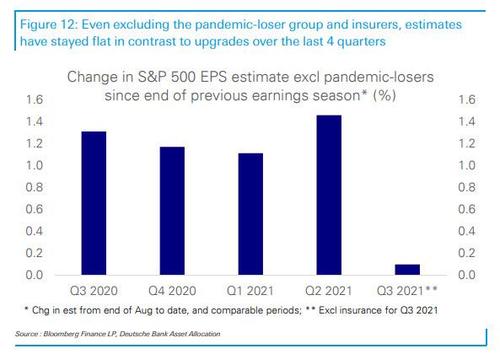

In a conspicuous break from the last 4 quarters which saw upgrades, DB notes that Q3 consensus estimates are being downgraded ahead of the earnings season, marking a return to what has been the historical norm. Downgrades have largely been driven by the pandemic-loser group on delta variant concerns, and by insurers following the impacts of hurricane Ida. But even excluding these lumpy impacts, estimates have stayed flat in contrast to the upgrades of recent quarters.

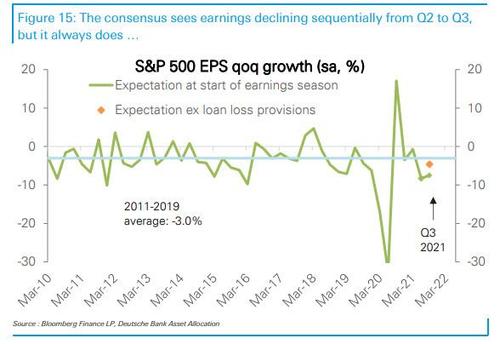

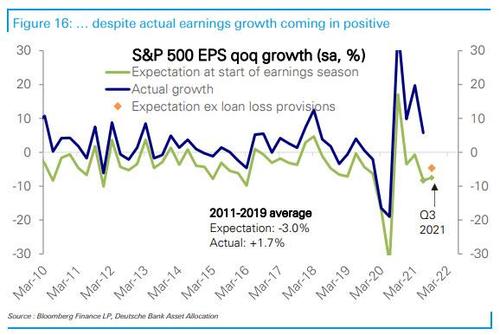

As is typical, the consensus sees a drop in earnings sequentially (-4.5% qoq excluding loan loss provisions)...

... with nearly all sector groups seeing declines. But that's usually the case and in the end, earnings growth usually comes in positive.

Cutting to the chase, DB notes that amidst a macro backdrop that is a little less supportive than over the last 4 quarters, the bank sees earnings continuing to rise but only modestly so (+1.5% qoq), beating consensus by 6%, far lower than the 14-20% range of the last 5 quarters and closer to the historical average beat of 5%

Expect no beat this quarter

In Q2, S&P500 companies delivered another monstrous beat topping consensus by 17%. With the strong beat, 3Q EPS estimates have risen 3% over the past three months, but BofA sees increased headwinds heading into 3Q, primarily driven by supply chain issues, delta-driven slowdown, and continued inflationary pressure.

That said, while there are reasons to be cautious, earnings misses are extremely rare: since 2009, there have been only two quarters (out of 50) when earnings missed consensus (2Q11 & 1Q20). And with consensus expecting a meaningful moderation in the 2-year growth rate to 16% from 27%, BofA's 3Q EPS estimate is in line with consensus, representing the worst earnings season since COVID and below the historical median beat of 3.5%.

BofA generally agrees with DB, and expects earnings to come in in-line with consensus and revises its 3Q EPS down by $2 (to $49) and 4Q by $1. But, as has been the case for much of the past year, one of the top questions will be around guidance (which started to soften) and 2022 EPS will be revised lower.

Another core question: who is best positioned to weather the surging input costs: "What we are going to be laser-focused on in this earnings season is pricing power," said Giorgio Caputo, senior portfolio manager at J O Hambro Capital Management. "What we're seeing is that getting the machine back up and running -- those who thought it would be an easy quick fix are being disappointed now."

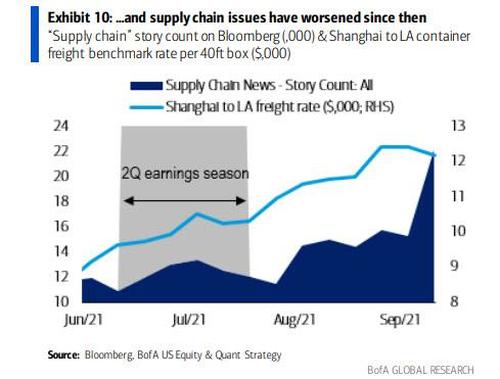

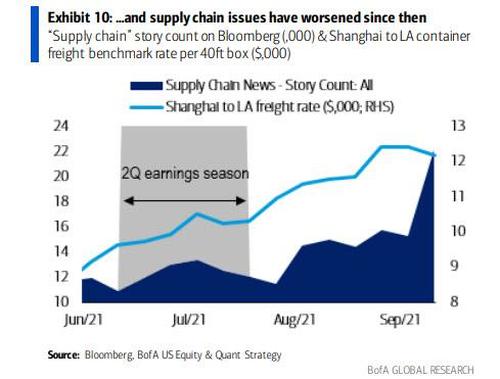

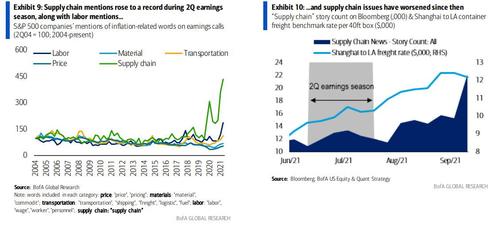

Which leads us to the most important variable of Q3 season: profit margins. As we noted at the time, although margins expanded to record highs in 2Q, companies highlighted increasing difficulties passing through cost inflation. Since then, issues have worsened: supply chain news stories increased 74% and freight rates from China rose 20%...

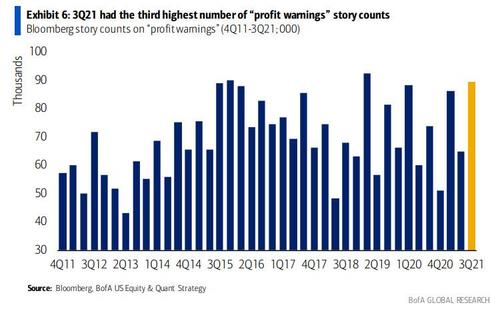

... with record backlogs at the West Coast Ports. In 3Q, we also saw a near-record number of profit warnings stories (third highest since 2011), only after 4Q15 and 1Q19.

In those quarters, earnings beat consensus by 0.6% and 4.9%, respectively, but subsequent quarter earnings were revised down by 9.3% and 2.2% mostly due to supply issues.Incidentally, we predicted that this would happen.

If MS and BofA are right on slumping consumer demand and margin contraction we should start seeing Q3 earnings warnings in the next 2 weeks.

— zerohedge (@zerohedge) August 30, 2021

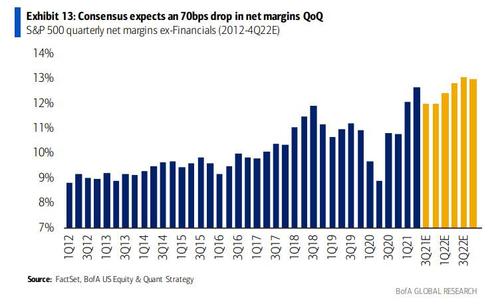

To be sure, consumer demand remains robust but soaring inflation poses downside risks. While analysts have baked in margin contraction this quarter (non-Financials net margins -70bps QoQ), both BofA and Morgan Stanley see big risks to 2022 numbers, where analysts expect record margins, an outcome which is virtually impossible unless all the input cost inflation is passed through to consumers.

It's not just broken supply chains: wages are surging too; indeed as BofA writes, "wage inflation is just as big of a headwind (if not

bigger)" than supply chains. The BEA estimates wages are as much as 40% of total private sector costs. At the same time, slowing China and its property sector issues also pose risks to US multinationals. And while higher oil prices have historically been positive for S&P earnings (every 100bps move up in WTI added 50bps to S&P earnings growth), but Energy companies' capital discipline could translate to a lower earnings multiplier (i.e. less revenue for energy capex beneficiaries). Soaring gas prices also add pressure to Chemicals and Utilities. In other words, higher oil could be a headwind rather than a tailwind this time.

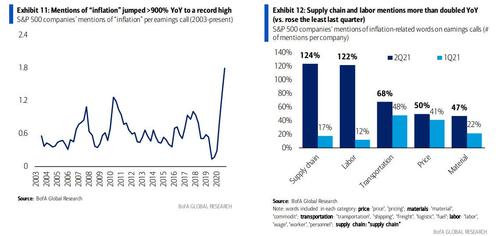

Mentions of "inflation" on 2Q earnings calls topped 1Q levels and jumped to a record high, based on BofA's Predictive Analytics team's analysis. On a YoY basis, inflation mentions rose more than 900% YoY, in line with the increase we saw last quarter.

Notably, supply chain mentions rose the most among inflation categories tracked in 2Q, more than doubling YoY (along with labor mentions). Since then, supply chain issues have worsened: news stories on "supply chain" increased 74% since the 2Q earnings season according to Bloomberg, and freight rates from China also rose 20% (Exhibit 10)

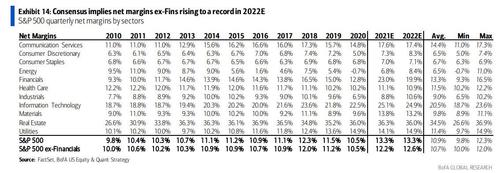

And yet, amid all these rising margin risks, analysts are expecting margins to hit a new peak in 2022!

Consistent with recent developments, consensus does point to a 70bps drop in net margins (ex-Fins) to 12.0% in 3Q, which does reflect some conservatism. However, they then expect the margin compression to stop there – with flattish margins in 4Q21, and expanding margins in 2022 to new record highs (above 2018 peaks).

Analysts expect margins to hit new highs in 4 of 10 sectors, excluding Financials (Exhibit 14). BofA disagrees and expects current headwinds to last well into 2022, and sees risk to consensus numbers.

As the bank cautions, "analysts have consistently underestimated margins over the past five quarters, but given the worsened macro environment for corporate profits (more below), we do not expect those big margin beats to repeat in 3Q."

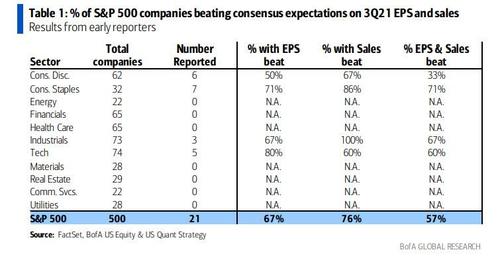

And with good reason: the early reporters have shared mixed data at best. So far, 21 companies (primarily "early reporters" with August quarter-end) have reported 3Q results. Early reporters are concentrated in Consumer, Tech and Industrials, but can often give a read on the full quarter's results: BofA has found a 71% correlation between the proportion of early reporter beats on EPS and sales and the proportion of full-quarter beats on EPS and sales. So far, 67% have beaten on EPS, 76% on sales and 57% on both. This is weaker than last quarter (67%/94%/67%), but still above the historical average (since 2012) of 70% EPS beats, 63% sales beats and 49% both beats. The median EPS beat so far has been 4.0%.

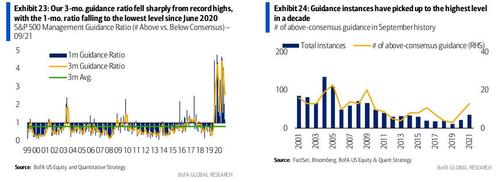

More ominously, BofA's 3-month guidance ratio (# of above- vs. below-consensus guidance instances) sharply fell from a record high to 2.6x in September, albeit it remains well above the historical average of 0.8x. The more volatile 1-mo. guidance ratio also fell to 1.2x, representing the lowest level since Jun 2020, as companies warned about rising inflationary pressure. Meanwhile, guidance instances have picked up to the highest level in a decade in September.

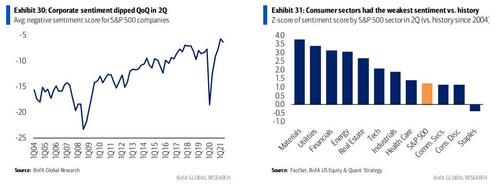

But perhaps the most troubling indication of what to expect comes from companies themselves after what BofA notes was peak corporate sentiment. According to BofA's Predictive Analytics team overall, corporate sentiment dipped from a record high, potentially indicating peak corporate sentiment amid inflation concerns and the Delta variant. Consumer sectors had the weakest sentiment compared to their own history, while Materials and Real Estate had the worst sentiment on an absolute basis.

Similarly, companies' mentions of business conditions (ratio of mentions of "better" or "stronger" vs. "worse" or "weaker") indicate slightly weaker business conditions vs. the peak level last quarter. Mentions of optimism also plummeted from record highs in the prior two quarters.

Putting it all together, below is a handy list of what to expect courtesy of Deutsche Bank:

- The macro backdrop is a little less supportive. After having been strongly positive for over a year, data surprises turned negative in late-July. Earnings estimate revisions have historically been tied to data surprises. Consensus Q3 GDP estimates have also been revised downwards from over 7% at the end of Jul to 5% now. DB economists also cut their Q3 GDP forecast for growth from 8.9% to 4.7% in early September. The sales-weighted G4 manufacturing PMI, a preferred measure of global growth, rose sharply from its trough of 42.4 in Q2 2020 to 59.3 in Q2 2021. In Q3 so far, it has stayed flat (Jul-Aug average of 59.4). The US dollar is also up slightly in Q3 after 4 quarters of declines.

- Secular growers (MCG+ Tech) earnings likely to flatten at an elevated level. Earnings for MCG+ Tech have been boosted well above trend by a broad cyclical lift as well as from being direct beneficiaries given the realities of the pandemic. The cyclical component which is tied to global growth and the US dollar is likely to stay flat. With re-opening having gathered steam through the quarter, the idiosyncratic pandemic-related benefit should arguably start to wane, but even if the full benefit were to remain intact, it would still point to earnings overall staying largely flat (0.4%). With consensus seeing a drop (-4.5%), DB sees a beat of about 5.2%, a sharp slowdown from the 10-17% beats they posted over the last 5 quarters, but in line with the historical average of 6%. Notably, earnings remaining flat would also mean a modest move back towards their historical trend with the gap shrinking from a record +25% in Q2 to +22% in Q3.

- Cyclicals earnings almost back to trend. The consensus sees losses for the pandemic losers diminishing in Q3 (-$6.6bn to -$2.4bn) as mobility rose albeit not as quickly as initially expected. Outside of the direct pandemic losers, the rest of the cyclicals in our view should continue to post modest growth (+1.7% qoq sa) as activity levels remain robust at elevated levels. Consensus sees earnings for cyclicals declining modestly (-0.4%), implying a beat of 8%, a sharp slowdown from the 14-38% range seen in the past four quarters, but ahead of the historic average level of 5.2%. If realized, cyclicals earnings would be almost back to their pre-pandemic trend, a strong and fast recovery after being over 70% below in Q2 last year

- Defensives earnings likely to move back down towards trend. Earnings for the defensives were significantly above trend in Q2 (+7%), as they continued to benefit from a pandemic boost. We see earnings retrace halfway back to trend in Q3 implying a modest (-1.5% qoq sa) decline, while the consensus sees a larger -6.3% drop, pointing to a potential 5.1% beat in the quarter. If realized, this would be the weakest aggregate beat since the start of the pandemic, which has seen surprises in the 7-18% range, but at about the average level of pre-pandemic beats (historical average of 4.4%).

- Financials to continue posting outsized beats as benign credit costs remain a tailwind. Banks released large amounts from loan loss reserves in the past two quarters ($13.8bn in Q1 and $9.5bn in Q2), boosting earnings, and that is expected to continue given benign credit conditions. However, the consensus sees banks adding to reserves in Q3 ($3.8bn). Moreover, excluding loan-loss provisions the consensus sees earnings fall to the bottom of their 2013-19 trend channel. Together this points to a massive 29% beat again this quarter, in line with the 13-36% range of the last five quarters and way ahead of the typical +4.2% average.

- Energy. Oil prices have risen from $69/bbl in Q2 to $73/bbl in Q3 on average. The consensus forecasts Energy sector earnings to grow 22.5% (qoq) in Q3, which is somewhat ahead of what is implied by the increase in oil prices. DB sees lower earnings growth of 12.8% qoq, which could see the sector miss (-8%) in the quarter, in contrast with the solid double digit beats of the past four quarters and a historic average beat of 6.4%. Energy earnings beats historically have tended to be extremely volatile.

- Overall beats to remain robust but returning towards the historical norm. DB sees earnings for the S&P 500 rising modestly by +0.8% and EPS coming in at $53.6/share in Q3 2021. This compares with the consensus at $49.2/share, or a beat of 9%, significantly lower than the 14-21% range of the last 5 quarters. Excluding the outsized contribution from lumpy loan-loss reserve changes, DB expects a beat of 6.3%, close to the historical average of 5% and compares to the 10-21% range of the last 5 quarters

In conclusion, and as noted earlier, huge beats and upward revisions kept the forward consensus rising steeply over the last 15 months according to DB's Chadha. Since then, consensus estimates for 2021 have edged slightly lower over the last few weeks (-0.2%), while 2022 estimates have flat-lined. The 4 quarter ahead growth rate of consensus estimates has now fallen to the steady pre-pandemic average (around 14%). In the absence of upgrades, current forecasts point to the growth rate falling well below (11%) over the next 2-3 quarters. As beats and forward earnings look to be returning to historical norms, will forward valuations follow?

Commenti

Posta un commento