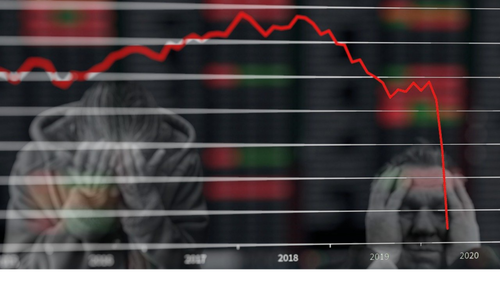

We got the highly anticipated employment report on Friday. It came in far below expectations. But despite weak economic data, bond yields are rising, along with the price of just about everything. Meanwhile, a gold rally fizzled. Peter Schiff talked about it during his podcast, explaining just how badly the markets are misinterpreting the data. When you add up plunging bonds yields, strong oil, and weak economic data – that equals stagflation.

According to the September Labor Department report, the US economy added 194,000 jobs last month. The projection was for around 500,000 new jobs.

A big decline in government jobs helped drive overall job growth down. As Peter noted, that's not necessarily a bad thing.

The only way to pay government workers is through taxes. So, if government workers are not employed, that is actually a benefit for the taxpayer because they're relieved of the burden of paying their salaries. And of course, a lot of the government work that's done actually interferes with productivity. We're actually better off without those workers because the workers are simply getting in the way of the productivity of everybody else."

The report was "highly anticipated because Jerome Powell specifically said the September job numbers would be instrumental in the Fed's decision as to whether or not to start the quantitative easing taper.

If this was the number the Fed was hanging its hat on for confirmation that the data supported a taper, well clearly, now that this number is out, if the Fed was basing a decision to taper on this number, well, it's not going to taper, which is basically what I've been saying all along — that the Fed is just bluffing when it comes to any movement to take the punch bowl away."

Although job creation came in far below expectations, unemployment dropped from 5.2% to 4.8%. On the surface, that seems like a positive. But one of the reasons that number came down is people simply left the workforce. The labor force participation rate went down from 61.7% to 61.6%. Peter said this is another reason the Fed won't likely taper. Powell has said he's looking at participation.

The fact that the rate went down is just another reason why the Fed is not going to taper before the end of the year. And of course, if it's not going to start the taper, when's it going to start raising rates? Because again, Powell has already said that the rate-raising process — liftoff — that's not even going to happen until tapering is completed."

Average hourly earnings were up 0.6% but real wages continue to fall. Inflation is eating up income gains.

The bottom line is this is a weak jobs report, especially when you consider everybody was expecting a strong jobs report.

Normally, inflation news combined with weak economic data would be a big plus for gold. Gold did initially rally on the bad news – as you would expect. But a rise in interest rates and bond yields weighed on the yellow metal and the rally fizzled.

Meanwhile, oil prices pushed above $80 a barrel. This is the first time we've seen oil this high since 2014. Peter said he thinks rising oil prices, along with rising commodity prices more broadly, spooked the bond market. Normally, weak economic data would send bond prices rising and yields falling. Instead, yields went up due to inflation.

Bond yields are only rising because of inflation. They're not rising because of a strong economy, but higher inflation. That is not negative for gold. Inflation driving bond prices down should also be driving gold prices up. The only reason it's not is because the market still expects the Fed to fight inflation. Every time we see more evidence of higher inflation, gold gets hammered because investors assume that the Fed's going to do something. The narrative pretty much goes like this: the Fed thought inflation was transitory and they were wrong. And because they were wrong as more evidence manifests itself that shows that they were wrong, now the Fed is going to have to change their policy and they're going to have to be more aggressive."

In fact, some media pundits have expressed concern that the central bank might be too aggressive and overshoot on rates. Peter said this is all nonsense. How can anybody really think the risk is that the Fed will be too tight?

There's no way that's going to happen. The risk is the reverse. The risk is that the Fed waits so long to raise rates that by the time they do, it's too little too late."

Nevertheless, investors aren't buying gold.

People aren't buying gold as an inflation hedge because they don't think there's any inflation to hedge because they're confident the Fed is going to put out the fire before it really gets burning."

The bottom line is we got a very weak jobs report. We have surging oil prices. We have rising bond yields, so interest rates are rising instead of falling to stimulate a weak economy. The dollar index fell.

So, a weakening dollar with rising consumer prices, rising bond yields and weak economic data – that spells stagflation. I mean, stagflation is here."

Commenti

Posta un commento