Tariff disputes weigh on commodities trade

After around two years of trade tensions between the US and China, S&P Global Platts analyzed the impact on global product flows.

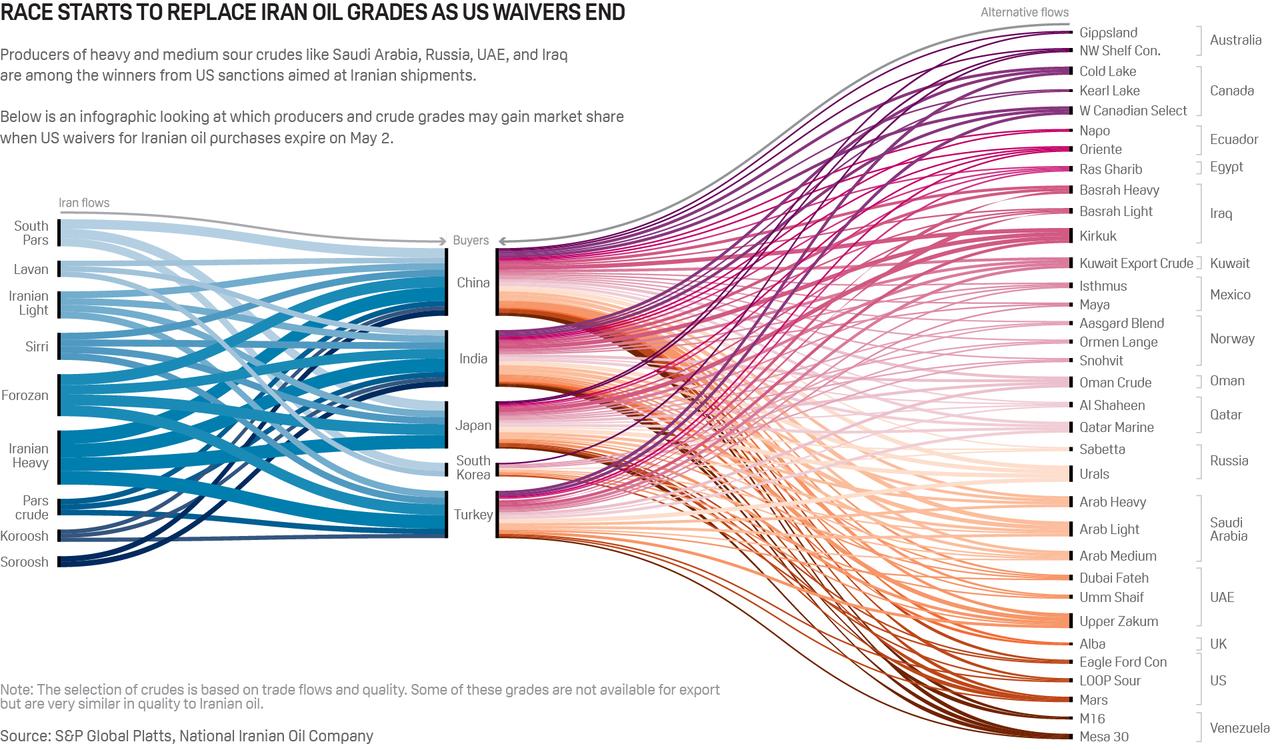

How to replace Iranian oil?

After US sanctions on Iran tightened with the non-renewal of waivers for oil importers, there were still plenty of options on the table to replace specific Iranian crude grades.

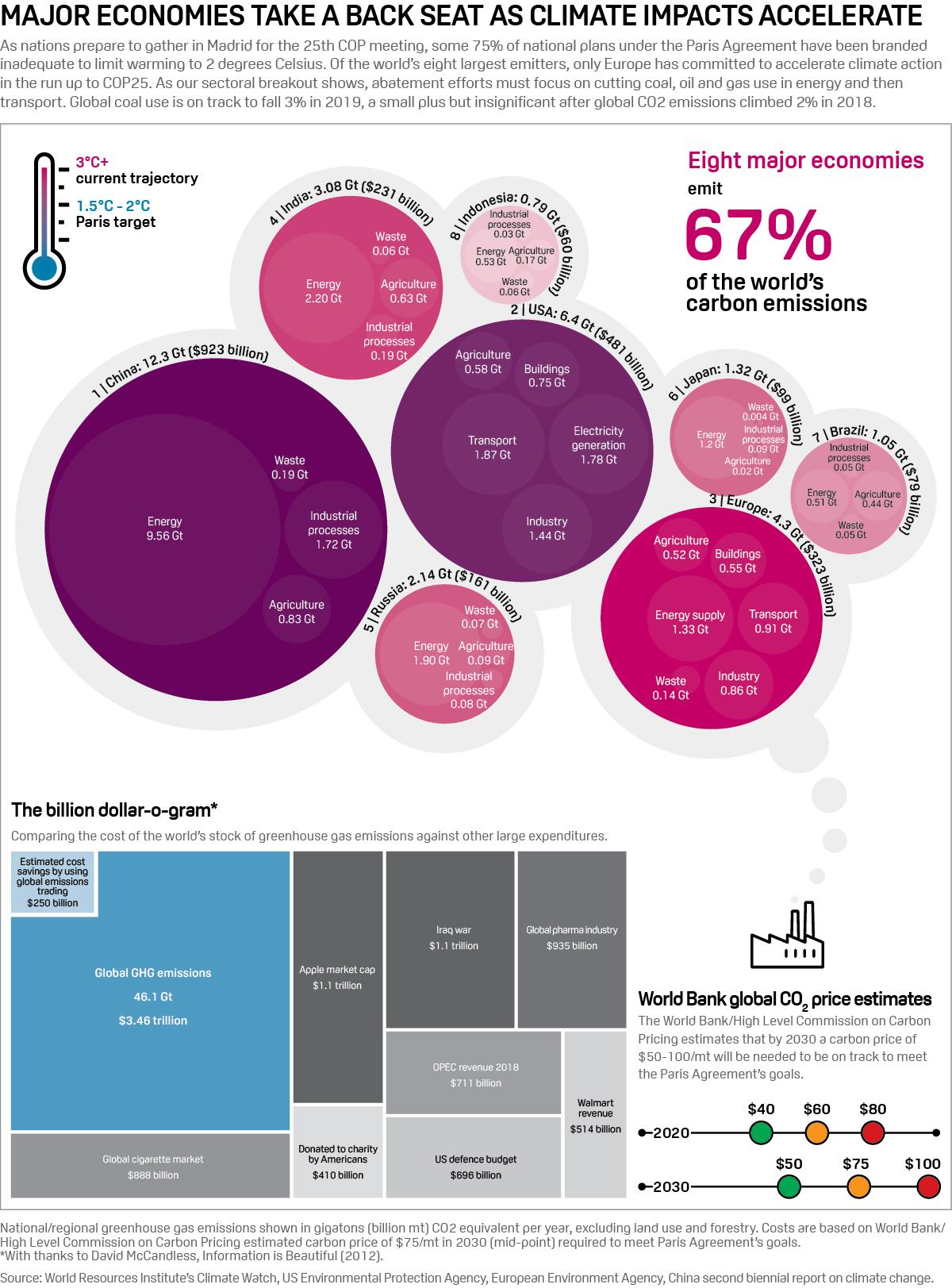

The biggest carbon emitters

Ahead of COP 25 in Madrid, S&P Global Platts crunched the numbers to show carbon emissions of the biggest global economies, and their costs compared to other major expenditures.

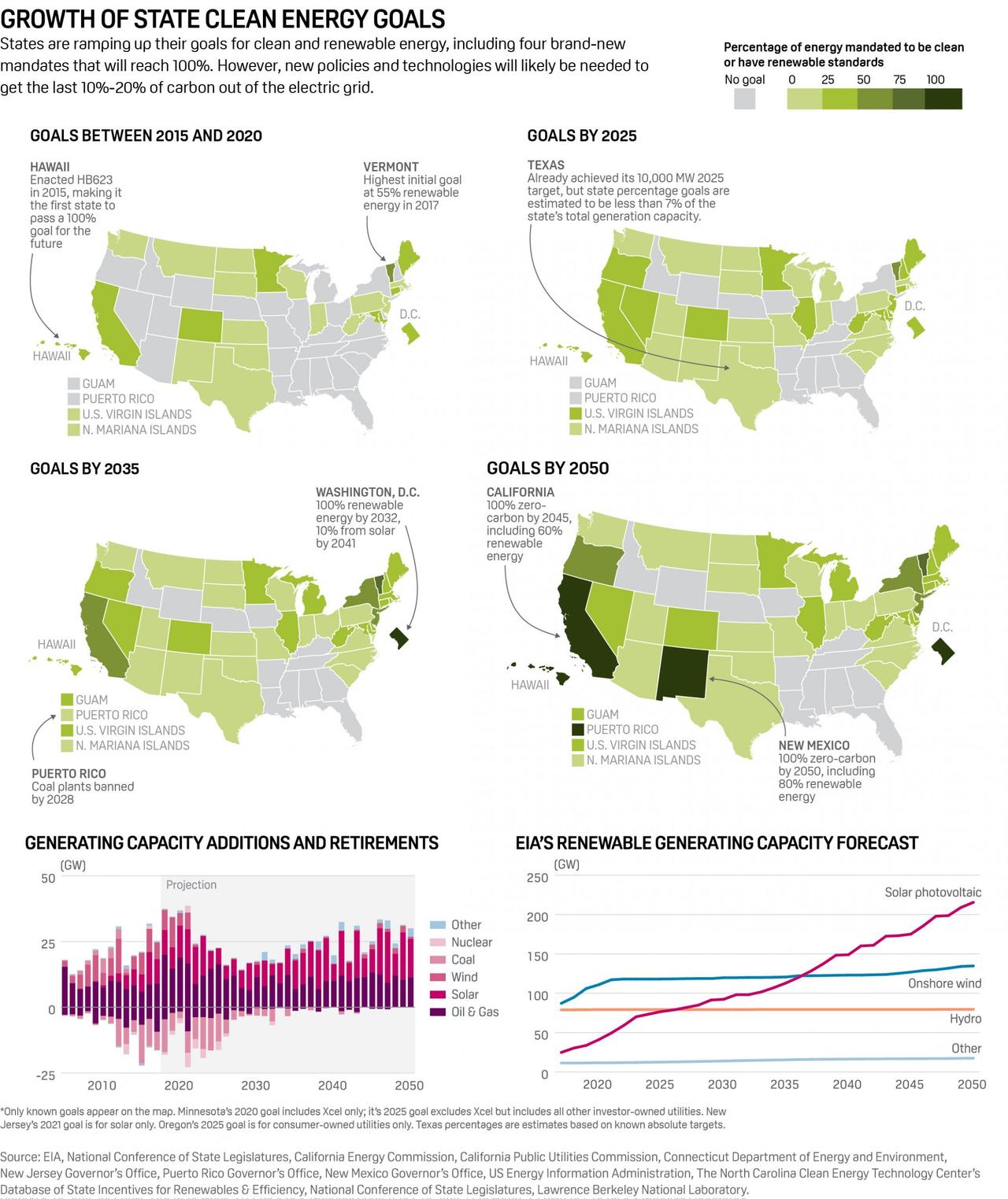

US states ramp up clean energy goals

President Trump may have disengaged from global efforts to tackle climate change, but individual US states are still pushing ahead with ambitious targets to ramp up renewables.

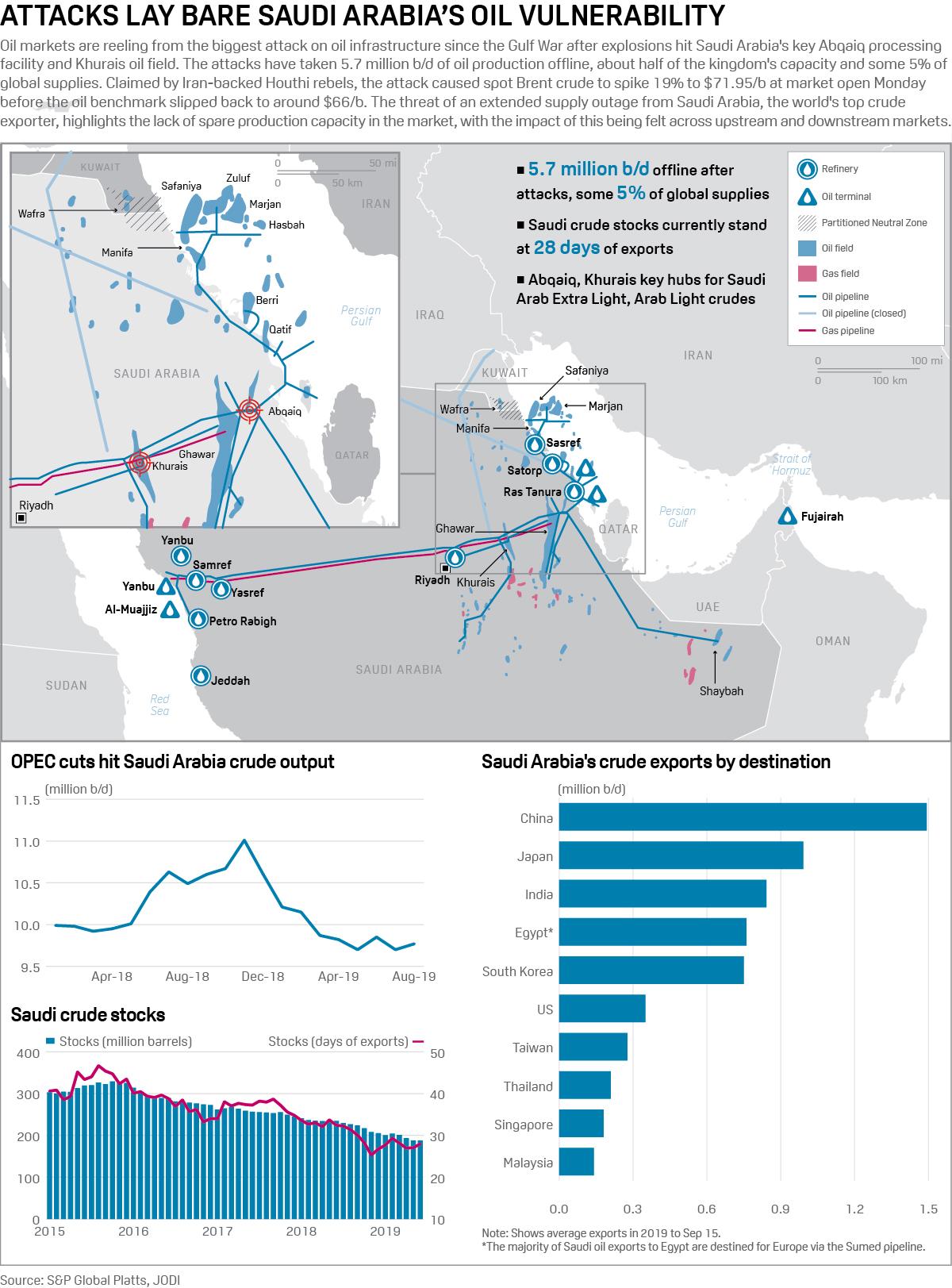

Middle East oil supply vulnerability

The succession of attacks on Middle Eastern oil infrastructure had a short-lived effect on crude oil prices, but was a reminder of how exposed a large portion of the world's supply really is.

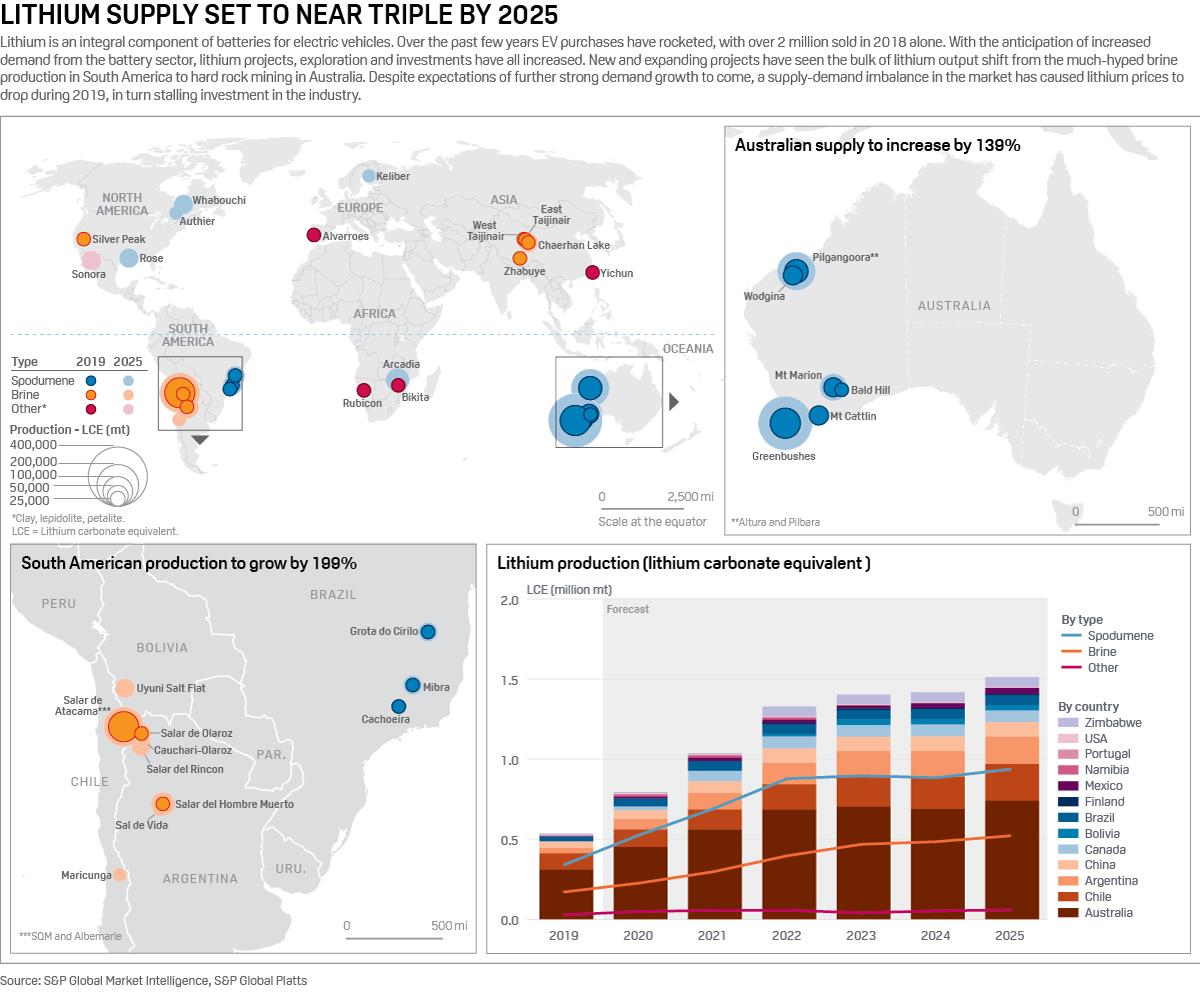

Lithium supply in the age of EVs

Amid tumbling prices, can lithium supply keep up with demand going into the next decade? S&P Global Platts looked at global production hotspots and market fundamentals.

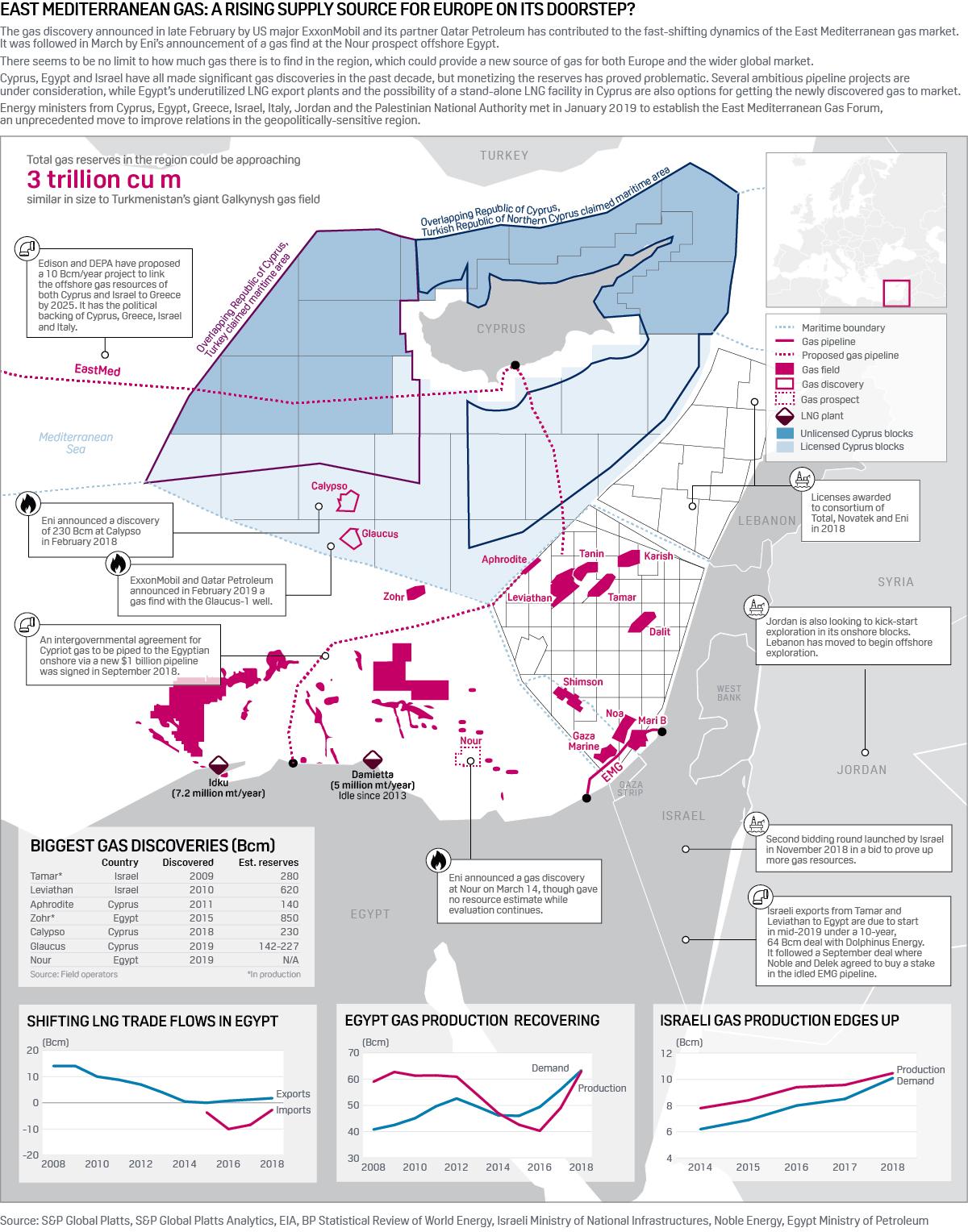

East Med a burgeoning gas supply hub

New discoveries this year elevated the East Mediterranean's position as a gas supplier. Egypt has begun exporting LNG again, and hopes also to capitalize on rising Israeli gas production.

Commenti

Posta un commento