Following Europe's disappointing downturn this morning (and UK), US' final Manufacturing PMI print for 2019 was expected to confirm a slight deceleration in the late-year rebound.

However, it was a disappointment, as the final US Manufacturing data dipped from 52.6 in November (and 52.5 in flash December data) to 52.4...

Source: Bloomberg

Chris Williamson, Chief Business Economist at IHS Markit said:

"The US manufacturing sector continued to recover from the soft-patch seen in the summer, ending 2019 with its best quarter since the early months of 2019.

"The overall rate of expansion nevertheless faltered somewhat in December and remains well below that seen this time last year, suggesting producers are starting 2020 on a softer footing than they had enjoyed heading into 2019.

"Business sentiment about the outlook remains especially subdued compared to a year ago, reflecting ongoing worries about geopolitics and trade wars, especially the impact of tariffs, as well as fears that political and economic uncertainty surrounding the 2020 elections could dampen demand.

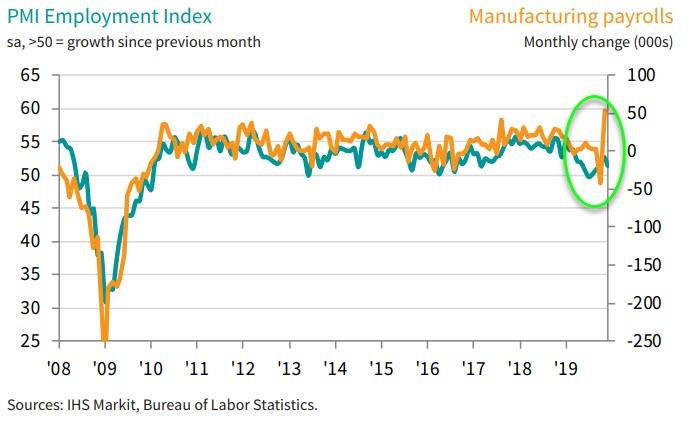

"The impact of tariffs was clearly evident via higher prices, while the relatively subdued level of business confidence manifested itself in a pull-back in hiring, hinting at risk aversion and cost-cutting."

The bottom-line is that despite an increase in client demand and stock markets, output expectation towards the coming year remained relatively muted at the end of 2019.

Commenti

Posta un commento