With an historic 2000 point drop in the Dow Jones Industrials on Monday in response to Saudi Arabia and Russia declaring an oil price war on, well, everyone it's clear that one of the two 'flations, deflation, has won out.

It initiated a reflation trade based on the hope that the Fed just being there was all that was needed to restore confidence in global markets.

In that post I made the point that the choice between inflation and deflation is a non-choice. They are two sides of the same coin. The question is only who benefits from which side.

Those in power always choose inflation because, in their minds, it is less upsetting to the social order than deflation.

And their power rests on maintaining the current social order.

Deflation benefits savers and, frankly, normal people who don't have access to new money at the lowest available prices, those set by the Fed's discount window.

It gives them back power stolen from them through inflation.

The media helps this narrative limp along bamboozling all of us with poorly-conceived first order analysis of why we want inflation while refusing to admit they are a recipients of this government/central bank largess through advertising fees paid with a portion of this fake capital.

They inflate to maintain their power and their illusion of control over the forces of economic law.

But more importantly, they inflate because they can.

And worse than that, they do so by conjuring this new money out of thin air by selling debt against our labor.

It is, frankly, beyond criminal.

Those on the left endlessly crying about evil corporations miss the point that it is government itself which creates this dynamic, spending far beyond its means. Wresting control of the government and sticking it to the man, as the Bernie Bros want to do, isn't the solution.

It's just becoming part of the problem.

They miss the fundamental dynamic of debt-based money. It's a tax against your future labor. We are all debt serfs in a world where the money in your pocket is a liability owed to someone else.

That's not community. That's usury. And the great game of our global financial system is that those who are closest to power borrow at the best rates, sell that money to us at a markup while the government spends it without limit.

This crowds us out of the market for goods and services, further driving up costs to the productive portion of the economy, us. In effect it's a form of double taxation that's applied before they then collect taxes at every stage of production.

And in the off chance we actually turn a profit on any of this, they punitively tax that income as well.

But, hey, didn't you know, you can now borrow for a new mortgage at the lowest rates in history. You can buy a new car, a depreciating asset, for longer term than the life of the car.

You can have it all and have it now. Debt is patriotic. It boosts GDP!

Saving is bad. It causes recessions. I know this because some very smart misread John Maynard Keynes, c.f. The Paradox of Thrift.

In short this system is designed to give to government and its consiglieres the outrageous advantage of spending tomorrow's money at yesterday's prices for today's goods.

And punishing us in every way for daring to save even a penny of our meager earnings. So hostile have they become to savers that they have instituted negative interest rates to further push up the velocity of money hoping to whip up some of that old time inflation to keep the value of their assets from falling.

In a real economy, savings forms the basis for the pool of investible capital. That savings is deployed at a market rate of interest based on the risks associated with that investment.

Mucking with interest rates distorts the use of available capital. It is capital destructive in the end, as eventually the amount of debt issued supporting the economic activity is greater than the profit generated by that activity.

That creates the bust and in the words of the late Neil Peart, "all those wasted years."

Because it is time that is stolen from us with this terrible system. And our time is the only truly scarce resource in the world since none of us get out of here alive.

Ultimately this inflation game is a Ponzi scheme. The amount of money going to pay off the debt eventually becomes greater than the next round of debt you can sell to the greater fool.

And no amount of money printing can fill the void when the entire edifice begins to collapse.

That's what's happening today. There is no fixing the plumbing of the global financial system at the repo window. Nor can lower interest rates help stimulate demand no matter what President Trump thinks.

So he can berate the Fed all he likes, rates want to go higher because the demand for dollars is acute and the market is willing to pay a far higher rate than 1.0% to get them.

All that can happen now is assets deflate and into that vortex of deflation they'll pour endless amounts of new money in the vain hope of filling up the void.

What happened this week occurs when one who has saved, Russia, decided that it no longer wanted to subsidize those who have borrowed to the hilt. When Russia said, "No!" on Friday to cutting production to support asset prices based on $60 per barrel oil, they were saying that's enough.

I like to think of global trade in real goods as the M0, or base money, of the global financial system and the oil trade that which is the M0 of that.

All of the credit, government debt, corporate debt, stocks prices and the rest are simply credit derivatives in a fractional reserve banking system of that fundamental trade in goods and services.

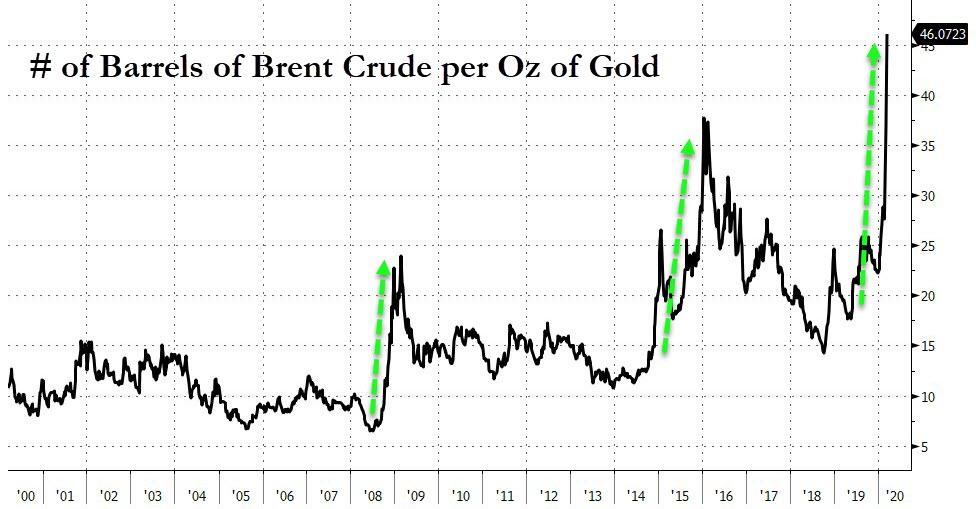

And the value of the monetary base for global trade was just halved in the last six weeks with the price of oil crashing from $70 per barrel (Brent) to around $35.

We all know what happens with the Fed raises rates and contracts its balance sheet. We get deflation.

So why should we be surprised that Russia prompted a reset of all valuations when they are the ones whose political power is degraded by a world leveraged up on an oil price that is too high?

The outrageous benefit of this debt-based Ponzi scheme run by the West has morphed into a the ultimate punishment tool for those who stand against it.

This move will force trillions in debt to be liquidated. Prices will adjust down. Debtor economies which are in desperate need of U.S. dollars, just had their energy costs cut in half, making it far easier for real people to get to work, buy food, pay off debt and build a life for themselves.

Those who have saved in real assets, like gold, just saw their wealth double in real terms over the past few days.

All Russia had to do was look Saudi Prince Mohammed bin Salman in the eye and say no. Bin Salman took the bait and cut off what's left of his kingdom to spite Putin's face.

Both countries feel comfortable for now with $30 per barrel oil. All the debt the U.S. has issued to enslave the world supporting your assets at higher prices now have to be repriced.

Russia, as a net saver, chose deflation as the way forward. As I said on Friday, this is the moment they have been preparing for for years.

The number of dollars you have is irrelevant. It is only what you can buy with that money that gives that money power.

Deflation is the transfer of wealth back from debtors to savers through the increase in purchasing power of your money and the liquidation of over-priced assets by desperate debtors trying to remain solvent.

The cries and howls you hear today are from debtors. Savers smiled. Gold held its water. Russia's balance sheet held firm thanks to years of buying it on sale and storing it away for the right moment.

This is why Russia is saying they can weather $25 per barrel oil longer than anyone else. Because they can.

Will it be easy? No. Do they want to? No. Will they if they have to? Yes.

And if the West does what it is likely to do, print to inflate away the debt coupled with massive stimulus spending, which is what I'm expecting from both Christine Lagarde at the ECB and Donald Trump in the U.S. then Russia's clean balance sheet and its prodigious gold reserves will insulate them from the chaos while asset prices deflate.

And that's the lesson to all of us. It's time for savers to stand up for themselves. It's time for a little pain to be felt by those who have inflicted it without end for so long. Deflation is hard but at this point it is hardest on those who have lent the most.

They are the ones screaming for relief today. They are the ones bellying up to the repo window in record numbers. And they will be the ones who will have to sue for peace in the end.

I keep reminding you that when you owe the bank a thousand dollars it's your problem. When you owe the bank a few billion, it's the bank's problem.

And today the banks' problems are multiplying like mushrooms in cow shit after a good rain.

Commenti

Posta un commento