... stocks crashed, sparking a reflexive market panic because as BMO explained, "the biggest risk was always that by acting too proactively and aggressively Powell would signal that the situation is worse than initially feared. Check." And indeed, following the the rate cut, volatility exploded in the subsequent days as traders panicked from one market extreme to the other, with the VIX eventually blowing out above 54 on Friday, its highest print since the Lehman failure (as a Chicago market-maker reportedly blew up).

Amid this series of volatile moves, the S&P 500 tumbled 12% from its all-time high of 3,386 hit less than three weeks ago on February 19, and 4% since the Fed delivered its cut.

Initially, US stocks fell by 13% over the span of just 7 trading sessions, the fastest 10% correction in the Dow Jones index since a few weeks before the Great Depression started.

From the market peak, the decline in equity prices has lowered the P/E multiple from 19.4x to 17.0x while 10-year US Treasury yields have fallen by 80 bp to the lowest level in history (0.77%). Put together, Goldman notes that the yield gap (S&P 500 earnings yield less 10-year US Treasury yield) has widened to 510 bp, the widest since 2013 and considerably wider than the long-term average of 230 bp.

And speaking of Goldman, the bank's equity strategist David Kostin writes that - as one would expect - all its clients care about is the coronavirus correction. To allay their fears, the perpetually cheerful Kostin writes that his baseline assumption "is the COVID-19 virus becomes widespread but is relatively short-lived. We forecast flat earnings in 2020 followed by 6% growth in 2021. We estimate the yield gap will narrow to 395 bp by year-end as economic activity and confidence rebound, leading S&P 500 P/E to recover to 19.4x and the index to reach 3400, 14% above the current level."

That's the optimistic case.

In the not so optimistic one, Kostin admits that "the US economy could slip into a recession if the coronavirus contagion lasts for an extended period of time"; as a reminder, just yesterday it was nooted that a global recession is now Bank of America's baseline assumption. In such a situation, Goldman estimates S&P 500 EPS would fall by 13% to $143 in 2020 and the index would decline to 2450 by year-end.

Extending Kostin's observations, he notes that under the surface of the S&P 500 volatile decline, "sector performance has been well-ordered" and since the S&P 500 peak, "realized sector performance has generally been in line with the return implied by each sector's beta to S&P 500 (Exhibit 2)." Sectors with the most notable deviation from this trend have been Energy (-15% vs. -9% implied), which has been driven by the 23% decline in Brent crude oil prices to $46/bbl, and Financials (-11% vs. -8% implied), which has underperformed sharply given the large decline in interest rates.

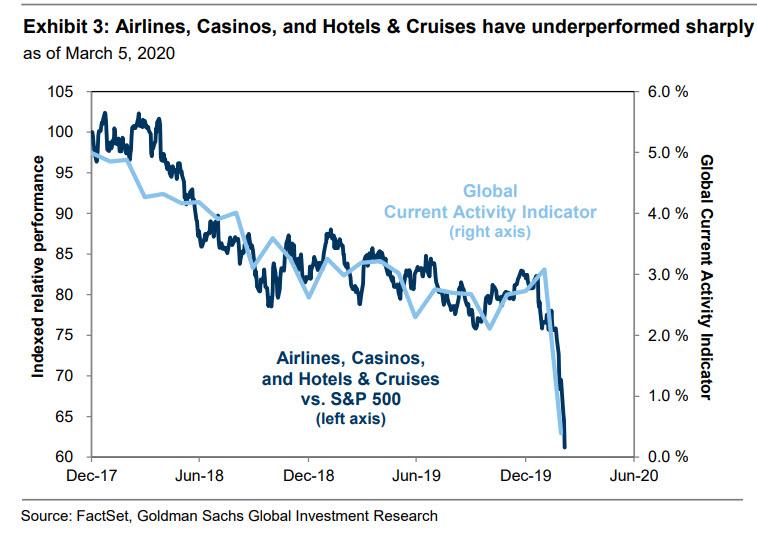

Looking at distinct industries, travel stocks have been among the most heavily monkey-hammered as virus concerns have intensified. Airlines, Casinos, Hotels, and Cruises have underperformed S&P 500 by 19 pp since February 19 (Exhibit 3). United Airlines announced that it would be cutting flights in April due to weaker demand amid coronavirus concerns. News broke on Thursday that authorities are holding another Princess cruise ship off the coast of California after a passenger died from the coronavirus and hotels have warned that occupancy rates are likely to dip amidst increasing travel restrictions

Meanwhile, as we warned almost a month ago, semiconductor stocks have also come under pressure due to the industry's outsized exposure to China. Semiconductors derives 85% of revenues from international sources, the highest of any S&P 500 industry group. 47% of sales come explicitly from Greater China. Despite a recent spate of negative guidance, the median semiconductors firm has experienced a 1-month 2020E EPS revision of just -0.2%. Goldman also cautions that while most companies have slashed 1Q guidance, they have not yet addressed the longer-term or full-year outlook.

Finally, looking at single-names, a number of companies we which Goldman had previously screened as secular growth stocks have also been hard-hit by virus concerns. While coronavirus may reduce the near-term earnings of some of these firms, certain companies have declined by more than 20%. Some of these secular growth companies trade at valuations below the 20th percentile relative to the past 5 years. In contrast, 19 S&P 500 stocks have actually generated a positive absolute return since the market's recent peak. Regeneron Pharmaceuticals, which expects to have a vaccine ready for human trials by August, is the bestperforming stock and has risen by 23% during the past week. Gilead Sciences (GILD, +19%), Newmont Corp. (NEM, +13%), Kroger Co. (KR, +8%), and Campbell Soup (CPB, +8%) round out the top five stocks

It's not just the coronavirus that is behind the market's violent moves: also this week, Joe Biden celebrated a number of big

wins on Super Tuesday, increasing his prediction market-implied probability of winning the Democratic primary to 83% from as low as 7% in early February.

Biden currently leads with 664 pledged delegates compared to Senator Bernie Sanders' 573 delegates. Candidates will need to amass 1991 delegates to win the nomination on the first ballot.

Managed Care stocks have outperformed sharply this week as the odds of a progressive candidate winning the Democratic nomination have fallen. During the last several months, Managed Care stocks have demonstrated the strongest sensitivity among US equity industries to the Democratic primary race. These stocks outperformed by 6% on Wednesday after Joe Biden's Super Tuesday win dramatically decreased the perceived likelihood of major health care policy reform.

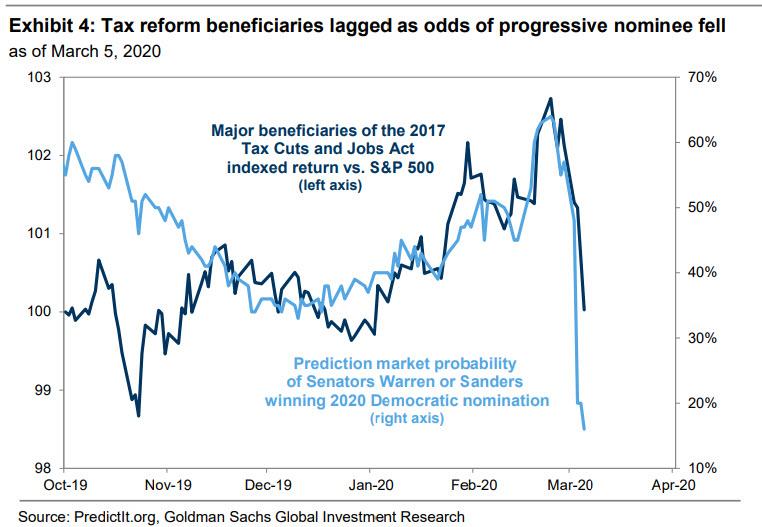

On the other hand, the recent performance of stocks with high tax rates appears to reflect the increasing likelihood that Democrats could control both the White House and Senate after November. Following Super Tuesday, the prediction market odds of a Democratic president have risen to the highest level since early February (49%) and the odds of Democratic control of the Senate have risen to the highest level in more than a year (41%). As Goldman previously noted, prospective changes to tax policy would likely be similar regardless of which Democratic candidate won the White House. Exhibit 5 shows a list of 40 S&P 500 stocks that experienced a large boost to earnings from the Tax and Jobs Act of 2017 and outperformed their beta-implied returns in the months following the law's passage. These stocks have lagged the S&P 500 by 130 bp since Super Tuesday.

Commenti

Posta un commento