With oil prices cratering by almost a third, the math is simple: junk-bond (and in some cases IG) funded shale producers, which were already cash flow negative when WTI was trading around $50, are about to become cash incineration machines and will almost certainly be forced to default in the coming months - perhaps as soon as the next interest payment, certainly by the next bond maturity which they will no longer be able to rollover as the junk bond market is now frozen - unless oil somehow stages a miraculous recovery from here.

As such, the market was focused on how shale-linked bonds will react to this weekend's oil price shock. Addressing this issue, Goldman sent an email early on Monday in which the bank made the following points for those looking at energy debt:

- Credit markets were having problems before the Saudi announcement, credit down when equities traded higher

- Significant increase in non-credit accounts looking to short the sector last week

- Last week saw record outflow across IG, high yield and loans

- Liquidity issue even more prevalent because of virus related contingency / BCP planning

The bank concludes by noting that "although clients are better positioned than in 2015 (when had a lot of energy issuance to fund shale revolutions); expect continued selling as oil re-prices lower and the virus spreads."

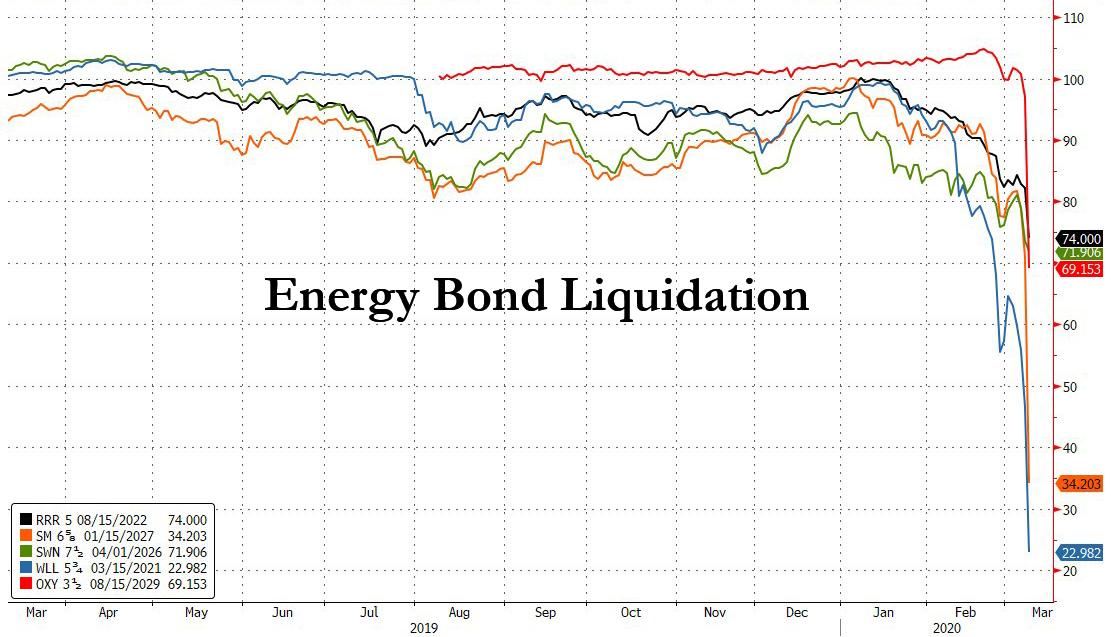

That said, much of the selling appears to have already taken place this morning, with select energy bonds already in freefall as of this morning, including issues from Range Resources, SM Energy, Southerwestern Energy, Whiting Petroleum and Oxy.

Yet despite the sudden repricing of stressed energy bonds lower, one can again note that energy credit was well ahead of the oil market, which has finally caught down to the HY Energy OAS spread.

Expect many more E&P bonds to join the liquidation fray before the day is over.

Commenti

Posta un commento