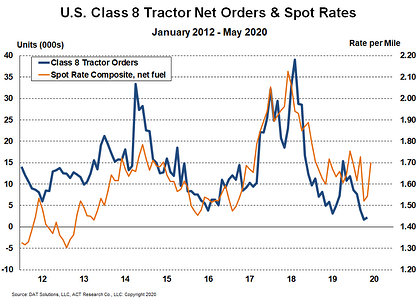

Still struggling with the remnants of an order backlog that started almost two years ago with record orders in August 2018, the industry was unable to find an equilibrium prior to the coronavirus pandemic. Orders were sluggish and we noted numerous trucking companies that closed up shop altogether in 2019.

After a 73% crash in April, Class 8 orders once again plunged 62.5% in May, to their lowest sales levels since 2011. Sales came in at just over 9,000, according to Transport Topics.

Don Ake, vice president of commercial vehicles at FTR, tried to look at the bright side: "It's not a horrible number. It's a fair number under bad conditions. It is going to be a long, slow climb back."

"We went into 2020 with very high inventories," Ake said. YTD sales for Class 8 trucks were 69,379, which is down 37.5% from 2019.

Dan Clark, head of BMO Transportation Finance, says a V-shaped recovery isn't likely: "Given that the industry is still wrestling with the hangover of a near-record two-year stretch of heavy-duty truck sales, which is now compounded by lower than previously expected economic activity for the next year or two, we aren't expecting to see a V-shaped recovery in Class 8 sales."

He believes that orders will remain "choppy" during the second half of 2020, especially heading into the election.

Steve Tam of ACT Research took a longer term view: "These trucking companies have to assume I'm here today, I will be here tomorrow and so will my business. A lot of what we are dealing with now is just noise. It's another cycle in the industry, although a very different cycle, with a very different catalyst. But a cycle nonetheless. So in some ways they have to look past the short term to what the more strategic picture is. So they have to continue to invest in the business if they want it to continue, and, hopefully, grow as well. So they are taking the long view."

As for individual company performance, Transport Topics reported:

- Volvo Trucks North America earned an 11.8% share with 1,084 sales, or 60.2% fewer compared with a year earlier.

- Mack Trucks posted a 9.6% share on 879 sales, or 51.5% fewer compared with a year earlier.

- Kenworth Truck Co. earned the second-highest share, 13.9%, with 1,277 sales, or 65% fewer compared with a year earlier.

- Peterbilt Motors Co. notched a 12.2% share with 1,119 sales, or 71% fewer, the biggest decline, compared with the 2019 period.

Recall, April's numbers were the lowest since FTR began tracking orders in 1996.

Many companies canceled or delayed new orders as demand, measured by the ratio of loads to trucks, fell 66% in April.

TFI's Chief Executive Alain Bédard said in an April 22 call: "Everything has been canceled."

Commenti

Posta un commento