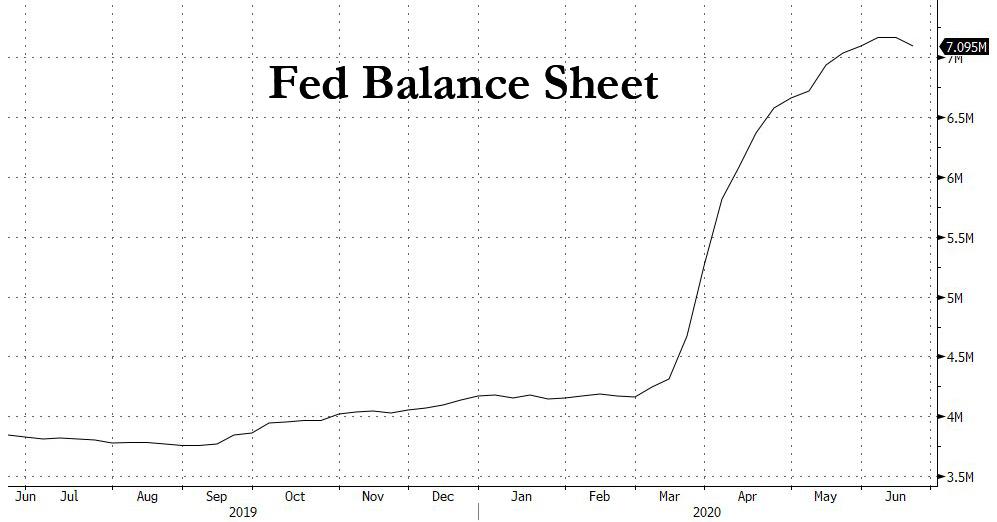

This was not only the first shrinkage in the Fed's balance sheet since the week ended February 26, but also the biggest drop since May of 2009.

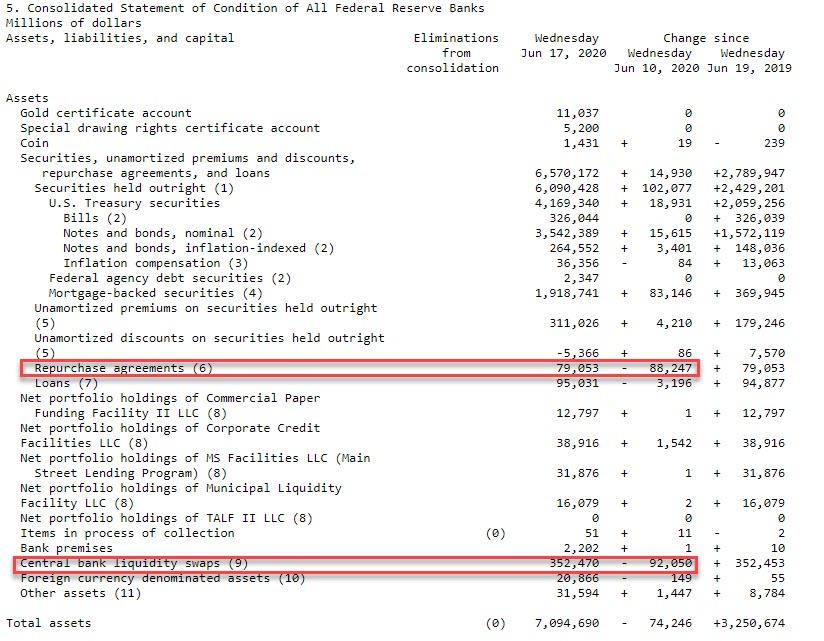

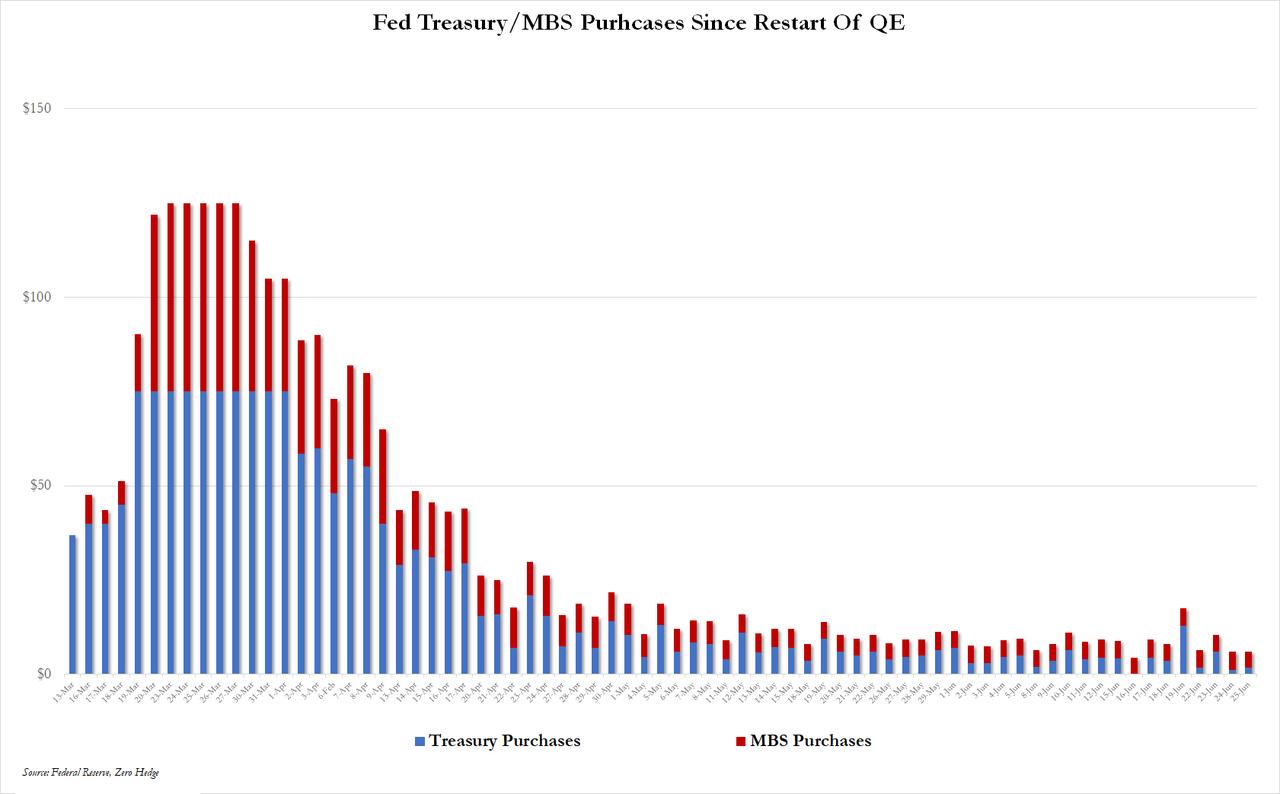

The drop, however, was not due to a reversal or even slowdown in QE which continues almost every single day, with the Fed adding over $100 billion in Treasurys and MBS, but due to an $88 billion decline in outstanding repos to $79 billion for the week ended Jun 17, 2020, as well as a $92 billion decline in liquidity swaps to $352 billion.

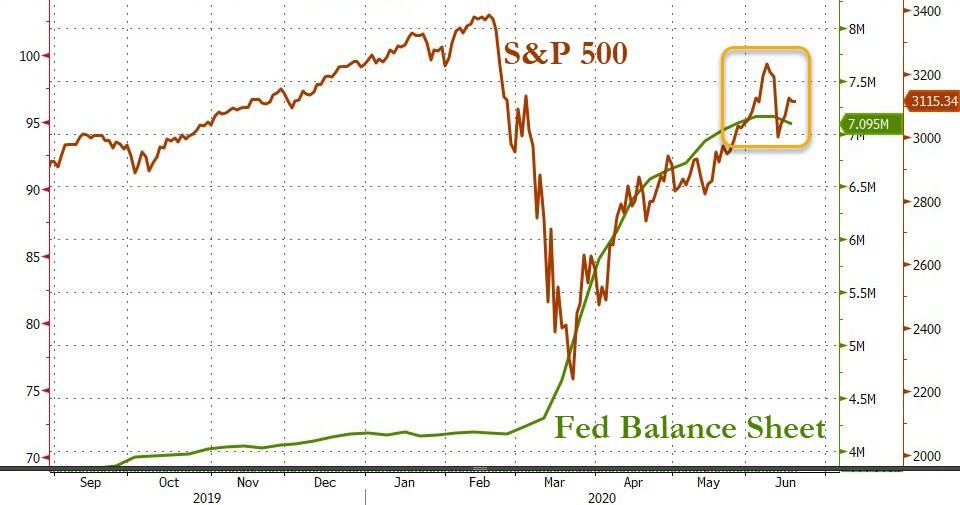

With the S&P500 closely tracking the Fed's balance sheet in the past three months, which has served as the primary factor behind the rebound in the market, the latest weekly drop coincides with the period of heightened volatility in the past two weeks.

The shrinkage comes at a time when the Fed's monthly liquidity injection has been tapered to approximately $120 billion, which suggests that while the balance sheet is likely to resume growing in the next week, it will be at a more gradual pace.

It also means that for the stock market to surge from this point on, Powell will need to find another justification to expand the Fed's QE aggressively.

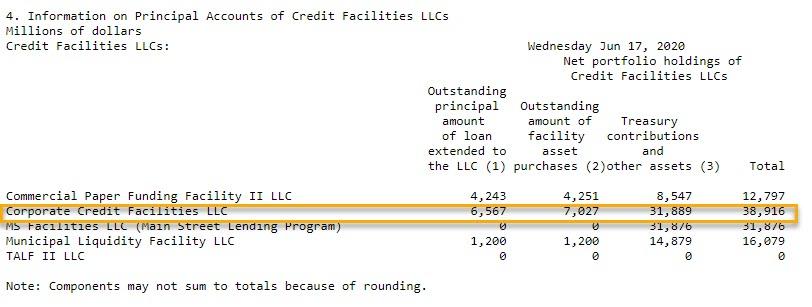

Finally, those keeping track of how much corporate bonds the Fed has bought, the latest total for the Fed's Corporate Credit Facilities LLC which includes purchases of both ETFs and corporate bonds, the Fed disclosed that as of June 17, there was $6.6 billion in book value of holdings (the Fed does not break out how many actual bonds it has bought vs ETFs).

Having started corporate bond ETF purchases on May 12, this means that the Fed has bought on average roughly $1.1 billion per week, a pace which has been more than sufficient to result in record fund inflows into various investment grade and junk bond ETFs.

Commenti

Posta un commento