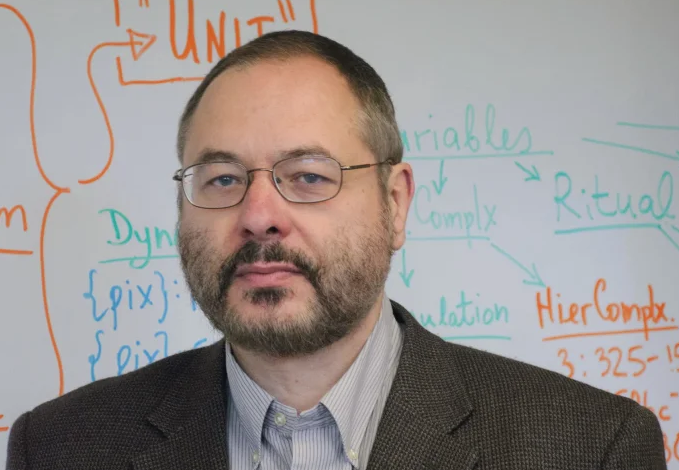

Turchin teaches cultural evolution at the University of Connecticut and, in 2010, predicted in the scholarly journal Nature that America would "suffer a period of major social upheaval" starting around the year 2020.

"They had no reason to believe I wasn't crazy," back in 2010, he told Time. "People did not understand that I was making scientific predictions, not prophecies."

And from the current vantage point, he looks to be exactly right. 2020 started with a global pandemic and has torpedoed into further chaos with the killing of George Floyd and the ensuing riots and protests.

Turchin isn't especially excited about being right: "As a scientist, I feel vindicated. But on the other hand, I am an American and have to live through these hard times."

Turchin has spent decades studying crises in America and the structural defects that helped created them. He said there were "many signs" that there would be upheaval starting in this decade.

Citing stretches of turmoil that occur about every 50 years, he looked at data that analyzed peaceful and violent anti-government demonstrations involving at least 100 people over the 230 years preceding 2010.

And to no Zero Hedge reader's surprise, he looked at "declining wages, wealth inequality and exploding national debt" as social pressures that affected national stability. His model showed that the U.S. would reach a "boiling point" in 2020.

Recall, money manager and Central Bank critic Bill Fleckenstein commented on a recent podcast that the Fed's actions over the last several decades also helped contribute to this boiling point.

Turchin says that worse conditions could be on their way, as societal crises often last 5 to 15 years. He believes that the underlying roots of the unrest need to be addressed to prevent situations like those playing out in South Africa, where protests about inequality have been taking place for 26 years.

"President Donald Trump's administration has denied that systemic racism exists in the U.S. law enforcement system, which could delay change longer," Turchin says.

With the coronavirus still worsening the wellbeing of the country and millions out of work, he now believes that the unrest "may escalate all the way to a civil war."

"Things are not as bad as they can be," Turchin concluded.

Commenti

Posta un commento