In Latest Liquidity Flood; ECB Hands Out A Record €1.3 Trillion In Negative Yielding TLTRO-III Loans

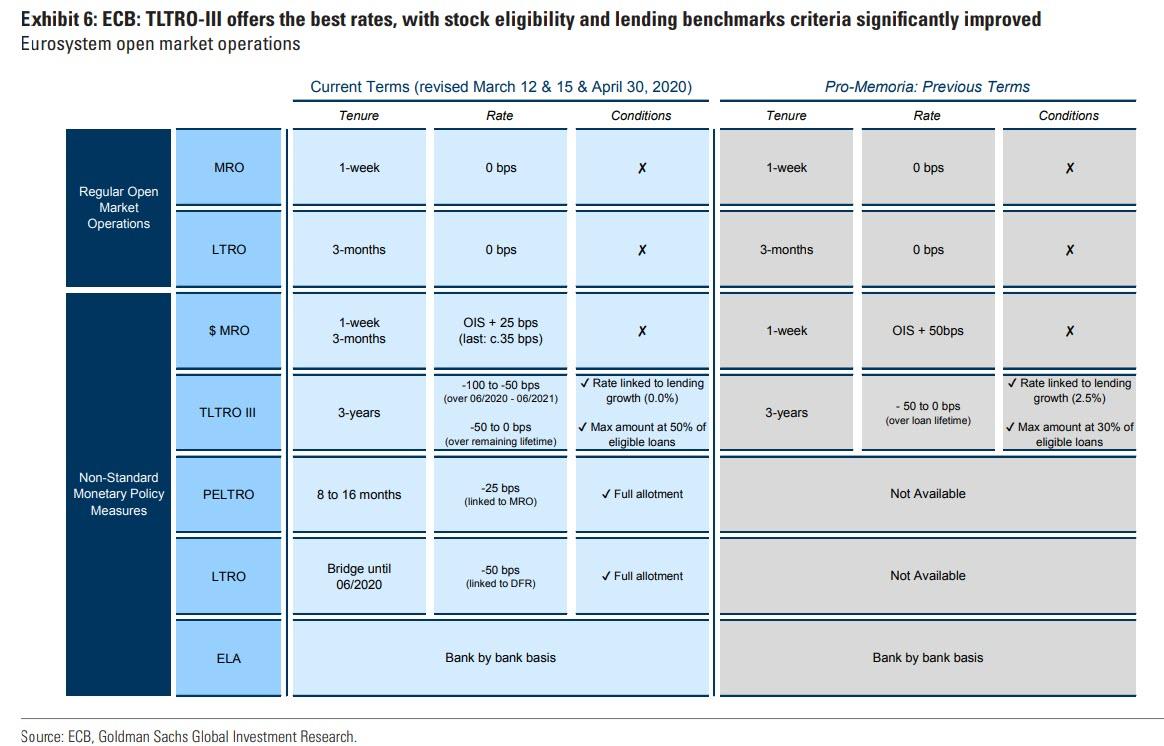

Furthermore, as Goldman notes, it is also apparent that the generous financial terms of this facility (-1% for Year 1, -0.5% for Years 2-3), with fixed rate/full allotment, more than offseting any associated stigma. All in, this auction was important from the perspective of overall financial stability, and, on the margin, supportive of bank revenue. The next auction, on the same terms, is on September 24, with subsequent auctions running quarterly until March 2021.

As a reminder, the main benefit to bond markets is the TLTRO "carry trade", where banks are expected to use the cheap ECB loans - which pay the borrower to take out a loan - to buy higher yielding assets such as short-dated Italian government bonds.

German 10-year government bond yields were unchanged at -0.42%. Italian 10-year yields were also unchanged at 1.37%.

Courtesy of Goldman, here are the four key takeaways from today's TLTRO:

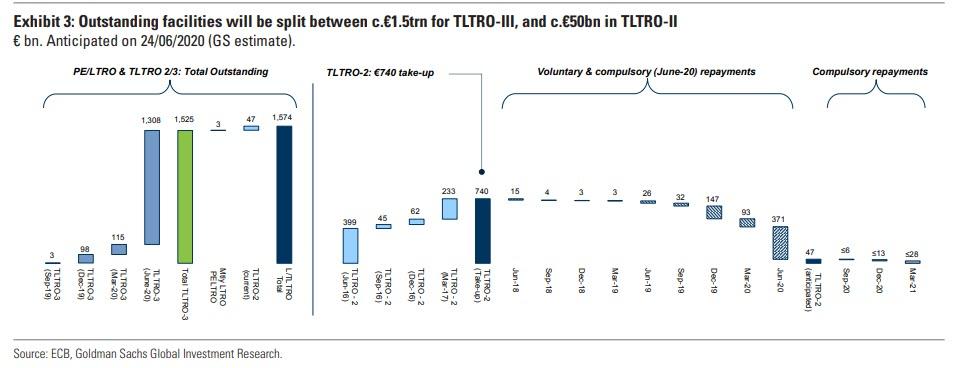

1. Volume is very high at >€1.3 trn. With this take-up, banks are

- replacing c.€760 bn (GSe) of weekly LTRO / TLTRO-II and

- adding some €550 bn of net liquidity.

The replacement of existing facilities consists of two main parts:

- the weekly LTRO, designed in March as a bridge between emergency liquidity measures and today's auction; our expectation therefore was that the entirety of this legacy facility would be rolled into today's auction;

- and the portion of TLTRO-2 maturing later this month (June 24).

Given improved terms (-1% for YR1 until June 2021, and -0.5% for YR2-3 if lending benchmarks criteria are met) starting with this auction, banks were expected to repay some outstanding TLTRO-II early to refinance at cheaper rates. Taken together, this still leaves some €550bn of net new take-up.

2. Usage is broad = stigma is not there. 742 banks participated in the auction, which indicates very broad participation. This is a clear indication that the generous terms of the facility offset any associated stigma.

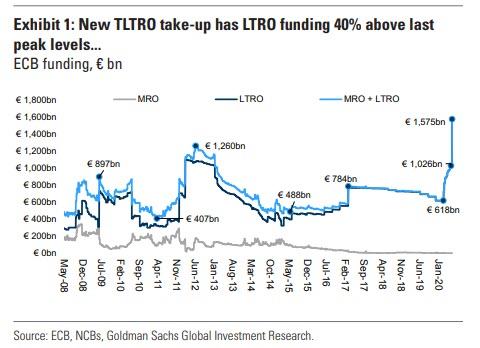

3. Usage now at all-time high. During the 2008/9 crisis, the ECB funding facility usage peaked at just under €900 bn. The period of European sovereign crisis saw the introduction of TLTROs, and usage increased to €1.26 trn. With today's auction, usage has risen to €1.57 trn, the highest on record.

4. Further capacity exists. On current collateral terms, this facility could be scaled up further over the coming auctions

Commenti

Posta un commento