Seven top economies plus several major emerging markets economies "face the heaviest bond maturities in at least a decade, much of the borrowings to dig their economies out of the worst slump since the Great Depression," according to Bloomberg, adding that these governments will need to roll over at least half of this debt in 2020.

Gregory Perdon, co-chief investment officer at Arbuthnot Latham, said, "government debt ratios have exploded, but I believe that the short-term worrying over a rising debt is fruitless."

Perdon said, "debt is leverage and assuming it's not abused, it's one of the most successful tools for growing wealth."

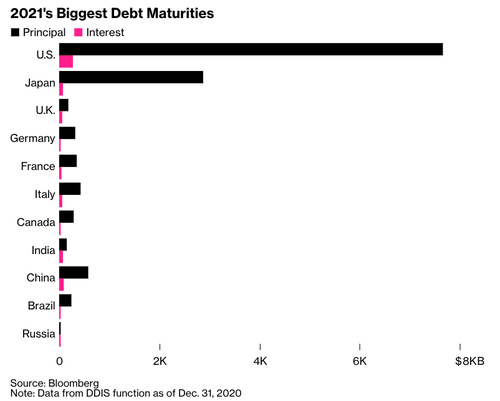

The largest government debt refinancing will be in the US, with $7.7 trillion of debt coming due, followed by Japan with $2.9 trillion. China has $577 billion coming due, Italy has $433 billion, followed by France's $348 billion. Germany has $325 billion.

Source: Bloomberg

Source: Bloomberg All of the countries' respective central banks will need to hold interest rates as low as possible for debt refinancing. No country - whatsoever - can afford to pay higher interest on debt in these challenging times.

"The practical reality is that debt levels and rates are linked, because most of the developed world cannot afford higher interest rates," said Steven Major, the global head of fixed-income research at HSBC Holdings Plc.

This brings us to today's big event, the Georgia Senate run-off elections. The outcome of the election, as explained by Bank of America's global economist Aditya Bhave will be a huge deciding factor on the amount of 2021 debt issuance.

"If Republicans win at least one of the two seats, they will retain control of the Senate. In this case, we do not expect major additional fiscal stimulus. But if Democrats are able to win both seats and take control of the Senate, the prospects would improve for another package, including direct aid for state and local governments," Bhave wrote.

The bottom line: With sovereign yields plunging to record lows, it is only reasonable that governments across the world flood the market with as much debt as possible, to roll over 2020 pandemic debt, and also attempt to thwart a double-dip recession. As long as sovereign yields stay low, global debt will soar.

Commenti

Posta un commento