... as well as the highest 5Y5Y fwd swaps and breakevens in years...

... prompting Morgan Stanley to list five reasons why even higher inflation is coming in the next few months, attention has turned to the only key variable that matters: what yield on the 10Y Treasury will be the catalyst that send stocks plunging?

We touched briefly on this point last Wednesday when we said that just a 1% increase in 10Y yields would slash P/E multiples by 18%.

Of course, if this multiple contraction is accompanied by an offsetting increase in corporate profits (which one would expect in a reflating world), all shall be well and stocks would be flat, all else equal. Of course, all else is never equal, and a question that is perhaps even more important than "what rate" will break stocks is how fast we get there. Recall what Morgan Stanley said last week:

While there is still very good potential upside for many of the stocks we like in this new bull market, one should be prepared for an adjustment in valuations lower as interest rates catch up to what other asset markets have been saying for months. If this adjustment is gradual, then stocks and other assets will likely go sideways for a while until earnings eventually take them higher.

However, should that adjustment in rates occur more rapidly, all stock prices will adjust lower, perhaps sharply, rather than just go sideways.

We suspect such an adjustment is more likely than most if we are right about growth and inflation surprising further on the upside.

Picking up on the critical topic of rising yields as a catalyst for a stock crash, is - who else - SocGen's resident permabear Albert Edwards, who last week echoed the latest J. Grantham note, underscoring the key line namely that "This bubble will burst in due time no matter how hard the Fed tries to support it."

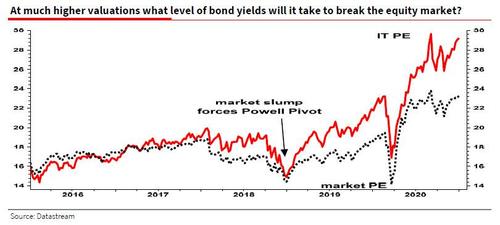

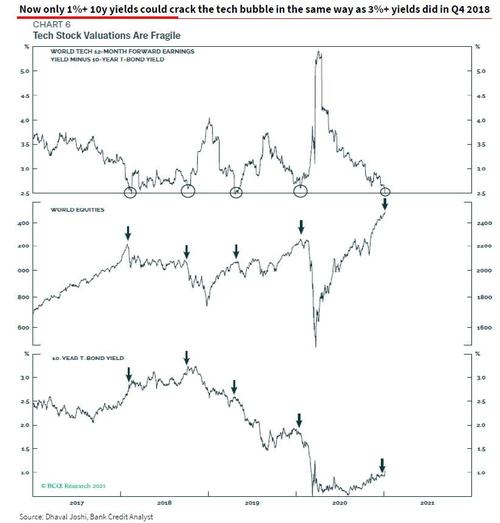

While that may be right ultimately, the more immediate question is the one under consideration, namely "At much higher valuations what level of bond yields will it take to break the equity market?", which Edwards has represented in the following chart, which he prefaces as follows:

We all understood in 2018 (and we still know now) just how dependent this equity bull market is on low bond yields, especially in recent years with the 'Growth' and FAANG stocks leading the market higher. But back then, with the S&P just shy of 3000 and much more moderate multiples than today (see chart below) it took a rise in 10y bond yields above 3% to 'break' the bull run. Now with the US tech sector on a forward PE close to 30x (vs 20x back in Q4 2018, see chart below), it will clearly take a lot less to break the equity market and trigger the bursting of this bubble.

While there is little argument there, Edwards proceeds to the heart of the matter: "what is that 'danger level' of bond yields?"

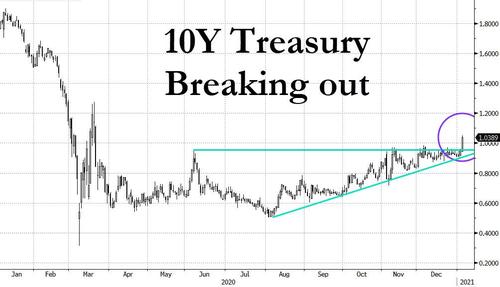

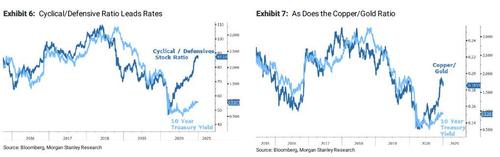

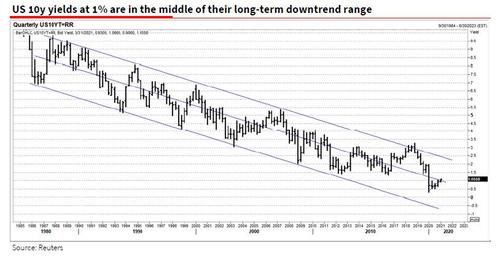

To be sure, while yields may be still in their long-term downtrend (as Edwards shows in the next chart below), "they have broken out oftheir recent trading range" as we showed in the first chart up top, "and the US 10y has now risen above 1%." The SocGen strategist then reminds his readers that due to an optimistic view of the recovery and given the supply issues (discussed below) SocGen's own US rates strategist, Subadra Rajappa, "expects US 10y yields to continue rising to 1.5% this year."

Our US rates strategist writes "The Federal deficit and Treasury issuance are breaking records. With deficits set to exceed $2.4tn in FY21 and $1.3tn in FY22, Federal debt as a percentage of GDP is expected to surpass WWII levels. Since mid-March, the Fed has purchased $2.0tn of Treasuries, reducing the pressure on markets to absorb the additional supply. Nonetheless, the pressure on markets to absorb long-end supply is palpable as auction metrics continue to deteriorate."

While perfectly reasonable and logical, to Edwards all of this is a non-starter because, as he puts it, it's simply impossible: "the equity market will collapse long before we reach 1.5%."

As Edwards frames it, a key part of the market's reflexivity will again be driven by the coming Fed error of tapering which just like in 2013, just like in 2018, was the catalyst the broke the bond market and sent equities spiraling (it's also why the second most important question in the market today after "what rates will burst the stock bubble", is when will the Fed start tapering as we discussed last week):

The bond market's increasing jitters about a tsunami of issuance were not just exacerbated this week by the Democrat success in the Georgia Senate race, but also from comments made by the Atlanta Fed. I must admit when I saw the title "Fed's Bostic says bond-buying 'recalibration' could happen in 2021", I assumed Bostic was talking about stepping up purchases because of the supply issues above. Instead the Reuters article quoted Bostic saying "the Fed could begin to trim its monthly asset purchases this year if the distribution of coronavirus vaccines boosts the economy as expected". Wow! No wonder the long end is selling off. (Article here).

Personally, I have never been so hung up on supply as a deciding factor for bond yields. My experience of following Japan closely in the 1990s and 2000s was that the constant refrain about JGB supply driving yields higher was always wrong. If the fundaments in the way of weak growth and deflation justify low bond yields, then massive supply only affects yields at the margin. In any case I don't believe there is a cat in hell's chance that the Fed can tighten and/or that US 10y yields can rise to 1½%. The equity market bubble will burst long before we get there!

Why? Here Edwards quotes Dhaval Joshi at the Bank Credit Analyst (BCA), who has identified an important tipping point for the ever - inflating tech (FAANG) bubble that has led this equity bull market "to infinity and beyond". Dhaval writes:

"Since early 2018, a rise in the long bond yield has sent shudders through the stock market on four occasions: February 2018, October 2018, April 2019, and January 2020. On all four occasions, the tipping point was the earnings yield premium on tech stocks versus the 10y T-bond yield falling towards its lower limit of 2.5 percent." (see chart below).

Well, with last week's spike in 10y TSY yields above 1%, the danger level 2.5% yield gap Dhaval highlights has now been breached:

As Edwards concludes, already at these much lower bond yields - the 10Y closed Friday at 1.12% - tech valuations are now stretched beyond breaking point, and as a result "the US equity market might crack any time now."

But it won't crack for long because as even the world's most popular permabear echoes what we said last week...

Dear @federalreserve when YCC

— Z.H. January 8, 2021

... namely that "if/when it does, the Fed will increase QE to implement effective yield curve control to pin the 10y below 1%."

And yet, "by then it might be too late if an equity market retreat is in full swing and taking on a momentum all of its own. For as Jeremy Grantham points out, this equity bubble will ultimately burst "no matter how hard the Fed tries to support it". And that is something many simply cannot comprehend."

Or... they comprehend it, but realize that with financial assets to GDP now at a record 650%, the Fed has no choice but to never allow stocks to drop, and if the Fed has to buy not only ETFs but single-name equities in the next crash, well... so be it.

Commenti

Posta un commento