Commodities are booming. A lot of people seem to think this is a sign of pending economic growth. But in his podcast, Peter Schiff said it's really a sign of inflation.

Most of the investment world continues to focus on the stock market and they're not really paying attention to what going on in the commodities markets. And as Peter put it, that's going to have a big impact on what happens in the supermarket.

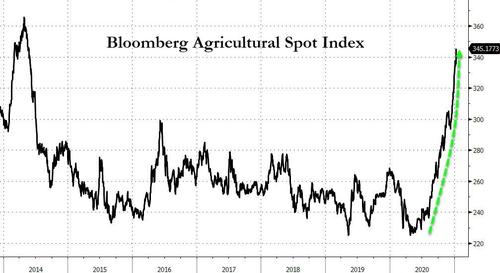

Agricultural commodities, in particular, are on fire. We're seeing five-year highs on many commodities. Corn was up 5% on Wednesday (Jan. 13). Wheat was up 4.73%. Oats and rice were up over 2%.

It's not just agricultural commodities charting big price increases. Industrial metals are also up. Copper was up 2.13% on Wednesday and hit a 5-year high.

What's driving prices for industrial metals, for agricultural commodities, it's not strong economic growth. We're not having record growth. In fact, we still have the pandemic. What's driving commodity prices higher is the record growth in money supply. The Fed is cranking out money like it's going out of style."

In fact, the money supply grew at record levels in 2020. Historically, the growth in the money supply has never been higher with the 1970s being the only period that comes close.

The Federal Reserve is printing money to monetize the record US budget deficits. And it's also expanding the money supply in order to keep interest rates from rising.

While yields on US Treasury bonds remain relatively low, interest rates have spiked significantly from their lows last spring and the trend is clearly up. This stands to reason given the huge numbers of bonds the US Treasury is issuing to fund the borrowing and spending.

Since we have such a historically large amount of debt, we can't handle historically normal interest rates."

Peter pointed out that we could easily see the yield on the 30-year Treasury quickly move from 2% to 4%. That would be a large move, but 4% remains low in historic terms.

It hasn't been until recently that … the government was able to borrow for 30 years at 4%. That is a historically low cost of debt. But again, your cost of borrowing should commensurate with your risk and how much you've already borrowed. So, given the fact that we have so much more debt now than we had in the past, America is a worse credit risk now than it was in the past — not necessarily a risk of default because as long as we have a printing press we don't have to default — the risk is inflation. The risk is that we print a bunch of money because we owe so much debt. We can't raise taxes on the population to cover the debt. So, we have to print money, which is exactly what we're doing, which is why commodity prices are rising. And that's why bond prices are falling. That's why the dollar is falling."

So, why aren't we seeing a big rise in the price of gold and silver? Peter said he thinks it's because investors believe the Fed will ultimately fight inflation and rising interest rates will be bad for precious metals. (Of course, that's not going to happen.) The rising stock market also makes investors less inclined to hedge their portfolios with gold and silver.

But stock portfolios are going up for the same reason that commodity prices are going up. It is inflation."

Peter pointed out that oil is over $53 a barrel.

Oil prices are not going to stop going up. … And again, it is not economic growth that is driving this oil train. It is inflation. It is money supply growth. It is the Fed and other central banks that are debasing fiat currencies. And so you need more currency to buy oil, or to buy copper, or to buy wheat. Any of these commodity prices that are going up — it's a reflection of the value of paper money going down."

Peter said we are heading for an inflationary holocaust.

It's going to be a death spiral of inflation where the more inflation we get the more inflation the Fed is forced to create."

Commenti

Posta un commento