Fast forward to today, when in Morgan Stanley's Sunday Start periodical, the bank's global head of economics, Chetan Ahya, doubles down on this topic and in "Five Reasons why we are inflation bulls" lists all the reasons why not only are 10Y yields set to rise (perhaps violently), but why runaway inflation may be just months away, an assessment which both 5Y5Y fwds and 5Y breakevens, both at 2 year highs, are in agreement with.

Below we excerpt from his full note:

In the spring of 2020, even when the world was clearly entering the deepest recession in a generation, we argued that the recession would be sharper but shorter. We forecast that the global economy would embark on a V-shaped recovery and that the recession had unleashed forces that would alter inflation's dynamics.

The consensus was and remains on a different page. Last year, it underestimated the rebound in growth and overestimated the disinflationary impact of COVID-19. This year, it is underestimating both growth and the upside to inflation. We differ with consensus on how the following five factors will shape the inflation outlook.

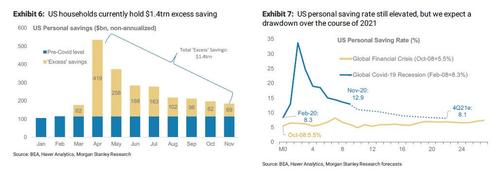

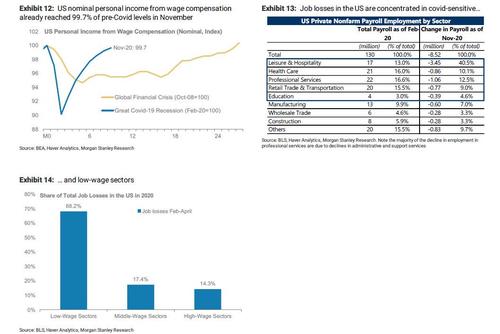

- 1. First, private sector risk appetite has experienced limited scarring: As we have argued at length, the pandemic was an exogenous shock. Policy-makers were unfettered by moral hazard concerns and had little hesitation about underwriting household and corporate income losses to an unprecedented degree. In particular, while unemployment cost US households US$330 billion in wage income, they have already received US$1 trillion in aggregate in transfers, a figure that will rise as the second round of fiscal stimulus kicks in. The excess saving of about US$1.4 trillion will provide the fuel for pent-up demand to drive a sharp rebound in growth once economies fully reopen. We forecast GDP growth of 5.9%Y for the US in 2021, a full 2 percentage points above the consensus. With the Democrats taking control of the Senate, hopes of further fiscal stimulus have risen (we expect an additional US$1 trillion for COVID-19 aid in the near term and further healthcare/infrastructure spending initiatives later in 2021), along with prospects for an even stronger recovery.

- 2. Second, the loss from unemployment overstates the economic loss: Like our growth expectations, our unemployment rate forecasts are more bullish than the consensus. As things stand, about 78% of US job losses have come in COVID-19- sensitive sectors, which will rebound rapidly once the economy fully reopens. Moreover, 68% of the job losses from February-April 2020 are in low-income segments, and one should not overstate the impact on aggregate growth, notwithstanding the need for additional policy support targeting low-income households.

- 3. Third, policy-makers are attempting to run the economy red-hot, with the aim of returning the economy to its pre-COVID-19 unemployment rate. However, accelerated restructuring in the economy will mean that displaced workers will need time for retraining. As this process unfolds, the labor market may tighten even earlier than the headline unemployment rate implies. While this dynamic was also at play following the 2008 recession, the recovery was more gradual, which crucially gave businesses and the labor market ample time to adjust.

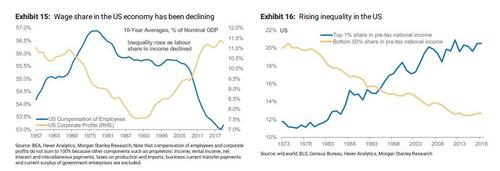

- 4. Fourth, policy-makers are pushing for further transfers to low-income segments, and they are likely to continue reining in the trio of tech, trade and titans in an effort to mitigate the impacts of a lower wage share and higher income inequality. The recession's disproportionate impact on lower-income households has exacerbated the pre-existing issue of inequality, increasing the impetus for policy-makers to act. Further transfers, especially given how they are now in excess of lost income, will impart an inflationary impulse. Disrupting the trio of tech, trade and titans, which have played an important disinflationary role for the past 30 years, will dampen their disinflationary impulse.

- 5. Finally, the Fed is committed to its 2%Y average inflation goal: The consensus believes that it is one thing to target a 2%Y average inflation goal and another to actually get it. But in previous cycles, the Fed had tightened monetary policy well before inflation moved above 2%Y sustainably. This is unlikely to be the case this time, hence any initial rises in inflation will have more time to take hold.

Our chief US economist Ellen Zentner forecasts US core PCE inflation to end 2021 at 2%Y and overshoot 2%Y on a sustained basis from 2022 onwards. The risk to our inflation outlook in the near term is a more severe COVID-19 outbreak, which may constrain activity and inflationary pressures.

Beyond the near term, we see two additional risks:

- First, the inflation overshoot may not be as moderate as we expect. If inflation momentum indicates that it could potentially breach 2.5%Y, we could see a sharp swing in expectations for Fed policy, with attendant financial market volatility.

- Second, if the supply side is more flexible than we think, it may help to keep inflation at bay but risks stoking asset bubbles. In that case, financial stability would outweigh price stability concerns.

Commenti

Posta un commento