Ex-Bridgewater Analyst: Yes, Bitcoin Is A Giant Bubble... But The Global Fiat System Is An Even Bigger Bubble

First, let's not kid ourselves. Bitcoin in its current form is not a viable candidate as a currency replacement. If we measured the US annual inflation in Bitcoin instead of dollars, you'd have seen 275% inflation in 2018, -50% deflation in 2019, -75% deflation in 2020. A healthy society cannot function with that kind of price volatility. The currency must be stable enough that if you get paid on Friday you know what kind of dinner you can buy on Sunday. While it may mature in the future, Bitcoin as it exists is largely a speculative asset.

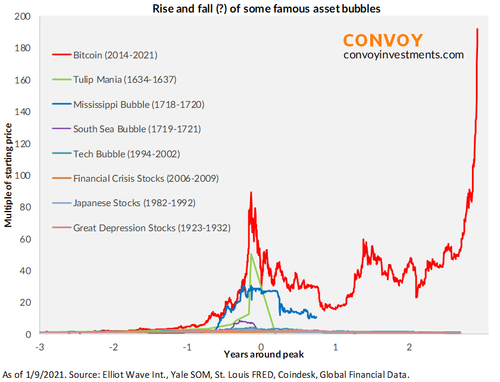

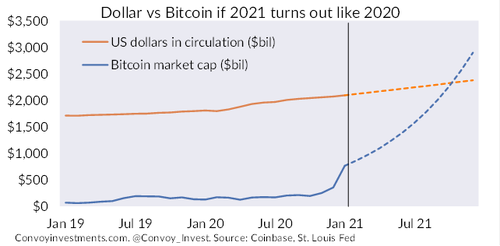

Bitcoin is almost certainly in another bubble and its current growth rate is not sustainable. If 2021 turns out like 2020, the market cap of Bitcoin would be greater than all US currency in circulation.

That said, I'm not as confident in calling the top this time around. The global fiat system is itself in an even bigger bubble. Investors are forced to hold $18 trillion of negative yielding debt while $trillions are being printed all around the world. Investors are drowning and are grabbing onto cryptocurrencies as a lifeline.

While the sustained low yields will increase prices and suppress expected returns across all markets, many investors will choose the unknown expected returns of risky assets over the guaranteed losses in bonds. Like panicked prey chased by predators, investors prefer to hide in markets that either have no fundamental metrics, like Bitcoin, or assets with growth stories that leave ample room to imagination, like Tesla.

In the short-term, there is still a lot of dry powder from stimulus checks and some institutions are also making the leap into the crypto space. So this Bitcoin party could continue as long as rates remain low and the printing press hot.

Bitcoin is the flip side of the same coin as fiat currencies, pun intended. Its long-term fate depends on the future of our fiat system. Since the 1980s, deflationary pressures have suppressed interest rates and ultimately necessitated money printing around the world. As long as this trend continues, investors will run away from guaranteed losses in government bonds. Capital will flee up the risk spectrum, pushing up prices, dropping yields and producing asset bubbles along the way.

As long as the world is flooded with money and safe assets offer poor compensation, Bitcoin will be relevant. Volatility and asset bubbles will be a fact of life. Calling the tops of these bubbles will be difficult because the fiat currency yard stick by which we measure prices is itself in a bubble.

Commenti

Posta un commento