A perfect storm of increased power demand and the calls to reduce carbon emissions has resulted in power rationing across China, according to Bloomberg, citing a new report Friday from 21st Century Business Herald.

Power curbs are being forced onto major factory hubs in more than ten provinces, including Jiangsu, Zhejiang, and Guangdong. Local governments ordered power cuts to meet carbon emission rules, following the country's top economic planner, outlining how an economic rebound in the year's first half resulted in high carbon emissions in nine provinces.

The Business Herald reported soaring coal prices are causing pain for power plants that have reduced power output, creating electricity supply gaps in some provinces. If those gaps are persistent through the winter season, larger power curtailments could be ahead.

Caixin reports in Zhejiang that the government ordered at least 160 energy-intensive companies to suspend operations to reduce carbon emissions. Many of these companies are chemical fiber industries. The halt in operations is expected to last from Sept. 21-30.

Power cuts were also issued across 14 cities in the northern province of Liaoning after the grid suffered supply shortfalls. "Power suppliers will spare no effort to keep providing electricity to residents, hospitals, schools, radio, TV, telecommunications, transportation hubs and other important users," a local grid operator's social media notice read.

AgriCensus reports broadening power cuts also impacted agriculture hubs. Several food plants in Jiangsu and the northern port city of Tianjin that crush soybeans into oils for salad dressings and animal food were affected.

CHINA ENERGY CRUNCH: The electricity shortages in China are worsening, and widening geographically. It's getting so bad Beijing is now asking some food processors (like soybean crushing plants) to shut down | #OATT #China #EnergyCrunch with @cangsizhi More on @TheTerminal

— Javier Blas (@JavierBlas) September 24, 2021

Caixin also reports the government canceled electricity price discounts for aluminum smelters in Yunnan province. Yunnan Aluminum Co. warned last week production would be significantly reduced because of consumption controls.

This all comes as carbon emissions have been soaring in the country this year as it increases the use of coal-fired plants amid the economic rebound.

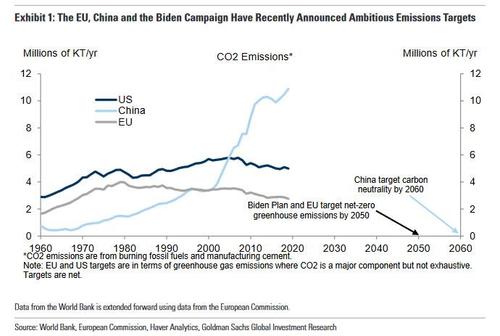

China has pledged to peak carbon emissions by 2030 and to reach full carbon neutrality in 2060. Renewable energy has increased in the country, but coal power is cheap and will remain king and expected to grow. Beijing's latest stunt is likely temporary.

Commenti

Posta un commento