Today we want to bring an excerpt from an award-winning letter:

EXCERPT:

"Our forecasts of the past month are coming true. We are seeing very bearish long-term chart patterns. Re-read some of the last several issues. They are now excellent guides for what to expect ahead."

In July 11th it was written "We have a feeling that the bad news for global stock markets may eventually come from China. We will watch it closely."

Since late June, the FXI (China 25 index) is down 19%.

Then, in our August 2nd issue we said "We have said that China will lead the world stock markets down into the next bear markets. Now it is happening, but no one seems to be worried."

The alleged reason for the latest plunge was the expected failure of Evergrande, a huge and over-leveraged real estate developer in China. It's as good a reason as any, but the plunge was due anyway. There are many over-leveraged China firms in trouble.

We warned in our September 7th issue:

Several huge companies in China are teetering on the edge of demise. Here is one headline on Monday 9-6-2021, "Evergrande Bonds Halted Amid Liquidation Panic As Contagion Spreads To Other Chinese Junk."

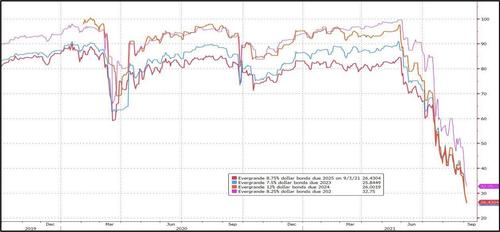

Our warnings this past month about China are now becoming reality. Evergrande is a big real estate developer. It has over $300 billion in debt. Almost $15 billion of that is coming due before year end. It doesn't look as though the government will come to the rescue. Its various bond issues crashed this Monday (9-6-2021) by around 25%.

Such sharp bond plunges usually occur ahead of the demise of the firm. Other real estate developers will be adversely affected because of this as well. Above are the various bond prices of the past several years (courtesy of Zerohedge).

To us, that could be the Black Swan event to trigger the next financial crisis in China, perhaps infecting other world markets.

We don't believe now is a good time to invest in China. Eventually, when the US has crumbled into a Marxist mess, China would become the country with the best economic future. There is plenty of time to invest in that when the time comes.

Experienced short sellers could look at Chinese companies traded on US exchanges. The have the precarious VIE structures, which the China government could take away at any time. The ensuing plunges in those stocks would be breathtaking.

The evidence suggests that the bull market in stocks is concluding. This comes at a euphoric peak in many indicators of the market. Bullish sentiment for stocks has never been higher. That always comes at important tops.

However social mood is turning negative, which is another big driving factor for the markets. Social mood usually leads the investment markets.

The Fed has started to talk about "tapering" but doesn't dare do it as these people recognize that the "house of cards" is threatening to collapse.

With leverage in the markets at an all-time record high, when the selling starts, forced margin selling will overwhelm the "buy the dip" crowd quickly, and they will become sellers as well.

Remember the words of legendary investor Bernard Baruch explaining why he didn't suffer from the Crash of 1929: "I always sell too early." We have urged selling the past month.

The bulls on financial TV already talk about "buying the dip" and how it is a "bargain buying opportunity," among other fairy tales. We disagree and believe the plunge has more room to the downside after a bounce attempt. The S&P 500 hit a 50% retracement of the rise since May. That offers first support. However, that won't end the decline.

We expect a potential 20% decline or slightly less in indices like the S&P 500. Remember, a 20% or more decline is called a "bear market." To prevent that, it will trigger massive support actions from the Fed and the PPT.

Well, if the S&P 500 "dips" that much, many stocks will be down 40%-50%. This decline won't be over until the Robinhood guys, barstools guys, Crypto bulls, NFTs, and buyers of all the scams have been demolished, financially.

Here is today's chart of the very broad NYSE COMPOSITE (two-day). It hit first minor support at the low of the September plunge and bounced. The red line is the 50-day m.a. which could be resistance.

We have also shown the chart of the ETF for the S&P 500, SPY, in our trading services. Here is today's updated chart. The huge down-gap at the opening is now very big resistance on any rally attempt. At the low today, It touched the 50% retracement of the rise since May this year. That too could produce a bounce.

The thin blue line is the A/D line that shows the advancing stocks minus declining stocks. Note that the peak of that line was in June. It has declined since then while the SPY made new highs, signaling, that the majority of stocks are lagging badly. When the "generals" i.e big caps, are abandoned by the majority, it is time to look for the exits. That is called a bearish divergence.

Conclusion: We have said for some time that when the period of "distribution" is this long, which for some sectors started in February, It suggests that the decline will be substantial and enduring. For newcomers, "distribution" is the process where the big, smart money sells to the less experienced investors as a market top is formed, and investors are kept bullish by upward manipulation of some high cap stocks.

Commenti

Posta un commento