Following mixed data in July, today's August print for personal income and spending was expected to show modest gains in both (with income growth slowing and spending growth increasing) and they were right with incomes growing 0.2% MoM (slightly worse than the 0.3% expected) and spending rising 0.8% (slightly better than the 0.7% MoM expected).

Source: Bloomberg

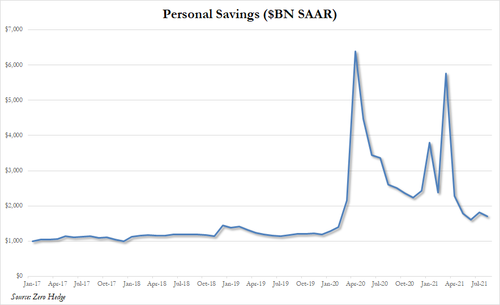

It appears the good days are behind us as stimmies run dry and Americans are once again left to rely on their earning power (or credit cards) to fund their excess spending.

Year-over-year wage growth slowed overall with Private wages up 11.0% Y/Y, down from 11.6%; and Government Wages up 6.6% Y/Y, down from 8.1%...

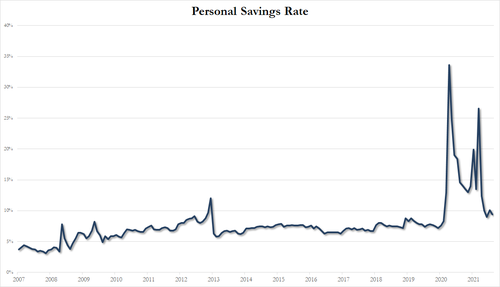

All of that means that the savings rate dipped to 9.4% (from a revised higher 10.1%)...

And all those personal savings from stimmies have gone (down to $1.7TN SAAR from a peak of $6.4TN in April 2020)...

Finally, we note that The Fed's favorite inflation indicator - Core PCE Deflator - rose 3.6% YoY (unchanged from July but hotter than the expected 3.5% YoY)...

Source: Bloomberg

Those are 30 year highs!! Get back to work Mr.Powell!

Commenti

Posta un commento