Global food prices climbed back to near-decade highs in early September, reviving concerns about inflationary pressures. A newly emerging risk that many have missed and could catapult food prices even higher this fall/winter is China's difficult harvest season as power curbs hurt the outlook for production, according to Bloomberg.

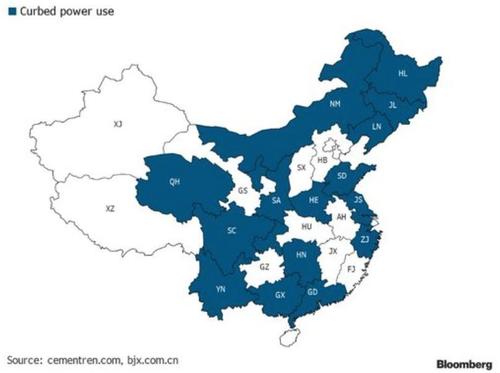

Autumn harvest has begun for the world's second-largest economy amid power constraints in at least 20 Chinese provinces and regions, making up more than 66% of the country's GDP. Some of these regions are industrial hubs that have key manufacturing plants.

Among the worst-hit are industrial hubs in China's northeastern heartland, such as Jilin, Liaoning, and Heilongjiang, where most of the country's corn and soybeans are grown.

"The crisis is stoking concern that China will have a tough time handling crops from corn to soy to peanuts and cotton this year after some plants were asked to suspend or cut output to conserve electricity," Bloomberg said.

Already, the power crunch has forced soybean processors in northern regions to shutter operations. There's a big concern the electricity crunch could slash operating rates of corn processors that make products like starch and syrup, Chinese brokerage Huatai Futures warned.

Futures Daily, a state-backed media, said the power crunch "will affect the supply and prices of agricultural products, which is a matter of importance for the national economy and people's livelihood."

China has been a top importer of agricultural products over the last year due to domestic shortages, helping to drive global food costs higher.

This means that China might have to tap international markets for food supplies as domestic power curbs may reduce production. If China continues to aggressively source from abroad as some top growing areas, such as Brazil and Argentina, have been dealing with extreme weather that damaged crops, this could very well suggest that global food prices may be headed higher.

Commenti

Posta un commento