There's panic-buying of gasoline in the U.K. Natural gas prices in Europe and Asia are skyrocketing. Protests are breaking out across Europe due to spiking electricity bills. India and China are short of coal for utilities. Power is being rationed to factories in multiple Chinese provinces — and winter is coming.

First came the COVID-induced global supply chain crisis for container shipping. Now comes a power crunch across Asia and Europe. Energy commodity stockpiles - just like U.S. retail inventories - did not build back up fast enough to contend with post-lockdown demand.

How could the power crunch affect ocean shipping? For U.S. importers of Asian containerized goods, it's a negative: another crimp in the supply chain. For commodity shipping - dry bulk, liquefied natural gas (LNG) and possibly oil tankers - it's a recipe for higher rates.

Container shipping

According to Bloomberg, power use is now being curbed by tight supply and emissions restrictions in the Chinese provinces of Jiangsu, Zhejiang and Guangdong. Bloomberg quoted Nomura analyst Ting Lu as stating, "The power curbs will ripple through and impact global markets. Very soon the global markets will feel the pinch of a shortage of supply from textiles and toys to machine parts."

Nikkei reported that an affiliate of Foxconn, the world's biggest iPhone assembler and a key supplier of Apple and Tesla, halted production at its facility in Kunshan in Jiangsu Province on Sunday due to lack of electricity supply. Another Apple supplier, Unimicron Technologies, also halted production in Kunshan on Sunday, said Nikkei, citing regulatory filings.

The New York Times reported on power outages in the heart of China's southern manufacturing belt, in Guandong. Factories in the city of Dongguan have not had electricity since last Wednesday. The Times interviewed a general manager of a Dongguan factory that produces leather shoes for the U.S. market who has kept his operation running with a diesel generator and who said that power outages began this summer.

Stoppages of Chinese factories would further delay deliveries of U.S. imports, which have already been waylaid by extreme congestion at ports in Southern California and, more recently, ports in China.

Dry bulk shipping

"Whether it was coal or natural gas or oil, there was very low capital available for companies to continue to reinvest [in production] for several years heading into the pandemic," explained Clarksons Platou Securities analyst Omar Nokta in an interview with American Shipper on Monday.

"We built up a big stockpile in the first few months of the pandemic and we went right through it as soon as lockdowns abated, but capital hasn't been redeployed. There has really been a true lack of investment."

In particular, thermal coal — coal used for power generation — faces steep restrictions in access to capital for environmental reasons.

Thermal coal supplies in China and India have dwindled as post-lockdown electricity consumption has eaten into inventories; India's stockpiles are at a four-year low. China's supplies are further limited by environmental restrictions on domestic mines and a ban on Australian imports. The Newcastle benchmark thermal coal price was up to $205 per ton on Monday.

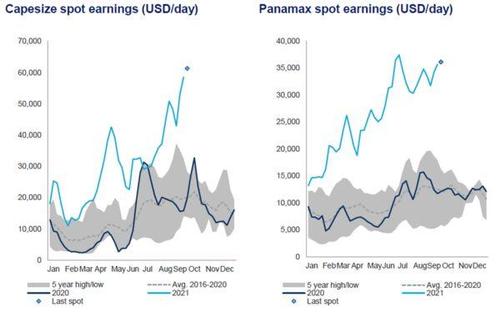

This is good news for dry bulk vessels in the Capesize and Panamax classes, said Nokta. (Capesizes have a capacity of around 180,000 deadweight tons, or DWT, and Panamaxes 65,000-90,000 DWT.)

Capesizes spot rose to $69,000 per day on Tuesday, with Panamax spot rates rising to $36,200 per day, according to Clarksons.

"People expected some bounce back in demand for thermal coal in 2021, but the surge in demand was not at all anticipated," said Nokta.

"That resurgence is keeping Panamaxes and Capes very busy when they can't count on the cargoes they normally would — grain for Panamaxes and iron ore for Capes. Grain has been consistent throughout the year and now the Panamaxes have this added thermal coal element. Capes have faced a somewhat inconsistent Chinese steel market [production plunged in August], but it hasn't mattered because of all of these thermal coal cargoes they've been able to carry."

Capesize rates have risen over the past week despite escalating concern over the fate of Chinese property developer Evergrande and the Chinese property market in general.

"The real-estate story is still a question, and the regulators are tempering steel production to limit pollution," said Nokta. "But we could have a situation where iron ore demand dips and there's a handoff to thermal coal, and when thermal coal demand diminishes after the winter season, the iron-ore market comes back to life. So, you may not even feel it."

LNG shipping

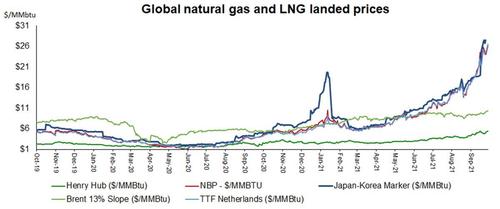

The shortfall of natural gas in Europe and Asia is clearly evident in historically high natural gas spot prices.

The Asia benchmark, the Japan-Korea Marker (JKM), had risen to $27.50 per million British Thermal Units (MMBtu) on Friday, nearly double the August price. The two European benchmarks, TTF Netherlands and the National Balancing Point (NBP), have risen in lockstep with the JKM, to $26.51 and $26.23 per MMBtu, respectively. TTF and NBP are at all-time highs. The U.S. Henry Hub price has risen, but to far below these levels, at $5.51.

Last winter, amid a huge spread between natural gas prices, LNG shipping spot prices spiked to $200,000 or more per day (one spot voyage reached $350,000 per day). But currently, rates for tri-fuel diesel engine LNG carriers are $51,000 per day, just below the five-year average for this time of year, according to Clarksons.

Asked why LNG spot shipping rates are not surging given extremely high commodity prices in Asia and Europe and a large spread with U.S. pricing, Nokta cited two reasons.

First, he said that the big spikes in spot shipping rates happen when there is a big spread between the European and Asian commodity prices, and there are aggressive re-exports from Europe to Asia by traders. "Right now, the JKM is at parity with Europe, so there isn't as much cross-hemispheric trade."

Second, when spot rates spiked last winter, cargo interests took LNG ships on long-term charter to protect against future high spot rates. "Most of the charterers covered their requirements and spot activity has really dwindled in the past three months. So, when you look at spot rates, they may tell you things aren't on fire, but there's actually a lot of [cargo] movement."

Even so, spot LNG shipping rates could see a jump this winter if the spread between European prices and the JKM widens and more companies with chartered ships "relet" them into the spot market to profit from higher rates.

Tanker shipping

Product and crude tanker rates remain below breakeven, but some analysts and brokers believe power shortage in Asia and Europe could help jumpstart these beleaguered shipping markets as well.

As with other commodities, oil stockpiles are low. Evercore ISI analyst Jon Chappell said Monday that "OECD refined product inventories are now lower than pre-COVID levels and are well below five-year averages, [however] at a certain point, inventories approach a level where there is no longer much slack in the system."

Nokta noted that in past commodity cycles "crude oil led the charge and this time it seems all the other commodities rose and crude is bringing up the rear. But all the same fundamental factors and drivers are there [for crude as with other commodities]."

In light of extremely high natural gas prices, Goldman Sachs recently estimated that Asia and Europe could use up to 900,000 barrels per day more oil for power generation, as a substitute for natural gas.

According to Gibson Brokers, "This would depend on a 'cold winter' and would also likely be focused east of Suez where oil-based fuels have greater potential to form part of the power-generation market."

Gibson said, "High-sulfur fuel oil [HSFO] is expected to be the primary beneficiary … and countries including Pakistan and Bangladesh, as well as some Middle Eastern players, have already been more active in the spot HSFO market as LNG prices began to rise.

"Higher HSFO prices could potentially increase refining run rates, supporting crude demand," added Gibson.

Nokta pointed to this upside as well. "When we think about oil consumption, that's been improving purely on mobility. Gasoline refining margins have strengthened as more people have gotten vaccinated," he said. "But you could have this other element with fuel oil. Refiners could ratchet up production, which would mean you're bringing higher amounts of crude into the refining system and producing more distillates and fuel oil.

"It's a nice setup for tankers," affirmed Notka. "You've got improving oil consumption, shrinking inventories, OPEC promising to boost output — and now throw in an energy crisis as we go into winter."

Commenti

Posta un commento